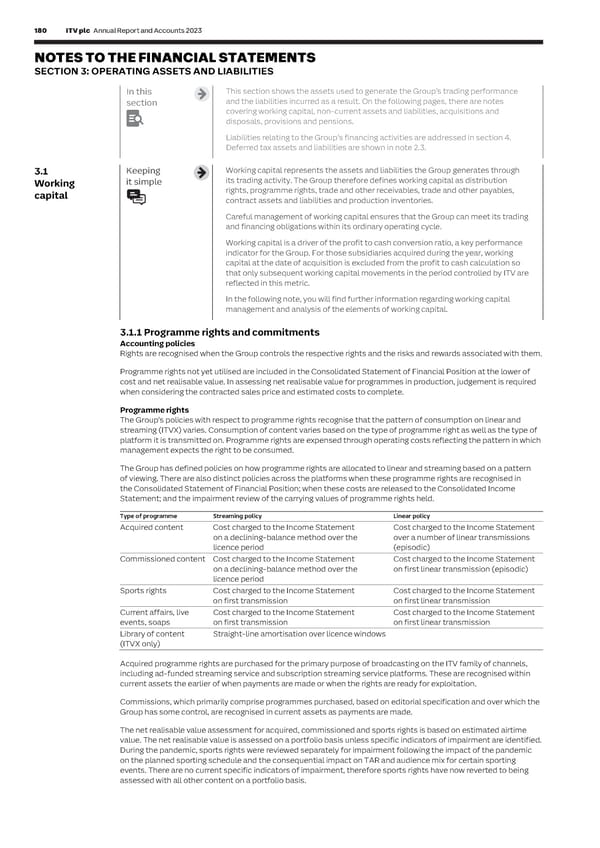

180 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 181 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES C I AL In this This section shows the assets used to generate the Group’s trading performance Programme rights and other inventory at the year end are shown in the table below: S T section and the liabilities incurred as a result. On the following pages, there are notes A T covering working capital, non-current assets and liabilities, acquisitions and 2023 2022 E £m £m M disposals, provisions and pensions. E Acquired programme rights 284 225 N T Liabilities relating to the Group’s financing activities are addressed in section 4. Commissions 83 103 S Deferred tax assets and liabilities are shown in note 2.3. Sports rights 46 49 413 377 3.1 Keeping Working capital represents the assets and liabilities the Group generates through Working it simple its trading activity. The Group therefore defines working capital as distribution £nil relates to stock that will be transmitted in 2025 and beyond (2022: £6 million transmitted in 2024 and beyond). capital rights, programme rights, trade and other receivables, trade and other payables, contract assets and liabilities and production inventories. Included within programme rights and other inventory is £46 million (2022: £49 million) relating to programme rights Careful management of working capital ensures that the Group can meet its trading that have been paid for but that are not yet in licence. These amounts are considered to be prepayments but are and financing obligations within its ordinary operating cycle. included within programme rights and other inventory as it is more useful to the reader to show all such rights together. Working capital is a driver of the profit to cash conversion ratio, a key performance Programme and transmission commitments indicator for the Group. For those subsidiaries acquired during the year, working Transmission commitments are the contracted future payments under transmission supply agreements that require capital at the date of acquisition is excluded from the profit to cash calculation so the use of transponder capacity for a period of up to ten years with payments increasing over time, limited by specific that only subsequent working capital movements in the period controlled by ITV are RPI caps. The application of IFRS requires judgement regarding the classification of transmission commitments. The reflected in this metric. Group has concluded that these contracts do not constitute leases as defined in IFRS 16 ‘Leases’, as the Group does not control these assets due to the nature of the operation of the assets and the rights retained by the supplier In the following note, you will find further information regarding working capital under the contracts. management and analysis of the elements of working capital. Programming commitments are transactions entered into in the ordinary course of business with programme 3.1.1 Programme rights and commitments suppliers, sports organisations and film distributors in respect of rights to broadcast on the ITV network including Accounting policies ITVX and on BritBox UK. Rights are recognised when the Group controls the respective rights and the risks and rewards associated with them. The Group has onerous contract provisions of £18 million (2022: £34 million) in respect of transponder capacity Programme rights not yet utilised are included in the Consolidated Statement of Financial Position at the lower of usage and sports rights commitments. See note 3.6 for further details. cost and net realisable value. In assessing net realisable value for programmes in production, judgement is required Commitments in respect of these transactions, which are not reflected in the Consolidated Statement of Financial when considering the contracted sales price and estimated costs to complete. Position, are due for payment as follows: Programme rights Transmission Programme Total The Group’s policies with respect to programme rights recognise that the pattern of consumption on linear and 2023 £m £m £m streaming (ITVX) varies. Consumption of content varies based on the type of programme right as well as the type of Within one year 20 488 508 platform it is transmitted on. Programme rights are expensed through operating costs reflecting the pattern in which Later than one year and not more than five years – 380 380 management expects the right to be consumed. 20 868 888 The Group has defined policies on how programme rights are allocated to linear and streaming based on a pattern of viewing. There are also distinct policies across the platforms when these programme rights are recognised in Transmission Programme Total the Consolidated Statement of Financial Position; when these costs are released to the Consolidated Income 2022 £m £m £m Statement; and the impairment review of the carrying values of programme rights held. Within one year 25 466 491 Later than one year and not more than five years 19 349 368 Type of programme Streaming policy Linear policy 44 815 859 Acquired content Cost charged to the Income Statement Cost charged to the Income Statement on a declining-balance method over the over a number of linear transmissions 3.1.2 Distribution rights licence period (episodic) Accounting policies Commissioned content Cost charged to the Income Statement Cost charged to the Income Statement Distribution rights are programme rights the Group buys from producers to derive future revenue, principally through on a declining-balance method over the on first linear transmission (episodic) licensing to other broadcasters. These are classified as non-current assets as these rights are used to derive long- licence period term economic benefit for the Group. Sports rights Cost charged to the Income Statement Cost charged to the Income Statement on first transmission on first linear transmission Distribution rights are recognised initially at cost and charged through operating costs in the Consolidated Income Current affairs, live Cost charged to the Income Statement Cost charged to the Income Statement Statement over a period not exceeding five years, reflecting the value and pattern in which the right is consumed. events, soaps on first transmission on first linear transmission Advances paid for the acquisition of distribution rights are disclosed as distribution rights as soon as they are Library of content Straight-line amortisation over licence windows contracted. These advances are not expensed until the programme is available for distribution. Up to that point, they are (ITVX only) assessed annually for impairment through the reassessment of the future sales expected to be earned from that title. The net book value of distribution rights at the year end is as follows: Acquired programme rights are purchased for the primary purpose of broadcasting on the ITV family of channels, including ad-funded streaming service and subscription streaming service platforms. These are recognised within 2023 2022 current assets the earlier of when payments are made or when the rights are ready for exploitation. £m £m Distribution rights 14 17 Commissions, which primarily comprise programmes purchased, based on editorial specification and over which the Group has some control, are recognised in current assets as payments are made. During the year, £18 million was charged to the Consolidated Income Statement (2022: £25 million). The net realisable value assessment for acquired, commissioned and sports rights is based on estimated airtime value. The net realisable value is assessed on a portfolio basis unless specific indicators of impairment are identified. During the pandemic, sports rights were reviewed separately for impairment following the impact of the pandemic on the planned sporting schedule and the consequential impact on TAR and audience mix for certain sporting events. There are no current specific indicators of impairment, therefore sports rights have now reverted to being assessed with all other content on a portfolio basis.

ITV Annual Report & Accounts Page 181 Page 183

ITV Annual Report & Accounts Page 181 Page 183