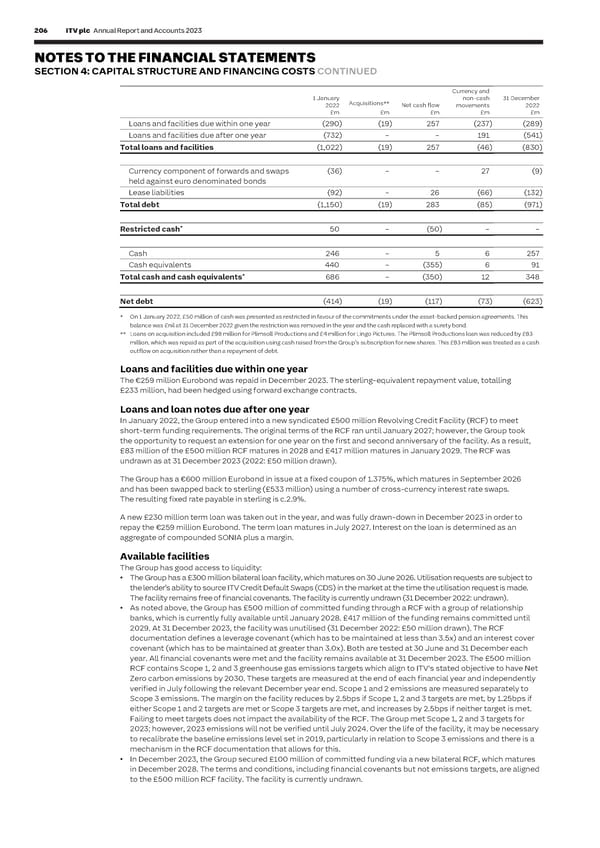

206 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 207 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Currency and 4.2 Borrowings Keeping The Group borrows money from financial institutions in the form of bonds, bank S 1 January non-cash 31 December T Acquisitions** it simple facilities and other financial instruments. The interest payable on these instruments A 2022 Net cash flow movements 2022 T £m £m £m £m £m is shown in the net financing costs note (note 4.4). E M Loans and facilities due within one year (290) (19) 257 (237) (289) E There are Board-approved policies in place to manage the Group’s financial risks. N T Loans and facilities due after one year (732) – – 191 (541) Macroeconomic market risks, which impact currency transactions and interest S Total loans and facilities (1,022) (19) 257 (46) (830) rates, are discussed in note 4.3. Credit and liquidity risks are set out below. • Credit risk: the risk of financial loss to the Group if a customer or counterparty Currency component of forwards and swaps (36) – – 27 (9) fails to meet its contractual obligations held against euro denominated bonds • Liquidity risk: the risk that the Group will not be able to meet its financial Lease liabilities (92) – 26 (66) (132) obligations as they fall due Total debt (1,150) (19) 283 (85) (971) The Group is required to disclose the fair value of its debt instruments. The fair value is the amount the Group would pay a third party to transfer the liability. * Restricted cash 50 – (50) – – This estimation of fair value is consistent with instruments included in note 4.5. Cash 246 – 5 6 257 Accounting policies Cash equivalents 440 – (355) 6 91 Borrowings * Borrowings are recognised initially at fair value less directly attributable transaction costs, with subsequent Total cash and cash equivalents 686 – (350) 12 348 measurement at amortised cost using the effective interest rate method. Under the amortised cost method, Net debt (414) (19) (117) (73) (623) the difference between the amount initially recognised and the redemption value is recorded in the Consolidated Income Statement over the period of the borrowing on an effective interest rate basis. * On 1 January 2022, £50 million of cash was presented as restricted in favour of the commitments under the asset-backed pension agreements. This balance was £nil at 31 December 2022 given the restriction was removed in the year and the cash replaced with a surety bond. Managing credit and liquidity risk ** Loans on acquisition included £98 million for Plimsoll Productions and £4 million for Lingo Pictures. The Plimsoll Productions loan was reduced by £83 Credit risk million, which was repaid as part of the acquisition using cash raised from the Group’s subscription for new shares. This £83 million was treated as a cash The Group’s maximum exposure to credit risk is represented by the carrying amount of derivative financial assets outflow on acquisition rather than a repayment of debt. (see note 4.3), trade receivables (see note 3.1.3), contract assets (see note 3.1.6) and cash and cash equivalents Loans and facilities due within one year (see note 4.1). The €259 million Eurobond was repaid in December 2023. The sterling-equivalent repayment value, totalling Trade and other receivables £233 million, had been hedged using forward exchange contracts. The Group’s exposure to credit risk is influenced mainly by the individual characteristics of each customer. Loans and loan notes due after one year The majority of trade receivables relate to airtime sales contracts with advertising agencies and advertisers. In January 2022, the Group entered into a new syndicated £500 million Revolving Credit Facility (RCF) to meet Credit insurance has been taken out against these companies to minimise the impact on the Group in the event short-term funding requirements. The original terms of the RCF ran until January 2027; however, the Group took of a possible default. The Group also reviews other significant receivables and will seek to take out credit insurance the opportunity to request an extension for one year on the first and second anniversary of the facility. As a result, on an individual basis where appropriate. Credit risk over contract assets is monitored proactively using daily reports £83 million of the £500 million RCF matures in 2028 and £417 million matures in January 2029. The RCF was from an external credit risk company. These reports are used to determine contractual obligations, monitor risk and undrawn as at 31 December 2023 (2022: £50 million drawn). amend terms where required. The Group has a €600 million Eurobond in