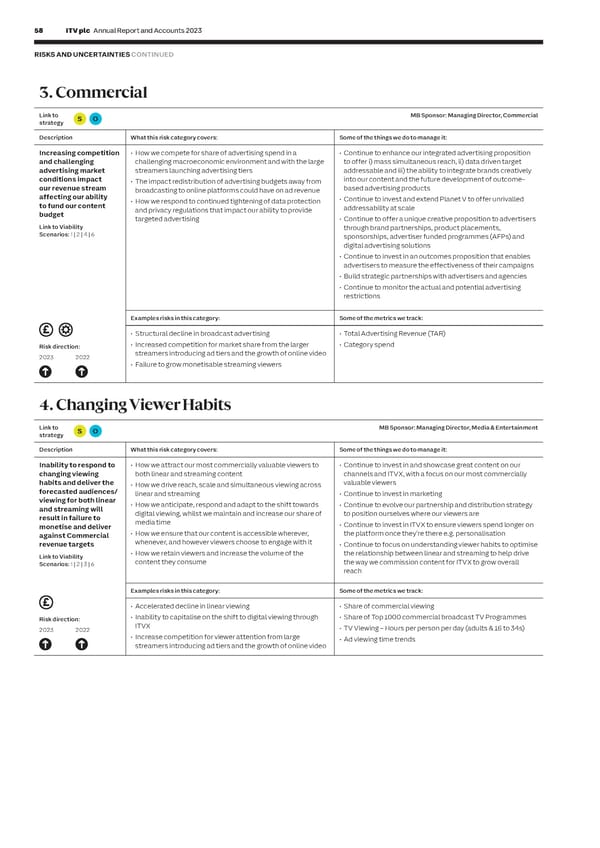

58 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 59 S RISKS AND UNCERTAINTIES CONTINUED T R A T E G I 3. Commercial 5. Content Pipeline C R E P O Link to MB Sponsor: Managing Director, Commercial Link to MB Sponsor: Managing Director, Media & Entertainment R strategy S O strategy S O T Description What this risk category covers: Some of the things we do to manage it: Description What this risk category covers: Some of the things we do to manage it: Increasing competition • How we compete for share of advertising spend in a • Continue to enhance our integrated advertising proposition Lack of diversified • How we anticipate and adapt to changes in the tastes and • Our data and insights team focuses on understanding the and challenging challenging macroeconomic environment and with the large to offer i) mass simultaneous reach, ii) data driven target commissioning habits of viewers preferences of our most commercially valuable viewers to advertising market streamers launching advertising tiers addressable and iii) the ability to integrate brands creatively pipeline (whilst • How we develop a quality and appealing content pipeline that help drive the way we commission content conditions impact • The impact redistribution of advertising budgets away from into our content and the future development of outcome- balancing/maintaining is both resilient to changes in viewer preferences, as well as • Continue to invest in content and talent our revenue stream broadcasting to online platforms could have on ad revenue based advertising products mass simultaneous being financially viable • Continue to focus on our key franchises and brands to ensure affecting our ability • How we respond to continued tightening of data protection • Continue to invest and extend Planet V to offer unrivalled reach on linear TV; • How we leverage the value of being an integrated producer, editorial protection to fund our content and privacy regulations that impact our ability to provide addressability at scale attracting light viewers broadcaster and streamer to enable us to continue to provide budget on ITVX; and managing • Continue to evolve the way we commission and acquire targeted advertising • Continue to offer a unique creative proposition to advertisers rising content costs) unrivalled viewers of scale for UK advertisers and to grow our content as well as innovating how we fund content (e.g. Link to Viability through brand partnerships, product placements, digital revenues partnerships, Advertiser Funded Programmes (AFPs) and Scenarios: 1 | 2 | 4 | 6 sponsorships, advertiser funded programmes (AFPs) and may impact total viewing • How we ensure we are commissioning content by, with co-productions) digital advertising solutions and for everyone (Diversity, Equity & Inclusion) whilst • Continue to focus on maintaining strong relationships with • Continue to invest in an outcomes proposition that enables Link to Viability also considering the impact our behaviours and those Scenarios: 1 | 2 | 3 | 6 independent studios from whom we commission content advertisers to measure the effectiveness of their campaigns portrayed through our content have on society and the • Continue to invest in live sports, high-end drama and • Build strategic partnerships with advertisers and agencies wider environment entertainment programmes to maintain mass simultaneous • Continue to monitor the actual and potential advertising reach and to attract our most commercially valuable viewers restrictions • Continue to commission content by, with and for everyone (e.g. £80 million Diversity Commissioning fund) and to Examples risks in this category: Some of the metrics we track: identify ways to make our content accessible to all (e.g. Dedicated British Sign Language (BSL) FAST channel) • Structural decline in broadcast advertising • Total Advertising Revenue (TAR) Risk direction: • Increased competition for market share from the larger • Category spend Examples risks in this category: Some of the metrics we track: 2023 2022 streamers introducing ad tiers and the growth of online video • Failure to grow monetisable streaming viewers • Increased cost of content driven by rising costs of production • Share of Commercial Viewing Risk direction: and increased competition from competitors • Share of Top 1000 commercial