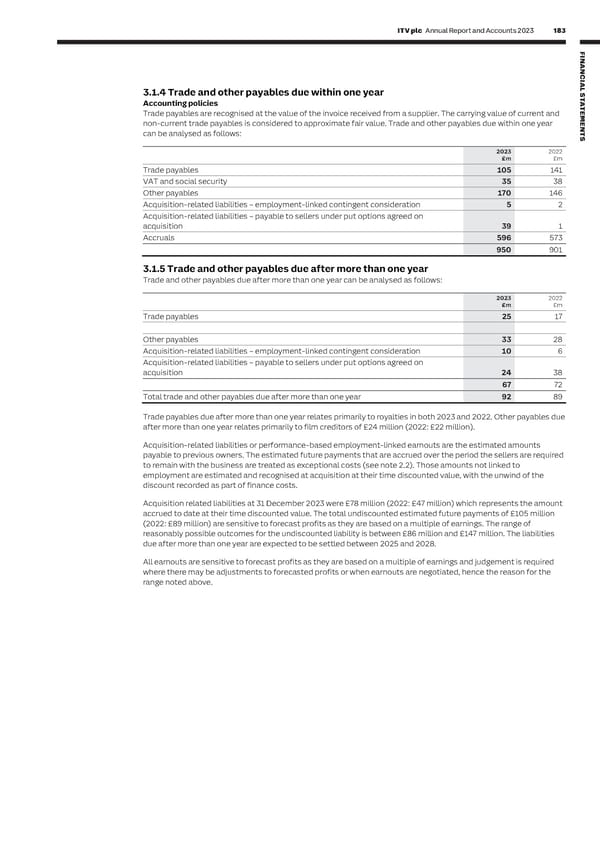

182 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 183 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL 3.1.3 Trade and other receivables 3.1.4 Trade and other payables due within one year S T Accounting policies Accounting policies A T E Trade receivables are recognised initially at the value of the invoice sent to the customer and subsequently at the Trade payables are recognised at the value of the invoice received from a supplier. The carrying value of current and M amounts considered recoverable (amortised cost). Where payments are not due for more than one year, they are non-current trade payables is considered to approximate fair value. Trade and other payables due within one year E N shown in the financial statements at their net present value to reflect the economic cost of delayed payment. can be analysed as follows: T The Group provides goods and services to substantially all of its customers on credit terms. S 2023 2022 The credit risk management practices of the Group include internal review and reporting of the ageing of trade and £m £m other receivables by days past due. The Group applies the IFRS 9 simplified approach in measuring expected credit Trade payables 105 141 losses, which use a lifetime expected credit loss allowance for all trade receivables. VAT and social security 35 38 Other payables 170 146 To measure expected credit losses, trade receivables and contract assets have been grouped by shared credit risk Acquisition-related liabilities – employment-linked contingent consideration 5 2 characteristics and days past due. As part of the expected credit losses, the Group may make additional provisions for the receivables of particular customers if the deterioration of financial position was observed. Acquisition-related liabilities – payable to sellers under put options agreed on acquisition 39 1 The carrying value of trade receivables is considered to approximate fair value. Trade and other receivables can be Accruals 596 573 analysed as follows: 950 901 2023 2022 3.1.5 Trade and other payables due after more than one year £m £m Due within one year: Trade and other payables due after more than one year can be analysed as follows: Trade receivables 427 476 2023 2022 Other receivables 145 162 £m £m Prepayments 58 54 Trade payables 25 17 630 692 Due after more than one year: Other payables 33 28 Trade receivables 37 24 Acquisition-related liabilities – employment-linked contingent consideration 10 6 Other receivables 25 20 Acquisition-related liabilities – payable to sellers under put options agreed on 62 44 acquisition 24 38 Total trade and other receivables 692 736 67 72 Total trade and other payables due after more than one year 92 89 £464 million (2022: £500 million) of total trade receivables, stated net of provisions for impairment, are aged as follows: Trade payables due after more than one year relates primarily to royalties in both 2023 and 2022. Other payables due 2023 2022 after more than one year relates primarily to film creditors of £24 million (2022: £22 million). £m £m Current 408 437 Acquisition-related liabilities or performance-based employment-linked earnouts are the estimated amounts Up to 30 days overdue 29 34 payable to previous owners. The estimated future payments that are accrued over the period the sellers are required Between 30 and 90 days overdue 21 20 to remain with the business are treated as exceptional costs (see note 2.2). Those amounts not linked to employment are estimated and recognised at acquisition at their time discounted value, with the unwind of the Over 90 days overdue 6 9 discount recorded as part of finance costs. 464 500 Acquisition related liabilities at 31 December 2023 were £78 million (2022: £47 million) which represents the amount Movements in the Group’s provision for impairment of trade receivables and contract assets can be shown as follows: accrued to date at their time discounted value. The total undiscounted estimated future payments of £105 million (2022: £89 million) are sensitive to forecast profits as they are based on a multiple of earnings. The range of 2023 2022 reasonably possible outcomes for the undiscounted liability is between £86 million and £147 million. The liabilities £m £m due after more than one year are expected to be settled between 2025 and 2028. At 1 January 24 43 Charged during the year 4 14 All earnouts are sensitive to forecast profits as they are based on a multiple of earnings and judgement is required Bad debts written off (8) – where there may be adjustments to forecasted profits or when earnouts are negotiated, hence the reason for the Release of provision (11) (33) range noted above. At 31 December* 9 24 * £1 million (2022: £8 million) of the provision relates to contract assets and is included in the balance disclosed in note 3.1.6. Of the provision total, £7 million relates to balances overdue by more than 90 days (2022: £22 million) and £2 million relates to current balances (2022: less than £1 million). In 2023, a settlement of the claim was agreed with the credit insurers in relation to the remaining amount receivable for The Voice of China, resulting in an exceptional credit of US$5 million (£3 million) consistent with the original treatment. See note 2.2. No further recovery of the remaining trade receivable is expected. The remaining release of the provision relates to other settlements for outstanding production related receivables and contract assets. The credit has been taken to operating profit.

ITV Annual Report & Accounts Page 184 Page 186

ITV Annual Report & Accounts Page 184 Page 186