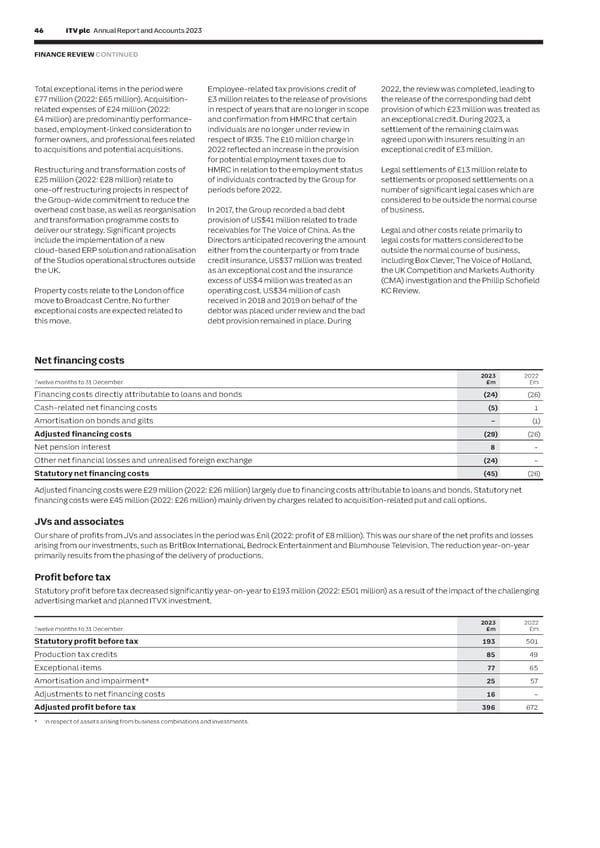

46 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 47 S FINANCE REVIEW CONTINUED T R A T E G I Total exceptional items in the period were Employee-related tax provisions credit of 2022, the review was completed, leading to Tax C R £77 million (2022: £65 million). Acquisition- £3 million relates to the release of provisions the release of the corresponding bad debt E Adjusted tax charge P related expenses of £24 million (2022: in respect of years that are no longer in scope provision of which £23 million was treated as O R £4 million) are predominantly performance- and confirmation from HMRC that certain an exceptional credit. During 2023, a The total adjusted tax charge for the year was £85 million (2022: £135 million), corresponding to an effective tax rate on adjusted PBT of 21.5% T based, employment-linked consideration to individuals are no longer under review in settlement of the remaining claim was (2022: 20.1%), which is lower than the standard UK corporation tax rate of 23.5% (2022: 19%). We expect the adjusted effective tax rate to be former owners, and professional fees related respect of IR35. The £10 million charge in agreed upon with insurers resulting in an around 25% in 2024, as a result of the increase in the UK statutory rate to 25% from April 2023. to acquisitions and potential acquisitions. 2022 reflected an increase in the provision exceptional credit of £3 million. for potential employment taxes due to On a reported basis, there is a tax credit of £16 million (2022: £66 million tax charge) which corresponds to an effective tax rate of (8.3%) Restructuring and transformation costs of HMRC in relation to the employment status Legal settlements of £13 million relate to (2022: tax charge rate 13.2%). This rate in 2023 is lower than in previous years due to the impact of higher HETV tax credits relative to the tax £25 million (2022: £28 million) relate to of individuals contracted by the Group for settlements or proposed settlements on a charge, as well as a proportionally lower profit before tax in the period compared to the prior year. The adjustments made to reconcile the one-off restructuring projects in respect of periods before 2022. number of significant legal cases which are statutory tax charge with the adjusted tax charge are the tax effects of the adjustments made to reconcile PBT and adjusted PBT, as detailed the Group-wide commitment to reduce the considered to be outside the normal course in the previous table. overhead cost base, as well as reorganisation In 2017, the Group recorded a bad debt of business. and transformation programme costs to provision of US$41 million related to trade 2 0 2 3 2 0 2 2 deliver our strategy. Significant projects receivables for The Voice of China. As the Legal and other costs relate primarily to 2023 Effective 2022 Effective Twelve months to 31 December £m tax rate £m tax rate include the implementation of a new Directors anticipated recovering the amount legal costs for matters considered to be Statutory tax (credit)/charge (16) (8.3)% 66 13.2% cloud-based ERP solution and rationalisation either from the counterparty or from trade outside the normal course of business, of the Studios operational structures outside credit insurance, US$37 million was treated including Box Clever, The Voice of Holland, Production tax credits 85 100% 49 100% the UK. as an exceptional cost and the insurance the UK Competition and Markets Authority Charge for exceptional items 12 15.6% 8 12.3% excess of US$4 million was treated as an (CMA) investigation and the Phillip Schofield Charge in respect of amortisation and impairment* 6 24.0% 12 21.1% Property costs relate to the London office operating cost. US$34 million of cash KC Review. Charge in respect of adjustments to net financing costs (2) (12.5)% – – move to Broadcast Centre. No further received in 2018 and 2019 on behalf of the exceptional costs are expected related to debtor was placed under review and the bad Adjusted tax charge** 85 21.5% 135 20.1% this move. debt provision remained in place. During * In respect of intangible assets arising from business combinations and investments. Also reflects the cash tax benefit of tax deductions for US goodwill. ** As a percentage of adjusted profit before tax. Net financing costs Cash tax Cash tax paid in the year was £32 million (2022: £55 million) and is net of £38 million of production tax credits received (2022: £31 million). 