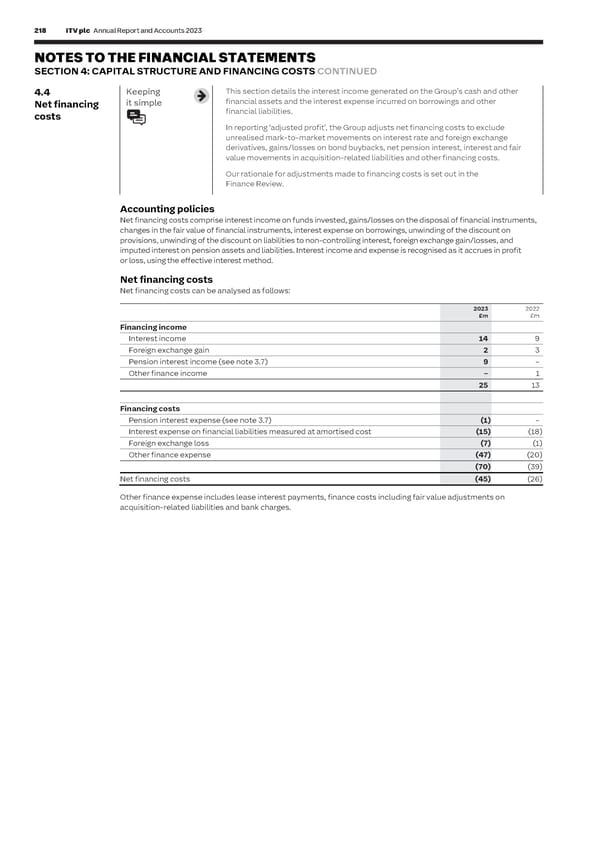

218 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 219 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL 4.4 Keeping This section details the interest income generated on the Group’s cash and other 4.5 Keeping The financial instruments included in the Consolidated Statement of Financial S T it simple financial assets and the interest expense incurred on borrowings and other it simple Position are measured at either fair value or amortised cost. The measurement of A Net financing Fair value T financial liabilities. this fair value can in some cases be subjective, and can depend on the inputs used in E costs hierarchy M the calculations. The Group generally uses external valuations using market inputs or E In reporting ‘adjusted profit’, the Group adjusts net financing costs to exclude N market values (e.g. external share prices). The different valuation methods are called T unrealised mark-to-market movements on interest rate and foreign exchange ‘hierarchies’ and are described below. S derivatives, gains/losses on bond buybacks, net pension interest, interest and fair value movements in acquisition-related liabilities and other financing costs. Level 1 Our rationale for adjustments made to financing costs is set out in the Fair values are measured using quoted prices (unadjusted) in active markets for Finance Review. identical assets or liabilities. Level 2 Accounting policies Fair values are measured using inputs, other than quoted prices included within Net financing costs comprise interest income on funds invested, gains/losses on the disposal of financial instruments, Level 1, which are observable for the asset or liability either directly or indirectly. changes in the fair value of financial instruments, interest expense on borrowings, unwinding of the discount on Interest rate swaps and options are accounted for at their fair value based upon exit provisions, unwinding of the discount on liabilities to non-controlling interest, foreign exchange gain/losses, and prices at the current reporting period. Forward foreign exchange contracts are imputed interest on pension assets and liabilities. Interest income and expense is recognised as it accrues in profit accounted for at the difference between the contract exchange rate and the quoted or loss, using the effective interest method. forward exchange rate at the reporting date. Net financing costs Level 3 Net financing costs can be analysed as follows: Fair values are measured using inputs for the asset or liability that are not based on observable market data. 2023 2022 £m £m The tables below set out the financial instruments included on the Consolidated Statement of Financial Position at Financing income fair value: Interest income 14 9 Foreign exchange gain 2 3 Fair value Level 1 Level 2 Level 3 31 December 31 December 31 December 31 December Pension interest income (see note 3.7) 9 – 2023 2023 2023 2023 Other finance income – 1 £m £m £m £m 25 13 Assets measured at fair value Financial instruments at fair value through reserves Financing costs Other pension assets – gilts (see note 3.7) 48 48 – – Pension interest expense (see note 3.7) (1) – Financial instruments at fair value through profit or loss Interest expense on financial liabilities measured at amortised cost (15) (18) Money market funds 125 125 – – Foreign exchange loss (7) (1) Equity investments (see note 3.5) 21 – – 21 Other finance expense (47) (20) Financial assets at fair value through profit or loss (70) (39) Foreign exchange forward contracts and swaps 1 – 1 – Net financing costs (45) (26) Convertible loan receivable 2 – – 2 Financial assets at fair value through reserves Other finance expense includes lease interest payments, finance costs including fair value adjustments on Cash flow hedges 4 – 4 – acquisition-related liabilities and bank charges. 201 173 5 23 Fair value Level 1 Level 2 Level 3 31 December 31 December 31 December 31 December 2023 2023 2023 2023 £m £m £m £m Liabilities measured at fair value Financial liabilities at fair value through profit or loss Acquisition-related liabilities – payable to sellers under put options agreed on acquisition (see notes 3.1.4 and 3.1.5) (63) – – (63) Financial liabilities at fair value through reserves Cash flow hedges (17) – (17) – (80) – (17) (63) There have been no changes in the classification of assets and liabilities and there have been no movements within levels. Information on the fair value measurements of level 3 assets and liabilities is detailed in the relevant notes referenced above.

ITV Annual Report & Accounts Page 219 Page 221

ITV Annual Report & Accounts Page 219 Page 221