issue at a fixed coupon of 1.375%, which matures in September 2026 Cash and cash equivalents and derivative financial instruments and has been swapped back to sterling (£533 million) using a number of cross-currency interest rate swaps. The Group operates investment guidelines with respect to surplus cash that emphasise preservation of capital. The The resulting fixed rate payable in sterling is c.2.9%. guidelines set out procedures and limits on counterparty risk and maturity profile of cash placed. Counterparty limits for cash deposits are largely based upon long-term ratings published by the major credit rating agencies. Cash and A new £230 million term loan was taken out in the year, and was fully drawn-down in December 2023 in order to cash equivalents include money market funds valued at fair value through profit and loss. repay the €259 million Eurobond. The term loan matures in July 2027. Interest on the loan is determined as an Cash and cash equivalents and derivative financial instruments exposure is limited to high credit quality financial aggregate of compounded SONIA plus a margin. institutions rated by two of the key rating agencies used by the Group. Counterparty credit limits are set in relation Available facilities to these ratings, in order to limit the concentration of exposure to individual counterparties based on their credit The Group has good access to liquidity: quality. As such, investments are sufficiently spread across high credit quality rated counterparties. • The Group has a £300 million bilateral loan facility, which matures on 30 June 2026. Utilisation requests are subject to Counterparty credit limits are reviewed by the Group’s Board of Directors on an annual basis and may be updated the lender’s ability to source ITV Credit Default Swaps (CDS) in the market at the time the utilisation request is made. throughout the year subject to approval of the Group’s Audit & Risk Committee. Investment exposure with external The facility remains free of financial covenants. The facility is currently undrawn (31 December 2022: undrawn). counterparties is made only with Board approved counterparties and within credit limits assigned to each • As noted above, the Group has £500 million of committed funding through a RCF with a group of relationship counterparty. The credit quality of financial counterparties and the outstanding exposure is monitored throughout banks, which is currently fully available until January 2028. £417 million of the funding remains committed until the year by the Group’s Treasury function in accordance with the Group’s policy. 2029. At 31 December 2023, the facility was unutilised (31 December 2022: £50 million drawn). The RCF documentation defines a leverage covenant (which has to be maintained at less than 3.5x) and an interest cover Borrowings covenant (which has to be maintained at greater than 3.0x). Both are tested at 30 June and 31 December each ITV is rated as investment grade by Moody’s and S&P. ITV’s credit ratings, which in turn are affected by key metrics, year. All financial covenants were met and the facility remains available at 31 December 2023. The £500 million such as leverage, the cost of credit default swap hedging, and the absolute level of interest rates are key RCF contains Scope 1, 2 and 3 greenhouse gas emissions targets which align to ITV's stated objective to have Net determinants in the cost of new borrowings for ITV. Zero carbon emissions by 2030. These targets are measured at the end of each financial year and independently verified in July following the relevant December year end. Scope 1 and 2 emissions are measured separately to Scope 3 emissions. The margin on the facility reduces by 2.5bps if Scope 1, 2 and 3 targets are met, by 1.25bps if either Scope 1 and 2 targets are met or Scope 3 targets are met, and increases by 2.5bps if neither target is met. Failing to meet targets does not impact the availability of the RCF. The Group met Scope 1, 2 and 3 targets for 2023; however, 2023 emissions will not be verified until July 2024. Over the life of the facility, it may be necessary to recalibrate the baseline emissions level set in 2019, particularly in relation to Scope 3 emissions and there is a mechanism in the RCF documentation that allows for this. • In December 2023, the Group secured £100 million of committed funding via a new bilateral RCF, which matures in December 2028. The terms and conditions, including financial covenants but not emissions targets, are aligned to the £500 million RCF facility. The facility is currently undrawn.

ITV Annual Report & Accounts Page 207 Page 209

ITV Annual Report & Accounts Page 207 Page 209