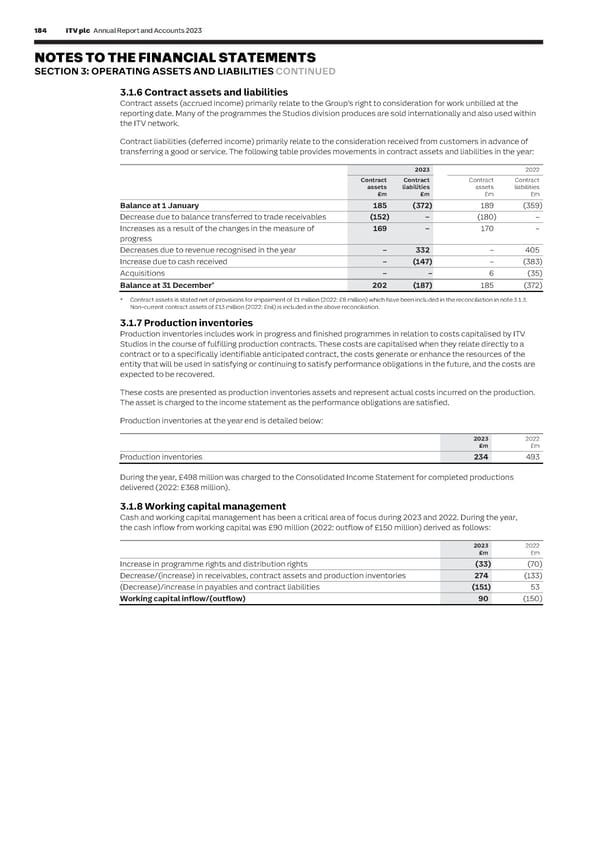

184 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 185 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL 3.1.6 Contract assets and liabilities 3.2 Keeping The following note shows the physical assets used by the Group to operate the S T Contract assets (accrued income) primarily relate to the Group’s right to consideration for work unbilled at the it simple business, generating revenues and profits. These assets include office buildings A Property, plant T and studios, as well as equipment used in broadcast transmission, programme E reporting date. Many of the programmes the Studios division produces are sold internationally and also used within and equipment M the ITV network. production and support activities. E N T Contract liabilities (deferred income) primarily relate to the consideration received from customers in advance of The cost of these assets is the amount initially paid for them or for right of use S transferring a good or service. The following table provides movements in contract assets and liabilities in the year: assets, the discounted future lease payments. A depreciation expense is charged to the Consolidated Income Statement to reflect annual wear and tear and the 2023 2022 reduced value of the asset over time. Depreciation is calculated by estimating the Contract Contract Contract Contract number of years the Group expects the asset to be used (useful economic life). If assets liabilities assets liabilities there has been a technological change or decline in business performance, the £m £m £m £m Directors review the value of the assets to the business to ensure they have not Balance at 1 January 185 (372) 189 (359) fallen below their depreciated value. If an asset’s value falls below its depreciated Decrease due to balance transferred to trade receivables (152) – (180) – value, an additional impairment charge is made against profit. Increases as a result of the changes in the measure of 169 – 170 – This note also explains the accounting policies followed by ITV and the specific progress estimates made in arriving at the net book value of these assets. Decreases due to revenue recognised in the year – 332 – 405 Increase due to cash received – (147) – (383) Accounting policies Acquisitions – – 6 (35) Property, plant and equipment * Balance at 31 December 202 (187) 185 (372) Property, plant and equipment are stated at cost less accumulated depreciation and impairment losses. Certain items * Contract assets is stated net of provisions for impairment of £1 million (2022: £8 million) which have been included in the reconciliation in note 3.1.3. of property, plant and equipment that were revalued to fair value prior to 1 January 2004 (the date of transition to IFRS) Non-current contract assets of £13 million (2022: £nil) is included in the above reconciliation. are measured on the basis of deemed cost, being the revalued amount less depreciation up to the date of transition. 3.1.7 Production inventories Right of use assets Production inventories includes work in progress and finished programmes in relation to costs capitalised by ITV A contract contains a lease if the contract conveys the right to control the use of an identified asset for a period of Studios in the course of fulfilling production contracts. These costs are capitalised when they relate directly to a time in exchange for consideration. These assets are called right of use assets and have been included on the contract or to a specifically identifiable anticipated contract, the costs generate or enhance the resources of the Group’s balance sheet at a value equal to the discounted future lease payments. For leases recognised on transition entity that will be used in satisfying or continuing to satisfy performance obligations in the future, and the costs are to IFRS 16 ‘Leases’ the value is also adjusted by any prepayments or lease incentives recognised immediately before expected to be recovered. the date of initial application. These costs are presented as production inventories assets and represent actual costs incurred on the production. Depreciation The asset is charged to the income statement as the performance obligations are satisfied. Depreciation is provided to write off the cost of property, plant and equipment less estimated residual value, on a Production inventories at the year end is detailed below: straight-line basis over their estimated useful lives. The annual depreciation charge is sensitive to the estimated useful life of each asset and the expected residual value at the end of its life. The major categories of property, 2023 2022 plant and equipment are depreciated as follows: £m £m Production inventories 234 493 Asset class Depreciation policy Freehold land not depreciated During the year, £498 million was charged to the Consolidated Income Statement for completed productions Freehold buildings up to 60 years delivered (2022: £368 million). Leasehold improvements shorter of residual lease term or estimated useful life Vehicles, equipment and fittings* 3 to 20 years 3.1.8 Working capital management Right of use assets over the term of the lease Cash and working capital management has been a critical area of focus during 2023 and 2022. During the year, the cash inflow from working capital was £90 million (2022: outflow of £150 million) derived as follows: * Equipment includes studio production and technology assets. 2023 2022 Assets under construction are not depreciated until the point at which the asset comes into use by the Group. £m £m Increase in programme rights and distribution rights (33) (70) Impairment of assets Decrease/(increase) in receivables, contract assets and production inventories 274 (133) Property, plant and equipment that is subject to depreciation is reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount may not be recoverable. Indicators of impairment may (Decrease)/increase in payables and contract liabilities (151) 53 include changes in technology and business. Working capital inflow/(outflow) 90 (150)

ITV Annual Report & Accounts Page 185 Page 187

ITV Annual Report & Accounts Page 185 Page 187