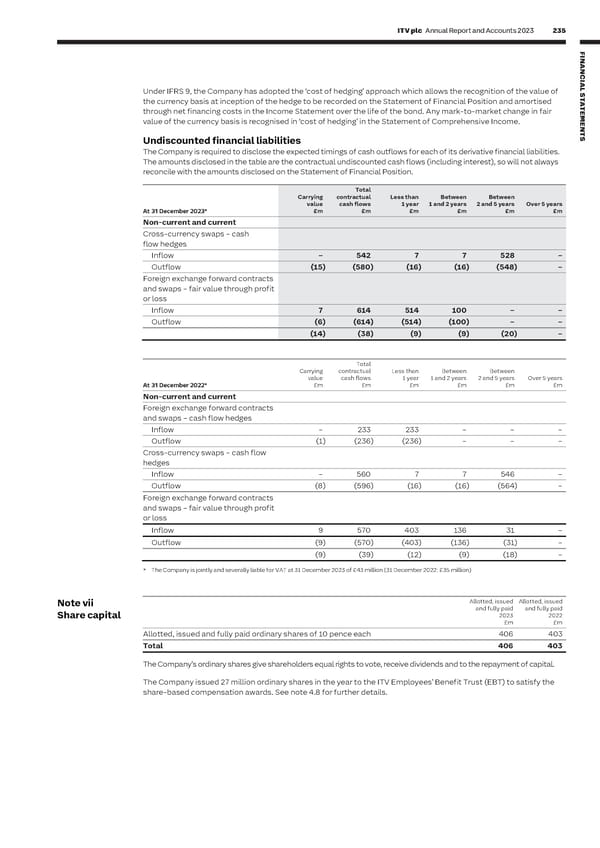

234 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 235 F I NOTES TO THE ITV PLC COMPANY FINANCIAL STATEMENTS CONTINUED NAN C I AL The Directors manage the Group’s capital structure as disclosed in section 4 to ch which allows the recognition of the value of S Under IFRS 9, the Company has adopted the ‘cost of hedging’ approa Note v Keeping T it simple the consolidated financial statements. Borrowings, cash and derivative financial the currency basis at inception of the hedge to be recorded on the Statement of Financial Position and amortised A Net debt T instruments are mainly held by ITV plc and disclosed in these Company through net financing costs in the Income Statement over the life of the bond. Any mark-to-market change in fair E M financial statements. value of the currency basis is recognised in ‘cost of hedging’ in the Statement of Comprehensive Income. E N T Undiscounted financial liabilities S Cash and cash equivalents The Company is required to disclose the expected timings of cash outflows for each of its derivative financial liabilities. At 31 December 2023, the Company has a cash position of £226 million (2022: £197 million). The amounts disclosed in the table are the contractual undiscounted cash flows (including interest), so will not always reconcile with the amounts disclosed on the Statement of Financial Position. Loans and facilities due within one year Total In January 2022, the Company entered into a new syndicated £500 million Revolving Credit Facility (RCF) to meet Carrying contractual Less than Between Between short-term funding requirements which was undrawn at 31 December 2023. The original terms of the RCF ran until value cash flows 1 year 1 and 2 years 2 and 5 years Over 5 years January 2027; however, the Group took the opportunity to request an extension for one year on the first and second At 31 December 2023* £m £m £m £m £m £m anniversary of the facility. As a result, £83 million of the RCF is committed until January 2028 and £417 million is Non-current and current committed until January 2029. The RCF was undrawn as at 31 December 2023 (2022: drawn-down by £50 million). Cross-currency swaps – cash flow hedges The €259 million Eurobond was repaid in December 2023. The sterling-equivalent repayment value, totalling £233 million, Inflow – 542 7 7 528 – had been hedged using FX forward rate agreements. Outflow (15) (580) (16) (16) (548) – Loans and loan notes due after one year Foreign exchange forward contracts The Company has a €600 million Eurobond in issue at a fixed coupon of 1.375%, which matures in September 2026 and swaps – fair value through profit and has been swapped back to sterling (£533 million) using a number of cross-currency interest rate swaps. or loss The resulting fixed rate payable in sterling is c.2.9%. Inflow 7 614 514 100 – – Outflow (6) (614) (514) (100) – – A new £230 million term loan was taken out in the year, and was fully drawn-down in December 2023 in order to (14) (38) (9) (9) (20) – repay the €259 million Eurobond. The term loan matures in July 2027. Interest on the loan is determined as an aggregate of compounded SONIA plus a margin. See section 4.1 of the Group Notes for further details of borrowings and available facilities. Total Carrying contractual Less than Between Between value cash flows 1 year 1 and 2 years 2 and 5 years Over 5 years Note vi What is the value of our derivative financial instruments? At 31 December 2022* £m £m £m £m £m £m Managing Non-current and current Assets Liabilities Foreign exchange forward contracts market risks: 2023 2023 and swaps – cash flow hedges derivative £m £m financial Current Inflow – 233 233 – – – instruments Foreign exchange forward contracts and swaps – fair value through profit or loss 5 (5) Outflow (1) (236) (236) – – – Non-current Cross-currency swaps – cash flow Cross-currency interest swaps – cash flow hedges – (15) hedges Foreign exchange forward contracts and swaps – fair value through profit or loss 2 (1) Inflow – 560 7 7 546 – 7 (21) Outflow (8) (596) (16) (16) (564) – Foreign exchange forward contracts and swaps – fair value through profit Assets Liabilities 2022 2022 or loss £m £m Inflow 9 570 403 136 31 – Current Outflow (9) (570) (403) (136) (31) – Foreign exchange forward contracts and swaps – fair value through profit or loss 7 (7) (9) (39) (12) (9) (18) – Foreign exchange forward contracts and swaps – cash flow hedges – (1) Non-current * The Company is jointly and severally liable for VAT at 31 December 2023 of £43 million (31 December 2022: £35 million) Cross-currency interest swaps – cash flow hedges – (8) Foreign exchange forward contracts and swaps – fair value through profit or loss 2 (2) Allotted, issued Allotted, issued 9 (18) Note vii and fully paid and fully paid Share capital 2023 2022 The Company employs cross-currency interest rate swaps to exchange the principal and interest coupons in a debt £m £m instrument from one currency to another. Allotted, issued and fully paid ordinary shares of 10 pence each 406 403 Currency risk Total 406 403 The Company’s foreign exchange policy is to use forward foreign exchange contracts and cross-currency interest The Company’s ordinary shares give shareholders equal rights to vote, receive dividends and to the repayment of capital. rate swaps both to manage foreign currency cash flow timing differences and to hedge foreign currency denominated monetary items. The Company issued 27 million ordinary shares in the year to the ITV Employees’ Benefit Trust (EBT) to satisfy the share-based compensation awards. See note 4.8 for further details. Cash flow hedges In order to fix the sterling cash outflows associated with the commitments and interest payments – which are mainly denominated in euros – the Company has taken out forward foreign exchange contracts and cross-currency interest rate swaps for the same foreign currency amount and maturity date as the expected foreign currency outflow. The amount recognised in other comprehensive income during the year all relates to the effective portion of the revaluation loss associated with these contracts. A cumulative loss of £26 million (2022: £37 million of cumulative gain) was recycled to the Consolidated Income statement to off-set movements on the hedged item, a residual £7 million loss (2022: £3 million loss) remained on the income statement which was not offset.

ITV Annual Report & Accounts Page 236 Page 238

ITV Annual Report & Accounts Page 236 Page 238