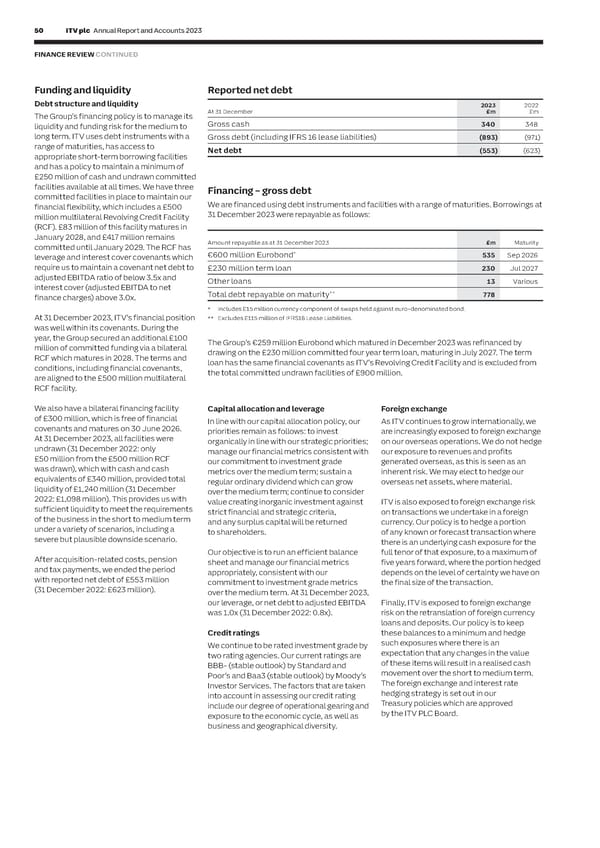

50 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 51 S FINANCE REVIEW CONTINUED T R A T E G I Funding and liquidity Reported net debt Production inventories, contract therefore the £16 million payment may • Total pension deficit funding contributions C R resume in 2024. The Group retains day-to- for 2024 are expected to come down year E Debt structure and liquidity 2023 2022 assets and liabilities P At 31 December £m £m day operational control of SDN and SDN’s on year. More detailed guidance will be O In 2023, contract assets increased by R The Group’s financing policy is to manage its Gross cash 340 348 £17 million, production inventories revenues, profits and cashflows continue to given following the completion on the T liquidity and funding risk for the medium to be consolidated in the Group’s accounts. On triennial valuation long term. ITV uses debt instruments with a Gross debt (including IFRS 16 lease liabilities) (893) (971) decreased by £259 million and contract completion of the final payment in 2031, the range of maturities, has access to liabilities decreased by £185 million • The Board has proposed a final dividend Net debt (553) (623) Scheme’s partnership interest will have been of 3.3p, which will be paid in May 2024. appropriate short‑term borrowing facilities compared to 31 December 2022. Contract repaid in full and it will have no right to any and has a policy to maintain a minimum of assets increased due to UK scripted growth This gives a full year dividend of 5.0p. further payments. Going forward, the Board intends to pay £250 million of cash and undrawn committed with streaming platforms. The production facilities available at all times. We have three inventories decrease was driven a full year ordinary dividend of at least committed facilities in place to maintain our Financing – gross debt predominantly by key US and UK deliveries. Post balance sheet event 5.0p, which it expects to grow over the W medium term financial flexibility, which includes a £500 e are financed using debt instruments and facilities with a range of maturities. Borrowings at Contract liabilities decreased due to the On 01 March 2024 the Group announced million multilateral Revolving Credit Facility 31 December 2023 were repayable as follows: phasing of production deliveries, particularly the sale of its entire 50% interest in BritBox (RCF). £83 million of this facility matures in in the US and the UK. International to its joint venture partner CMA Investigation January 2028, and £417 million remains BBC Studios for a cash consideration of As previously reported, on 12 July 2022, committed until January 2029. The RCF has Amount repayable as at 31 December 2023 £m Maturity Pensions £255 million. The Board intends to return the the UK Competition and Markets Authority leverage and interest cover covenants which €600 million Eurobond* 535 Sep 2026 entire net proceeds to shareholders through (CMA) opened an investigation into certain require us to maintain a covenant net debt to The net pension surplus for the defined a £235 million share buyback which will be £230 million term loan 230 Jul 2027 benefit schemes at 31 December 2023 on an conduct of ITV and other named companies adjusted EBITDA ratio of below 3.5x and completed within 18 months. Refer to notes in the sector relating to the production and Other loans 13 Various accounting basis was £209 million (31 3.4 and 5.3 to the financial statements for interest cover (adjusted EBITDA to net broadcasting of sports content in the United finance charges) above 3.0x. Total debt repayable on maturity** 778 December 2022: £192 million). The further details. movement in the year was driven by Kingdom. The investigation is at an early * Includes £15 million currency component of swaps held against euro‑denominated bond. employer contributions and a reduction in stage and the CMA has confirmed it is At 31 December 2023, ITV’s financial position ** Excludes £115 million of IFRS16 Lease Liabilities. liabilities due to changes in demographic Planning assumptions for the currently undertaking further investigation