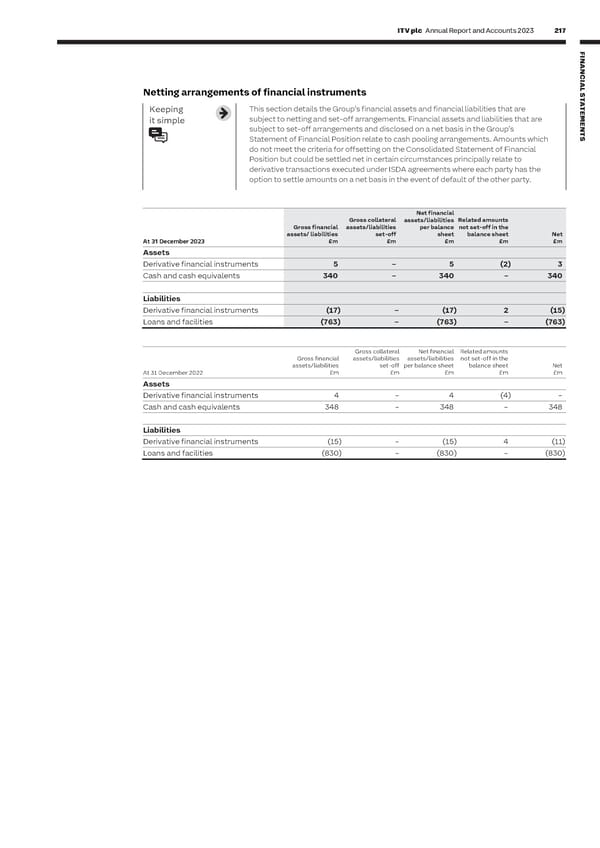

216 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 217 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Keeping This table provides a reconciliation of each component of the translation reserve Netting arrangements of financial instruments S T reported within equity and an analysis of other comprehensive income in A it simple T accordance with IAS 1. Keeping This section details the Group’s financial assets and financial liabilities that are E subject to netting and set-off arrangements. Financial assets and liabilities that are M it simple E subject to set-off arrangements and disclosed on a net basis in the Group’s N T Set out below is the reconciliation of each component of the translation reserve reported in the Consolidated Statement of Financial Position relate to cash pooling arrangements. Amounts which S Statement of Changes in Equity and the analysis of other comprehensive income: do not meet the criteria for offsetting on the Consolidated Statement of Financial Position but could be settled net in certain circumstances principally relate to Cash Cost of Foreign derivative transactions executed under ISDA agreements where each party has the flow hedge hedge currency Translation option to settle amounts on a net basis in the event of default of the other party. reserve reserve reserve reserve £m £m £m £m As at 1 January 2022 3 (7) 45 41 Effective portion of changes in fair value arising from: Net financial Foreign exchange forward contracts (1) (4) – (5) Gross collateral assets/liabilities Related amounts Gross financial assets/liabilities per balance not set-off in the Cross-currency interest rate swaps – borrowings: assets/ liabilities set-off sheet balance sheet Net • Change in fair value from the effective hedge instrument 25 4 – 29 At 31 December 2023 £m £m £m £m £m Assets Amount reclassified to Income Statement Derivative financial instruments 5 – 5 (2) 3 • FX forward reclassified to cost of sales/overheads 4 – – 4 Cash and cash equivalents 340 – 340 – 340 • FX forward and swaps reclassified to finance costs (10) – – (10) • Amounts reclassified to work in progress 7 – – 7 Liabilities • CCIRS reclassified to finance costs (27) – – (27) Derivative financial instruments (17) – (17) 2 (15) Net loss on cash flow hedges and cost of hedging (2) – – (2) Loans and facilities (763) – (763) – (763) Foreign currency revaluation of the net foreign operations – – 67 67 Exchange differences on translation of foreign operations – – 67 67 Income tax credit on other comprehensive income/(expense) 1 – – 1 Gross collateral Net financial Related amounts Gross financial assets/liabilities assets/liabilities not set-off in the As at 31 December 2022 2 (7) 112 107 assets/liabilities set-off per balance sheet balance sheet Net At 31 December 2022 £m £m £m £m £m Effective portion of changes in fair value arising from: Assets Foreign exchange forward contracts (13) 4 – (9) Derivative financial instruments 4 – 4 (4) – Cross-currency interest rate swaps – borrowings: Cash and cash equivalents 348 – 348 – 348 • Change in fair value from the effective hedge instrument (9) 2 – (7) Amount reclassified to Income Statement Liabilities • FX forward reclassified to cost of sales/overheads 2 – – 2 Derivative financial instruments (15) – (15) 4 (11) • FX forward and swaps reclassified to finance costs 15 – – 15 Loans and facilities (830) – (830) – (830) • CCIRS reclassified to finance costs 11 – – 11 Net gain on cash flow hedges and cost of hedging 6 6 – 12 Foreign currency revaluation of the net foreign operations – – (38) (38) Exchange differences on translation of foreign operations – – (38) (38) Income tax charge on other comprehensive income/(expense) (1) (2) – (3) As at 31 December 2023 7 (3) 74 78

ITV Annual Report & Accounts Page 218 Page 220

ITV Annual Report & Accounts Page 218 Page 220