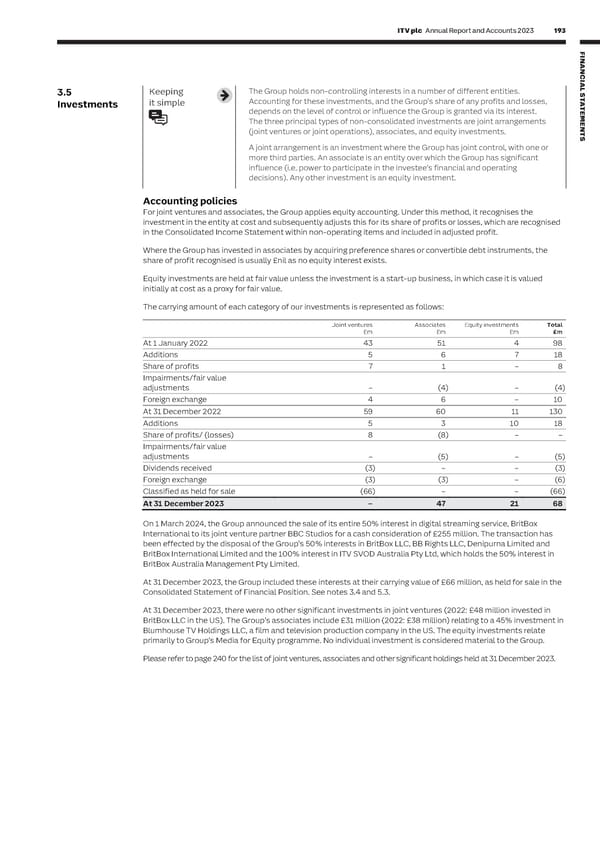

192 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 193 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL 3.4 Keeping The following section outlines the Group's assets and liabilities held for sale. 3.5 Keeping The Group holds non-controlling interests in a number of different entities. S T it simple it simple Accounting for these investments, and the Group’s share of any profits and losses, A Assets Assets and any associated liabilities, where management is committed to a plan to sell, Investments T depends on the level of control or influence the Group is granted via its interest. E classified as are recognised as held for sale in the Consolidated Statement of Financial Position. M The three principal types of non-consolidated investments are joint arrangements E held for sale N The sale should be highly probable and within 12 months of classification as held for sale. (joint ventures or joint operations), associates, and equity investments. T S A joint arrangement is an investment where the Group has joint control, with one or Accounting policies more third parties. An associate is an entity over which the Group has significant The Group measures non-current assets that are classified as held for sale at the lower of their carrying amount and influence (i.e. power to participate in the investee’s financial and operating fair value less costs to sell. decisions). Any other investment is an equity investment. On 1 March 2024, the Group announced the sale of its entire 50% interest in digital streaming service, BritBox Accounting policies International to its joint venture partner BBC Studios for a cash consideration of £255 million. The transaction has been effected by the disposal of the Group’s 50% interests in BritBox LLC, BB Rights LLC, Denipurna Limited and For joint ventures and associates, the Group applies equity accounting. Under this method, it recognises the BritBox International Limited and the 100% interest in ITV SVOD Australia Pty Ltd, which holds the 50% interest in investment in the entity at cost and subsequently adjusts this for its share of profits or losses, which are recognised BritBox Australia Management Pty Limited. in the Consolidated Income Statement within non-operating items and included in adjusted profit. At 31 December 2023, the Group included these interests at their carrying value, as held for sale in the Consolidated Where the Group has invested in associates by acquiring preference shares or convertible debt instruments, the Statement of Financial Position. There are no liabilities associated with this sale. share of profit recognised is usually £nil as no equity interest exists. 2023 2022 Equity investments are held at fair value unless the investment is a start-up business, in which case it is valued £m £m initially at cost as a proxy for fair value. Assets classified as held for sale - investments in joint ventures 66 – The carrying amount of each category of our investments is represented as follows: 66 – Joint ventures Associates Equity investments Total The results for the entities held for sale (other than ITV SVOD Australia Pty Ltd) are included in share of profits and £m £m £m £m losses after tax of joint ventures and associated undertakings and not within the M&E reportable segment. At 1 January 2022 43 51 4 98 Additions 5 6 7 18 Cash Balances held within ITV SVOD Australia Pty Ltd were fully utilised prior to completion of the sale and therefore Share of profits 7 1 – 8 have not been included in the above assets held for sale. Impairments/fair value Included in the Group’s Consolidated Statement of Financial Position are working capital balances with the entities adjustments – (4) – (4) held for sale, for content and other related trading activities. These balances will be settled in the normal course Foreign exchange 4 6 – 10 of business. At 31 December 2022 59 60 11 130 Additions 5 3 10 18 Share of profits/ (losses) 8 (8) – – Impairments/fair value adjustments – (5) – (5) Dividends received (3) – – (3) Foreign exchange (3) (3) – (6) Classified as held for sale (66) – – (66) At 31 December 2023 – 47 21 68 On 1 March 2024, the Group announced the sale of its entire 50% interest in digital streaming service, BritBox International to its joint venture partner BBC Studios for a cash consideration of £255 million. The transaction has been effected by the disposal of the Group’s 50% interests in BritBox LLC, BB Rights LLC, Denipurna Limited and BritBox International Limited and the 100% interest in ITV SVOD Australia Pty Ltd, which holds the 50% interest in BritBox Australia Management Pty Limited. At 31 December 2023, the Group included these interests at their carrying value of £66 million, as held for sale in the Consolidated Statement of Financial Position. See notes 3.4 and 5.3. At 31 December 2023, there were no other significant investments in joint ventures (2022: £48 million invested in BritBox LLC in the US). The Group’s associates include £31 million (2022: £38 million) relating to a 45% investment in Blumhouse TV Holdings LLC, a film and television production company in the US. The equity investments relate primarily to Group’s Media for Equity programme. No individual investment is considered material to the Group. Please refer to page 240 for the list of joint ventures, associates and other significant holdings held at 31 December 2023.

ITV Annual Report & Accounts Page 194 Page 196

ITV Annual Report & Accounts Page 194 Page 196