was well within its covenants. During the assumptions partly offset by a fall in full year 2024 until at least March 2024, subsequent to year, the Group secured an additional £100 The Group’s €259 million Eurobond which matured in December 2023 was refinanced by corporate bond yields. The following planning assumptions for 2024 which ITV anticipates it will receive additional million of committed funding via a bilateral drawing on the £230 million committed four year term loan, maturing in July 2027. The term are based on our current best view but may detail regarding any future steps. RCF which matures in 2028. The terms and loan has the same financial covenants as ITV’s Revolving Credit Facility and is excluded from The net pension assets include £48 million of change depending on how events unfold over conditions, including financial covenants, the total committed undrawn facilities of £900 million. gilts, which are held by the Group as security the rest of the year. On 11 October 2023, the CMA opened an are aligned to the £500 million multilateral for future unfunded pension payments to investigation into certain conduct of ITV RCF facility. four former Granada executives, the Profit and Loss impact: and other named companies in the sector liabilities of which are included in our pension relating to the production and broadcasting We also have a bilateral financing facility Capital allocation and leverage Foreign exchange • Total content costs are expected to of television content in the UK, excluding of £300 million, which is free of financial obligations. A full reconciliation is included be around £1,275 million as we further In line with our capital allocation policy, our As ITV continues to grow internationally, we within note 3.7 to the financial statements. sports content. The investigation remains at covenants and matures on 30 June 2026. priorities remain as follows: to invest are increasingly exposed to foreign exchange optimise linear, evolve our windowing an early stage and it is not currently possible At 31 December 2023, all facilities were organically in line with our strategic priorities; on our overseas operations. We do not hedge strategy and improve personalisation. to reliably quantify any liability that might undrawn (31 December 2022: only Deficit funding contributions We will invest an additional £15 million manage our financial metrics consistent with our exposure to revenues and profits result from the investigation. ITV is £50 million from the £500 million RCF The accounting surplus or deficit does not in marketing committed to complying with competition our commitment to investment grade generated overseas, as this is seen as an drive the deficit funding contribution. The was drawn), which with cash and cash metrics over the medium term; sustain a inherent risk. We may elect to hedge our • Delivery of £40 million of savings – law, and is cooperating with the CMA’s equivalents of £340 million, provided total Group’s deficit funding contributions in 2023 comprising of £10 million from our enquiries in relation to both investigations. regular ordinary dividend which can grow overseas net assets, where material. were £40 million, which included £37 million liquidity of £1,240 million (31 December over the medium term; continue to consider existing £150 million cost saving target 2022: £1,098 million). This provides us with following the agreement of the 2019 Triennial and £30 million of additional in year Foreign exchange sensitivity value creating inorganic investment against ITV is also exposed to foreign exchange risk valuation of the main section of the Scheme, sufficient liquidity to meet the requirements strict financial and strategic criteria, on transactions we undertake in a foreign savings as part of the new strategic The following table highlights ITV Studios of the business in the short to medium term and £3 million annual payment under the restructuring and efficiency programme and any surplus capital will be returned currency. Our policy is to hedge a portion London Television Centre pension funding sensitivity, for the remainder of the year