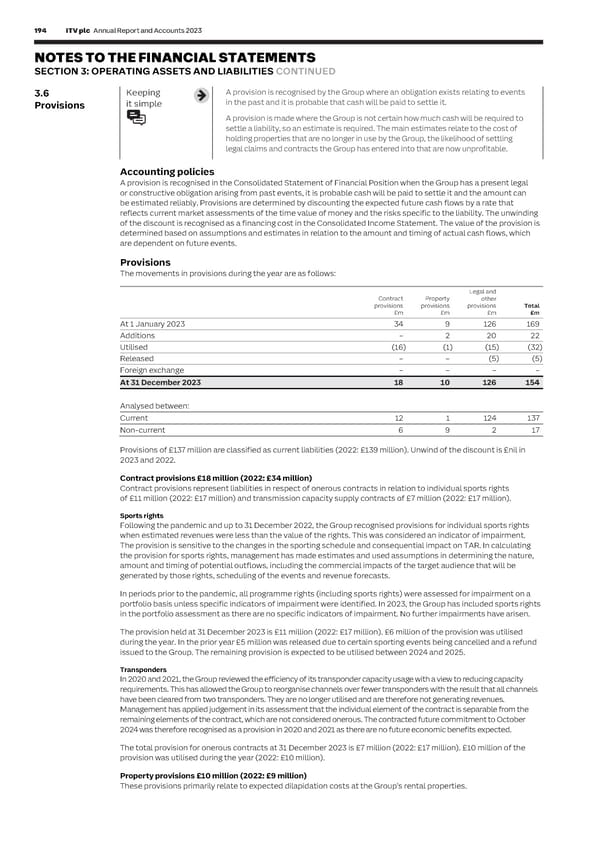

194 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 195 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL 3.6 Keeping A provision is recognised by the Group where an obligation exists relating to events Legal and other provisions £126 million (2022: £126 million) S T in the past and it is probable that cash will be paid to settle it. Represents provisions for potential liabilities (arising from legal disputes and claims) and their related legal costs. A Provisions it simple T These include £52 million (2022: £52 million) for the potential liability that may arise as a result of the Box Clever E A provision is made where the Group is not certain how much cash will be required to M Financial Support Directions (FSDs) issued by the Pensions Regulator (tPR), employee-related tax and other E settle a liability, so an estimate is required. The main estimates relate to the cost of N provisions of £61 million (2022: £59 million) and other legal and related costs. T holding properties that are no longer in use by the Group, the likelihood of settling S legal claims and contracts the Group has entered into that are now unprofitable. Box Clever Pension Scheme Box Clever Technology Limited (Box Clever) was a TV rental business joint venture set up by Granada Rental and Accounting policies Retail Limited and Carmelite Investments Limited (parent company of Thorn Limited (Thorn) in 1999. The business A provision is recognised in the Consolidated Statement of Financial Position when the Group has a present legal went into administrative receivership in 2003. The Box Clever Pension Scheme (the Scheme) was managed from its or constructive obligation arising from past events, it is probable cash will be paid to settle it and the amount can establishment by an independent Trustee and the Group has not had any commercial connection with the Box be estimated reliably. Provisions are determined by discounting the expected future cash flows by a rate that Clever business since it went into administrative receivership in 2003. After proceedings in the Upper Tribunal and reflects current market assessments of the time value of money and the risks specific to the liability. The unwinding Court of Appeal were dismissed, certain companies within ITV were issued with FSDs by tPR on 17 March 2020. of the discount is recognised as a financing cost in the Consolidated Income Statement. The value of the provision is An FSD does not set out what form any financial support should take, nor its amount, and those issues have not yet determined based on assumptions and estimates in relation to the amount and timing of actual cash flows, which been resolved as part of the legal process. are dependent on future events. The legislation provides that any contribution that ITV may make must be considered reasonable. If an agreement is Provisions reached with tPR there may not be an immediate cash flow impact. If an agreement cannot be reached, further legal proceedings could take several years to resolve. The movements in provisions during the year are as follows: At 31 December 2003, the Scheme was estimated to have had a deficit on a buyout basis of £25 million. An estimate Legal and of the deficit in the Box Clever Group Pension Scheme was calculated at £110 million as at 31 March 2021. This Contract Property other provisions provisions provisions Total estimate was calculated on a buyout basis based on membership data as of February 2020. This estimate has been £m £m £m £m updated based on 31 December 2023 market conditions and has reduced to £78 million primarily due to the increase At 1 January 2023 34 9 126 169 in gilt yields and recent changes in inflation. All of these valuations were of the whole Scheme, encompassing Additions – 2 20 22 liabilities in respect of former employees of Granada's joint venture partner, Thorn, as well as former employees Utilised (16) (1) (15) (32) of the Group. Released – – (5) (5) As reported previously, in 2022 the Group received a warning notice from tPR that it was considering exercising Foreign exchange – – – – its power to issue a contribution notice for the amount of £133 million, which is based on a buyout estimate as at At 31 December 2023 18 10 126 154 31 March 2021 provided by the Scheme’s actuarial adviser, plus a prudent margin. The Group made representations in relation to the warning notice on 31 October 2022, tPR responded on 28 July 2023 and the Group replied on Analysed between: 14 November 2023. ITV has continued to engage with tPR during the relevant period. Current 12 1 124 137 There remains a significant number of undecided issues as to the quantum and form of financial support and the Non-current 6 9 2 17 Directors continue to believe there are many important factors which need to be taken into account in any