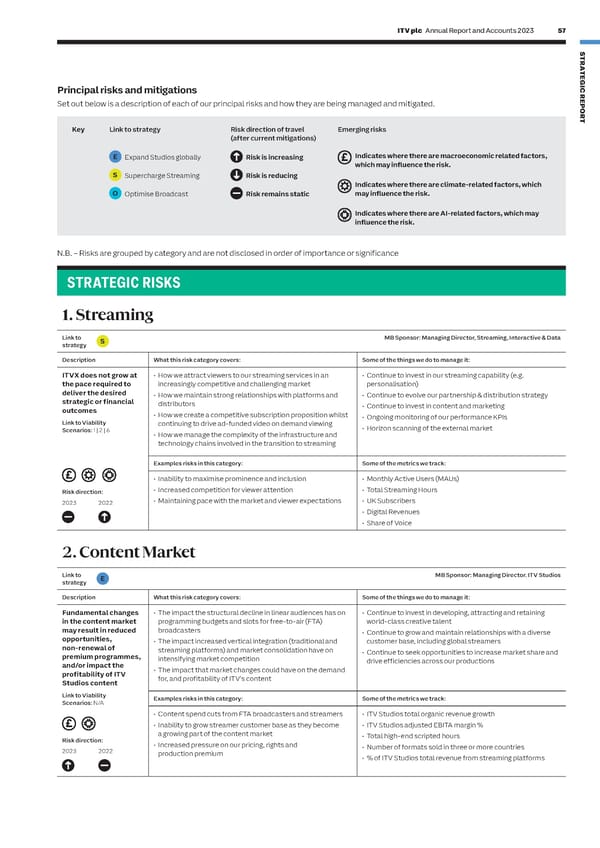

56 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 57 S RISKS AND UNCERTAINTIES CONTINUED T R A T E G I Principal risks and mitigations C R OUR RISK OVERSIGHT AND GOVERNANCE STRUCTURE AT A GLANCE E Set out below is a description of each of our principal risks and how they are being managed and mitigated. P O R T ITV PLC BoardAudit and Risk Key Link to strategy Risk direction of travel Emerging risks Committee (after current mitigations) (ARC) E Expand Studios globally Risk is increasing Indicates where there are macroeconomic related factors, which may influence the risk. S Supercharge Streaming Risk is reducing Indicates where there are climate-related factors, which O Optimise Broadcast Risk remains static may influence the risk. Management BoardRisk & Indicates where there are AI-related factors, which may Compliance influence the risk. Steering Committee (RCSC) N.B. – Risks are grouped by category and are not disclosed in order of importance or significance STRATEGIC RISKS Studios M&E Climate Action BoardBoardDelivery Group (CADG) 1. Streaming Link to S MB Sponsor: Managing Director, Streaming, Interactive & Data strategy Description What this risk category covers: Some of the things we do to manage it: ITVX does not grow at • How we attract viewers to our streaming services in an • Continue to invest in our streaming capability (e.g. the pace required to increasingly competitive and challenging market personalisation) Corporate Studios M&E deliver the desired • How we maintain strong relationships with platforms and • Continue to evolve our partnership & distribution strategy FunctionsRisk Working Risk Working strategic or financial distributors GroupGroup outcomes • Continue to invest in content and marketing • How we create a competitive subscription proposition whilst • Ongoing monitoring of our performance KPIs Link to Viability continuing to drive ad-funded video on demand viewing Scenarios: 1 | 2 | 6 • Horizon scanning of the external market • How we manage the complexity of the infrastructure and technology chains involved in the transition to streaming Examples risks in this category: Some of the metrics we track: • Inability to maximise prominence and inclusion • Monthly Active Users (MAUs) KeyDirection and managementReporting and escalationAdvice and oversightRisk direction:• Increased competition for viewer attention • Total Streaming Hours 2023 2022 • Maintaining pace with the market and viewer expectations • UK Subscribers • Digital Revenues • Share of Voice Risk Management EffectivenessChanges to principal risks • The addition of ‘Third-Party Risk 2. Content Market The PLC Board continues to monitor the during the yearManagement’ to recognise the increasing effectiveness of risk management at ITV. An complexity and importance of our Link to MB Sponsor: Managing Director. ITV Studios The ongoing management and monitoring of third-party relationships and the potential strategyE independent assessment of ITV’s risk ITV’s most critical risks throughout the year these have to cause significant damage management framework and practices was has led to changes to the principal risks from to our reputationDescriptionWhat this risk category covers: Some of the things we do to manage it: conducted during Q4 2023 as part of the the previous reporting period (H1 2023). 2023 internal audit plan. The review • Promoting ‘Operational Resilience’ Fundamental changes • The impact the structural decline in linear audiences has on • Continue to invest in developing, attracting and retaining These included: in the content market programming budgets and slots for free-to-air (FTA) world-class creative talent concluded that significant progress has been to recognise the importance of being • Splitting ‘cyber-attack or data breach able to withstand and recover from may result in reduced broadcasters • Continue to grow and maintain relationships with a diverse made over the last year to achieve an opportunities, • The impact increased vertical integration (traditional and customer base, including global streamers effective state for principal risk management incident’ into two separate principal risks our technology and/or services non-renewal of to enhance transparency, improve being compromised. streaming platforms) and market consolidation have on • Continue to seek opportunities to increase market share and within ITV, with a number of opportunities to premium programmes, intensifying market competition drive efficiencies across our productions enhance the framework and practices accountability and enable us to establish and/or impact the more focused mitigation strategiesprofitability of ITV • The impact that market changes could have on the demand identified and reflected in our risk for, and profitability of ITV’s content management plans for 2024.• Removing ‘Pensions Deficit’ as the Studios content ITV pension scheme position has Link to Viability Examples risks in this category: Some of the metrics we track: significantly improved Scenarios: N/A • Content spend cuts from FTA broadcasters and streamers • ITV Studios total organic revenue growth • Inability to grow streamer customer base as they become • ITV Studios adjusted EBITA margin % a growing part of the content market • Total high-end scripted hours Risk direction: • Increased pressure on our pricing, rights and 2023 2022 • Number of formats sold in three or more countries production premium • % of ITV Studios total revenue from streaming platforms

ITV Annual Report & Accounts Page 58 Page 60

ITV Annual Report & Accounts Page 58 Page 60