under a variety of scenarios, including a to shareholders. of any known or forecast transaction where • Adjusted financing costs are expected (using internal forecasts), to translation severe but plausible downside scenario. partnerships. Further details are included in to be around £35 million there is an underlying cash exposure for the Note 3.7 to the financial statements. resulting from a 10% appreciation/ Our objective is to run an efficient balance full tenor of that exposure, to a maximum of • The adjusted effective tax rate is expected depreciation in sterling against the US dollar After acquisition‑related costs, pension sheet and manage our financial metrics five years forward, where the portion hedged to be 25% over the medium term in line and euro, assuming all other variables are and tax payments, we ended the period appropriately, consistent with our depends on the level of certainty we have on SDN pension funding partnership with reported net debt of £553 million with the UK statutory tax rate of 25% held constant. An appreciation in sterling has commitment to investment grade metrics the final size of the transaction. In 2010, ITV established a Pension Funding • Exceptional items are expected to a negative effect on revenue and adjusted (31 December 2022: £623 million). over the medium term. At 31 December 2023, Partnership (PFP) with the Trustees backed EBITA; a depreciation has a positive effect. our leverage, or net debt to adjusted EBITDA Finally, ITV is exposed to foreign exchange by SDN, which was subsequently extended in be around £90 million mainly due to was 1.0x (31 December 2022: 0.8x). risk on the retranslation of foreign currency 2011. The PFP addressed £200 million of the costs associated with the new strategic restructuring strategic restructuring Adjusted loans and deposits. Our policy is to keep funding deficit in Section A of the defined Revenue EBITA benefit pension scheme and under the and efficiency programme and digital Currency £m £m Credit ratings these balances to a minimum and hedge transformation costs such exposures where there is an original agreement, a payment of up to US dollar +/-40-55 +/ – 5-7 We continue to be rated investment grade by two rating agencies. Our current ratings are expectation that any changes in the value £200 million was due in 2022. The existing Euro +/ – 40-50 +/-7-9 of these items will result in a realised cash PFP agreement was amended and extended Cash impact BBB‑ (stable outlook) by Standard and • Total capex is expected to be around Poor’s and Baa3 (stable outlook) by Moody’s movement over the short to medium term. to 2031. As a result of this agreement, CHRIS KENNEDY Investor Services. The factors that are taken The foreign exchange and interest rate payments of £94 million were made under £75 million as we further invest in our GROUP CFO & COO into account in assessing our credit rating hedging strategy is set out in our the SDN PFP arrangement in 2022. The digital capabilities include our degree of operational gearing and Treasury policies which are approved Group is committed to up to nine annual • The cash cost of exceptionals is expected exposure to the economic cycle, as well as by the ITV PLC Board. payments of £16 million from 2023. These to be around £90 million mainly due to business and geographical diversity. payments are required if the Scheme is costs associated with the restructuring calculated to be in a technical deficit. This and efficiency programme and digital calculation is based upon the most recent transformation cost triennial valuation updated for current market • Profit to cash conversion is expected to conditions. The partnership’s interest in SDN be around 80% out to 2026. In 2024 profit provides collateral for these payments. The to cash conversion will be lower reflecting £16 million payment under the SDN PFP was an increase in working capital. Across 2023 not required to be paid in 2023. However, this and 2024 we expect cash conversion to assessment is made on an annual basis and be around 80%

ITV Annual Report & Accounts Page 51 Page 53

ITV Annual Report & Accounts Page 51 Page 53