decision, and therefore there remains uncertainty around the financial support to be provided. The provision remains at Provisions of £137 million are classified as current liabilities (2022: £139 million). Unwind of the discount is £nil in £52 million, and represents the offer made to settle the matter and is based on an IAS 19 valuation to transfer certain 2023 and 2022. liabilities into the existing ITV pension scheme, which we consider to be the most likely form of settlement. We are Contract provisions £18 million (2022: £34 million) continuing to engage with tPR to resolve the matter. Contract provisions represent liabilities in respect of onerous contracts in relation to individual sports rights Employee-related of £11 million (2022: £17 million) and transmission capacity supply contracts of £7 million (2022: £17 million). The determination of the employment tax status of some individuals contracted by the Group is complex. HMRC has issued assessments to the Group for several individuals engaged by the Group during the tax years 2016/17 to Sports rights 2018/19 as employed for tax purposes and a provision of £56 million was made. Following the pandemic and up to 31 December 2022, the Group recognised provisions for individual sports rights when estimated revenues were less than the value of the rights. This was considered an indicator of impairment. During 2023, we have further reviewed the provision, which has resulted in an increase in the provision of £2 million The provision is sensitive to the changes in the sporting schedule and consequential impact on TAR. In calculating (2022: £20 million). This has resulted in a £5 million charge to the profit and loss account and a £3 million credit to the provision for sports rights, management has made estimates and used assumptions in determining the nature, exceptional items (2022: £10 million) as this relates to periods up to 31 December 2022 and therefore does not amount and timing of potential outflows, including the commercial impacts of the target audience that will be relate to the current year. generated by those rights, scheduling of the events and revenue forecasts. Due to ongoing reviews by HMRC and court cases in this matter, the final amount payable could be significantly In periods prior to the pandemic, all programme rights (including sports rights) were assessed for impairment on a different to the £58 million currently provided (2022: £56 million). It is difficult to provide a range for the expected portfolio basis unless specific indicators of impairment were identified. In 2023, the Group has included sports rights final amounts payable as case law is continually evolving on this matter, particularly in relation to Front of Camera in the portfolio assessment as there are no specific indicators of impairment. No further impairments have arisen. presenters. Very few cases have reached the higher courts and fact patterns can be very different in individual cases, The provision held at 31 December 2023 is £11 million (2022: £17 million). £6 million of the provision was utilised so determination of employment status for tax purposes remains very subjective. during the year. In the prior year £5 million was released due to certain sporting events being cancelled and a refund A further £3 million (2022: £3 million) is provided in relation to other employment related matters. issued to the Group. The remaining provision is expected to be utilised between 2024 and 2025. Other Transponders Other provisions relate to settlements or proposed settlements on a number of legal cases as well as historical In 2020 and 2021, the Group reviewed the efficiency of its transponder capacity usage with a view to reducing capacity environmental provisions in relation to our production sites, closure costs and provision for legal fees for other requirements. This has allowed the Group to reorganise channels over fewer transponders with the result that all channels ongoing litigation. have been cleared from two transponders. They are no longer utilised and are therefore not generating revenues. Management has applied judgement in its assessment that the individual element of the contract is separable from the remaining elements of the contract, which are not considered onerous. The contracted future commitment to October 2024 was therefore recognised as a provision in 2020 and 2021 as there are no future economic benefits expected. The total provision for onerous contracts at 31 December 2023 is £7 million (2022: £17 million). £10 million of the provision was utilised during the year (2022: £10 million). Property provisions £10 million (2022: £9 million) These provisions primarily relate to expected dilapidation costs at the Group’s rental properties.

ITV Annual Report & Accounts Page 195 Page 197

ITV Annual Report & Accounts Page 195 Page 197