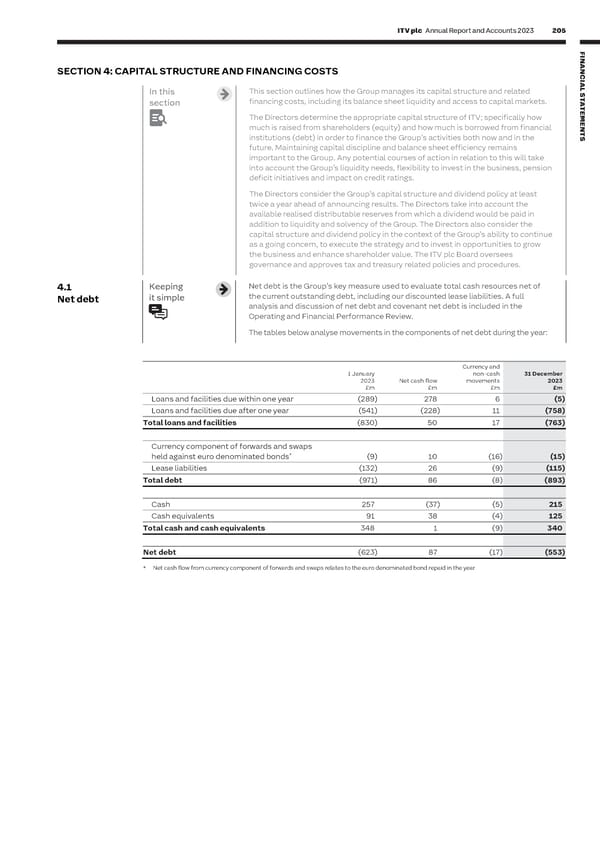

204 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 205 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS C I AL Addressing the defined benefit pension deficit In this This section outlines how the Group manages its capital structure and related S T section financing costs, including its balance sheet liquidity and access to capital markets. A Keeping The Group works closely with the Trustee to agree appropriate levels of funding T E it simple for the Scheme. This involves agreeing a Schedule of Contributions at each triennial The Directors determine the appropriate capital structure of ITV; specifically how M E valuation, which specifies the contribution rates for the employer and, where much is raised from shareholders (equity) and how much is borrowed from financial N T relevant, scheme beneficiaries and the date these contributions are due. A recovery institutions (debt) in order to finance the Group’s activities both now and in the S plan setting out the steps that will be taken to address a funding shortfall is future. Maintaining capital discipline and balance sheet efficiency remains also agreed. important to the Group. Any potential courses of action in relation to this will take In the event that the Group’s defined benefit scheme is in a net liability position, into account the Group’s liquidity needs, flexibility to invest in the business, pension the Directors must take steps to manage the size of the deficit. Apart from the deficit initiatives and impact on credit ratings. funding agreements mentioned above, this could involve pledging additional assets The Directors consider the Group’s capital structure and dividend policy at least to the Scheme, as was the case in the SDN and London Television Centre pension twice a year ahead of announcing results. The Directors take into account the funding partnerships. available realised distributable reserves from which a dividend would be paid in addition to liquidity and solvency of the Group. The Directors also consider the The levels of ongoing contributions to the Scheme are based on the expected future cash flows of the Scheme. capital structure and dividend policy in the context of the Group’s ability to continue Contributions in 2023 for administration expenses are £7 million (2022: £6 million). as a going concern, to execute the strategy and to invest in opportunities to grow the business and enhance shareholder value. The ITV plc Board oversees The Group has two asset-backed pension funding agreements with the Trustee – the SDN pension funding governance and approves tax and treasury related policies and procedures. partnership and the London Television Centre pension funding partnership which were set up in 2010 and 2014 respectively to address the pension deficit. Net debt is the Group’s key measure used to evaluate total cash resources net of 4.1 Keeping the current outstanding debt, including our discounted lease liabilities. A full SDN Pension Funding Partnership Net debt it simple analysis and discussion of net debt and covenant net debt is included in the In 2010, ITV established a Pension Funding Partnership (PFP) with the Trustees backed by SDN, which was Operating and Financial Performance Review. subsequently extended in 2011. The PFP addressed £200 million of the funding deficit in Section A of the defined benefit pension scheme and under the original agreement, a payment of up to £200 million was due in 2022. The The tables below analyse movements in the components of net debt during the year: existing PFP agreement was amended and extended to 2031. As a result of this agreement, payments of £94 million were made under the SDN PFP arrangement in 2022. The Group is committed to up to nine annual payments of £16 million from 2023. These payments are required if the Scheme is calculated to be in a technical deficit. Currency and This calculation is based upon the most recent triennial valuation updated for current market conditions. 1 January non-cash 31 December The partnership’s interest in SDN provides collateral for these payments. 