broadcast TV Programmes • Failing to secure the right talent at the right price 2023 2022 • Total Streaming Hours • Accelerated decline in linear viewing and growth of other • UK Subscribers 4. Changing Viewer Habits digital offerings Link to S O MB Sponsor: Managing Director, Media & Entertainment 6. Partnerships strategy Description What this risk category covers: Some of the things we do to manage it: Link to S O MB Sponsor: Chief Finance Officer / Chief Operating Officer Inability to respond to • How we attract our most commercially valuable viewers to • Continue to invest in and showcase great content on our strategy changing viewing both linear and streaming content channels and ITVX, with a focus on our most commercially Description What this risk category covers: Some of the things we do to manage it: habits and deliver the • How we drive reach, scale and simultaneous viewing across valuable viewers forecasted audiences/ linear and streaming • Continue to invest in marketing An inability to develop • How we develop and maintain strong partnerships with major • Continue to supercharge our streaming service to strengthen viewing for both linear • How we anticipate, respond and adapt to the shift towards • Continue to evolve our partnership and distribution strategy and maintain adequate platforms and distribution partners to maximise prominence our offering to our most commercially valuable viewers and and streaming will digital viewing, whilst we maintain and increase our share of to position ourselves where our viewers are relationships with and inclusion of our content advertisers result in failure to media time major platform and • How we manage the trade-offs inherent in our commercial • Work closely with Ofcom and the government (DCMS) to monetise and deliver • Continue to invest in ITVX to ensure viewers spend longer on distribution providers arrangements with our platforms and distribution partners modernise the PSB regulatory regime against Commercial • How we ensure that our content is accessible wherever, the platform once they’re there e.g. personalisation may result in reduced revenue targets whenever, and however viewers choose to engage with it • Continue to focus on understanding viewer habits to optimise brand prominence, • How we actively plan for long term changes in traditional • Continue to evolve our partnership and distribution strategy • How we retain viewers and increase the volume of the the relationship between linear and streaming to help drive viewers being unable distribution (DTT & DSat) as viewing continues to transition to reduce reliance on single platforms and secure more Link to Viability online (IP) advantageous commercial relationships Scenarios: 1 | 2 | 3 | 6 content they consume the way we commission content for ITVX to grow overall to find our content and reach a lack of fair value for • We have a dedicated team that continues to build that content relationships with the major distribution providers and Examples risks in this category: Some of the metrics we track: platforms to ensure ITV remains attractive from a distribution Link to Viability perspective Scenarios: 1 | 2 | 6 • Accelerated decline in linear viewing • Share of commercial viewing • Continue to collaborate with the other PSBs to a compelling Risk direction: • Inability to capitalise on the shift to digital viewing through • Share of Top 1000 commercial broadcast TV Programmes consumer controlled entry point to our content in readiness ITVX • TV Viewing – Hours per person per day (adults & 16 to 34s) for the shift to IP only viewing through Freely 2023 2022 • Increase competition for viewer attention from large • Ad viewing time trends • Proactive involvement of the ITV Legal team to ensure we streamers introducing ad tiers and the growth of online video continue to operate within our framework Examples risks in this category: Some of the metrics we track: • Failure to negotiate and re-negotiate favourable carriage • Relationship health check status terms with platforms and distribution partners Risk direction: • Our partners demanding a direct or indirect financial return 2023 2022 for continued carriage • The increasing prevalence of biased algorithmic or AI personalisation impacting the prominence of our content

ITV Annual Report & Accounts Page 59 Page 61

ITV Annual Report & Accounts Page 59 Page 61