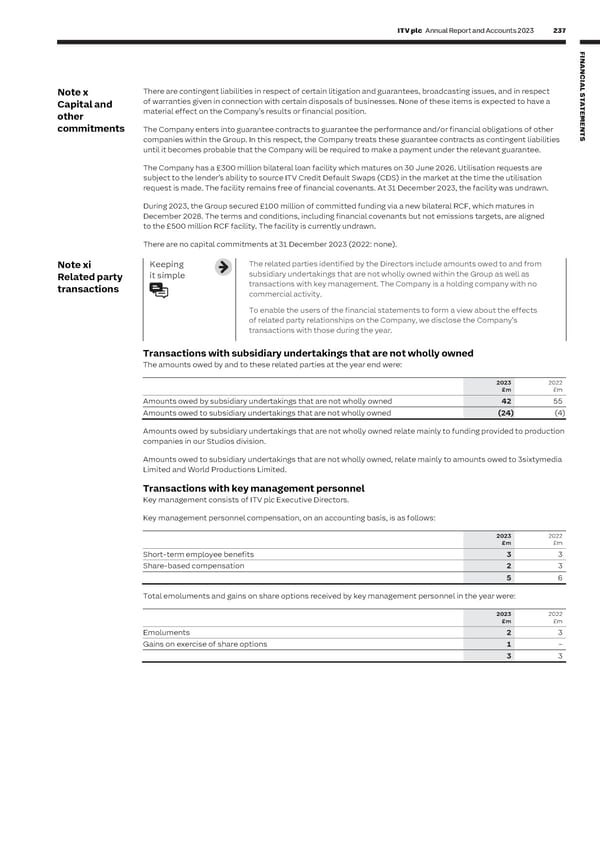

236 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 237 F I NOTES TO THE ITV PLC COMPANY FINANCIAL STATEMENTS CONTINUED NAN C I AL Note viii Keeping ITV plc is a non-trading investment holding company and derives its profits from Note x There are contingent liabilities in respect of certain litigation and guarantees, broadcasting issues, and in respect S T dividends paid by subsidiary companies. of warranties given in connection with certain disposals of businesses. None of these items is expected to have a A Equity and it simple Capital and T material effect on the Company’s results or financial position. E dividends The Directors consider the Company’s capital structure and dividend policy at other M E least twice a year ahead of announcing results and do so in the context of its commitments N The Company enters into guarantee contracts to guarantee the performance and/or financial obligations of other T ability to continue as a going concern, to execute the strategy and to invest in companies within the Group. In this respect, the Company treats these guarantee contracts as contingent liabilities S opportunities to grow the business and enhance shareholder value. until it becomes probable that the Company will be required to make a payment under the relevant guarantee. The dividend policy is influenced by a number of the principal risks as identified The Company has a £300 million bilateral loan facility which matures on 30 June 2026. Utilisation requests are on pages 57 to 64 that could have a negative impact on the performance subject to the lender’s ability to source ITV Credit Default Swaps (CDS) in the market at the time the utilisation of the Company. request is made. The facility remains free of financial covenants. At 31 December 2023, the facility was undrawn. In determining the level of dividend in any year, the Directors follow the dividend During 2023, the Group secured £100 million of committed funding via a new bilateral RCF, which matures in policy and also consider a number of other factors that influence the proposed December 2028. The terms and conditions, including financial covenants but not emissions targets, are aligned dividend and dividend policy, including: to the £500 million RCF facility. The facility is currently undrawn. • The level of retained distributable reserves in ITV plc the Company • Availability of cash resources (as disclosed in note 4.1 to the consolidated There are no capital commitments at 31 December 2023 (2022: none). financial statements) and The related parties identified by the Directors include amounts owed to and from • Future cash commitments and investment plans, to deliver the Company’s Note xi Keeping subsidiary undertakings that are not wholly owned within the Group as well as long-term strategic plan Related party it simple • Consideration of the factors underlying the Directors’ viability assessment and transactions transactions with key management. The Company is a holding company with no • The future availability of funds required to meet longer-term obligations commercial activity. including pension commitments. To enable the users of the financial statements to form a view about the effects of related party relationships on the Company, we disclose the Company’s Equity transactions with those during the year. The retained earnings reserve includes profit after tax for the year of £7 million (2022: £800 million), which includes Transactions with subsidiary undertakings that are not wholly owned dividends of £nil from subsidiaries in 2023 (2022: £980 million). The amounts owed by and to these related parties at the year end were: During the year, the Company provided for £22 million (2022: £192 million) of doubtful debts for amounts owed by its subsidiary undertakings. £2 million (2022: £11 million) was written back to the Income Statement for provisions of 2023 2022 doubtful debts no longer