2023 Net cash flow movements 2023 £m £m £m £m The £16 million payment under the SDN PFP was not required to be paid in 2023. However, this assessment is Loans and facilities due within one year (289) 278 6 (5) made on an annual basis and therefore the £16 million payment may resume in 2024. The Group retains day to day Loans and facilities due after one year (541) (228) 11 (758) operational control of SDN and SDN’s revenues, profits and cashflows continue to be consolidated in the Group’s Total loans and facilities (830) 50 17 (763) financial statements. On completion of the final payment in 2031, the Scheme’s partnership interest will have been repaid in full and it will have no right to any further payments. Currency component of forwards and swaps * London Television Centre Pension Funding Partnership held against euro denominated bonds (9) 10 (16) (15) Trustees backed by the London Television Centre, Lease liabilities (132) 26 (9) (115) In 2014, ITV established a Pension Funding Partnership with the which resulted in the assets of Section A of the defined benefit pension scheme being increased by £50 million. Total debt (971) 86 (8) (893) In November 2019, the London Television Centre was sold. £50 million of the proceeds was previously held in a restricted bank account as a replacement asset in the pension funding arrangement. In 2022, this security was Cash 257 (37) (5) 215 replaced with a surety bond and the cash was released to the Group. This structure continues to be reviewed. Cash equivalents 91 38 (4) 125 The Scheme’s interest in these Partnerships reduces the deficit on a funding basis but does not impact the deficit Total cash and cash equivalents 348 1 (9) 340 on an IAS 19 basis as the Scheme’s interest is not a transferrable financial instrument. Deficit funding contributions Net debt (623) 87 (17) (553) The accounting surplus or deficit does not drive the deficit funding contribution. The Group’s deficit funding * Net cash flow from currency component of forwards and swaps relates to the euro denominated bond repaid in the year contributions in 2023 were £40 million (31 December 2022: £137 million). This included £37 million deficit contribution agreed as part of the triennial valuation and £3 million annual payment under the London Television Centre PFP. The 2022 amount included £15 million deferred from 2020 and £25 million of deficit contributions agreed as part of the triennial valuation, £80 million one-off payment following the extension of the SDN PFP, a £3 million payment on the SDN PFP for the bridging period between the end date of the original agreement and the date of the extension, and £11 million and £3 million annual payments due under the SDN and London Television Centre PFPs respectively. Deficit contributions for 2024 and 2025 consist of contributions agreed with the Trustees following the last finalised triennial valuation (£53 million and £28 million respectively) and the annual payments under the SDN PFP and London Television Centre PFP (£16 million and £3 million respectively). IFRIC 14 clarifies how the asset ceiling rules should be applied if the Schemes are expected to be in surplus, for example as a result of deficit funding agreements. The Group has determined that it has an unconditional right to a refund of any surplus assets if the Schemes are run off until the last member dies. On this basis, IFRIC 14 rules do not cause any change in the pension deficit accounting or disclosures. In June 2023, the High Court ruled in the Virgin Media case that some historical rule amendments made without the correct actuarial certification were not valid. The Trustees of ITV’s defined benefit pension schemes have taken advice on the implications of the Virgin Media decision. Initial investigations have not revealed evidence that this will be a material issue for ITV’s pension schemes, and the Trustees are awaiting the outcome of the appeal (due in 2024) before deciding if further investigations are necessary. As a result, ITV does not consider it necessary to make any allowance for the potential impact of the Virgin Media case in its financial statements.

ITV Annual Report & Accounts Page 206 Page 208

ITV Annual Report & Accounts Page 206 Page 208