2023 2022 The majority of the cash tax payments were made in the UK. The cash tax paid is lower compared to the previous year due to lower profits and Twelve months to 31 December £m £m Financing costs directly attributable to loans and bonds (24) (26) higher production tax credits received. A reconciliation between the tax charge for the year and the cash tax paid in the year is shown below. Cash-related net financing costs (5) 1 2023 2022 Amortisation on bonds and gilts – (1) Twelve months to 31 December £m £m Adjusted financing costs (29) (26) Tax credit/(charge) (statutory) 16 (66) Net pension interest 8 – Temporary differences recognised through deferred tax* 7 44 Other net financial losses and unrealised foreign exchange (24) – Prior year adjustments to current tax 12 (9) Statutory net financing costs (45) (26) Current tax, current year 35 (31) Phasing of tax payments (including in respect of pension contribution benefits) (20) (6) Adjusted financing costs were £29 million (2022: £26 million) largely due to financing costs attributable to loans and bonds. Statutory net financing costs were £45 million (2022: £26 million) mainly driven by charges related to acquisition-related put and call options. Production tax credits – timing of receipt (47) (18) Cash tax paid (statutory) (32) (55) JVs and associates * Further detail is included within Note 2.3 of the financial statements. Our share of profits from JVs and associates in the period was £nil (2022: profit of £8 million). This was our share of the net profits and losses arising from our investments, such as BritBox International, Bedrock Entertainment and Blumhouse Television. The reduction year-on-year primarily results from the phasing of the delivery of productions. Changes to the current UK system increase our EBITA, adjusted EBITA, adjusted provides an exemption from the requirement Profit before tax of Audio-Visual tax credits EBITA margin, profit before tax and tax to recognise and disclose deferred taxes On 29 November 2023, the UK government expense but will leave our profit after tax arising from enacted or substantively Statutory profit before tax decreased significantly year-on-year to £193 million (2022: £501 million) as a result of the impact of the challenging unchanged, this is compared to the previous enacted tax law that implements the Pillar advertising market and planned ITVX investment. issued final legislation to reform the current system of Audio-Visual Expenditure Credit HETV accounting treatment. We continue to Two model rules. (‘AVEC’) tax credits to merge the four existing assess the impact on the Group and do not 2023 2022 AVEC schemes (Film, High-End Television anticipate there to be a material change in Based on an initial analysis of the current Twelve months to 31 December £m £m (HETV), Children’s Television and Animation) the net economic value. year financial data, most territories in which Statutory profit before tax 193 501 the Group operates are expected to qualify into a single scheme and has reviewed the Production tax credits 85 49 qualifying criteria. The AVEC legislation was Base Erosion and Profit Shifting (BEPS) for one of the safe harbour exemptions such Exceptional items 77 65 substantively enacted on 5 February 2024 Pillar Two that top-up taxes should not apply. In Amortisation and impairment* 25 57 and can be claimed on expenditure incurred On 20 June 2023, Finance (No.2) Act 2023 territories where this is not the case there is from 1 January 2024. was substantively enacted in the UK, the potential for Pillar Two taxes to apply, but Adjustments to net financing costs 16 – introducing a global minimum effective tax these are not expected to be material. The Adjusted profit before tax 396 672 The new scheme is one of expenditure rate of 15% for large groups and for financial Group continues to refine this assessment credits as opposed to corporate tax relief, years beginning on or after 31 December and analyse the future consequences of * In respect of assets arising from business combinations and investments. these rules. requiring a change to the accounting 2023. Taxation balances are adjusted for a treatment to include them within statutory change in tax law if the change has been operating profit rather than within the substantively enacted by the balance sheet consolidated tax charge. The effect of this date. However the amendments to IAS 12 change in legislation will therefore be to ‘Income Taxes’ Pillar Two income taxes

ITV Annual Report & Accounts Page 47 Page 49

ITV Annual Report & Accounts Page 47 Page 49