required. £m £m Amounts owed by subsidiary undertakings that are not wholly owned 42 55 The recoverability of the amounts owed by subsidiary undertakings is assessed on an annual basis or more Amounts owed to subsidiary undertakings that are not wholly owned (24) (4) frequently when circumstances indicate that the carrying value may be impaired. Determining whether there is an indication of impairment requires judgement as the assessment is based on either net assets of the undertaking or Amounts owed by subsidiary undertakings that are not wholly owned relate mainly to funding provided to production forecast future performance. companies in our Studios division. The share premium of £174 million remains unchanged in the year. Other reserves of £34 million (2022: £29 million) Amounts owed to subsidiary undertakings that are not wholly owned, relate mainly to amounts owed to 3sixtymedia comprises Merger reserves of £36 million (2022: £36 million) which relate to share buybacks in prior years and Translation Limited and World Productions Limited. reserves with net losses of £2 million (net losses of £7 million) which relate to cash flow hedges and cost of hedging. Transactions with key management personnel Dividends Key management consists of ITV plc Executive Directors. The Board recognises the importance of the ordinary dividend to ITV shareholders. Reflecting its confidence in the Key management personnel compensation, on an accounting basis, is as follows: business and its strategy, as well as the continued strong cash generation, the Board proposes a final dividend of 3.3p (2022:3.3p), giving a full year dividend of 5.0p (2022: 5.0p) per share. In 2023, £201 million of dividends were paid 2023 2022 (2022: £201 million), representing a final 2022 dividend of 3.3p per share and an interim 2023 dividend of 1.7p per share. £m £m A contingent liability is a liability that is not sufficiently certain to qualify for Short-term employee benefits 3 3 Note ix Keeping Share-based compensation 2 3 recognition as a provision where uncertainty may exist regarding the outcome of Contingent it simple 5 6 liabilities future events. Total emoluments and gains on share options received by key management personnel in the year were: As previously reported, on 12 July 2022, the UK Competition and Markets Authority (CMA) opened an investigation 2023 2022 into certain conduct of ITV and other named companies in the sector relating to the production and broadcasting of £m £m sports content in the United Kingdom. The investigation is at an early stage and the CMA has confirmed it is currently Emoluments 2 3 undertaking further investigation until at least March 2024, subsequent to which ITV anticipates it will receive Gains on exercise of share options 1 – additional detail regarding any future steps. 3 3 On 11 October 2023, the CMA opened an investigation into certain conduct of ITV and other named companies in the sector relating to the production and broadcasting of television content in the UK, excluding sports content. The investigation remains at an early stage and it is not currently possible to reliably quantify any liability that might result from the investigation. ITV is committed to complying with competition law, and is cooperating with the CMA's enquiries in relation to both investigations. There are contingent liabilities in respect of certain litigation and guarantees, broadcasting issues, and in respect of warranties given in connection with certain disposals of businesses. None of these items are expected to have a material effect on the Group’s results or financial position. Under a Group registration, the Company is jointly and severally liable for VAT at 31 December 2023 of £43 million (31 December 2022: £35 million). The Company has guaranteed certain performance and financial obligations of subsidiary undertakings.

ITV Annual Report & Accounts Page 238 Page 240

ITV Annual Report & Accounts Page 238 Page 240