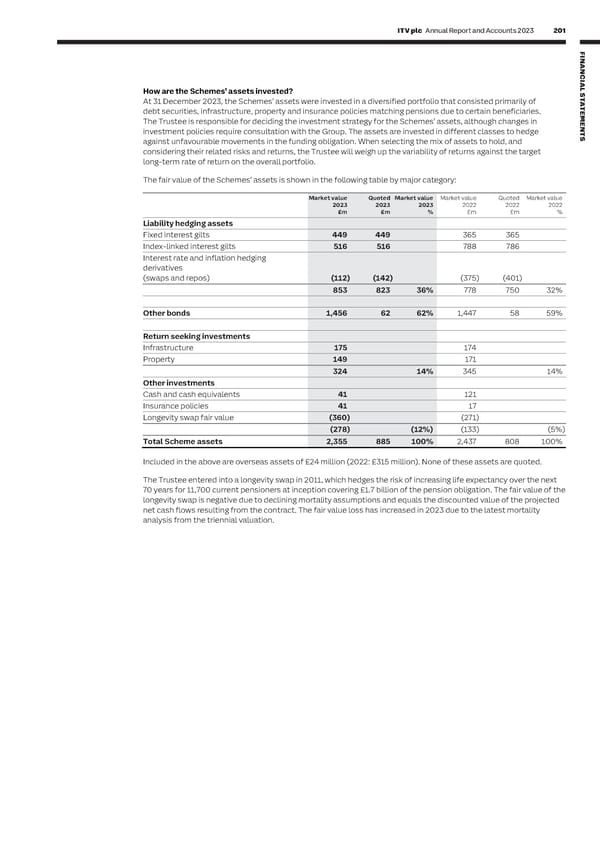

200 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 201 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL Total defined benefit scheme assets How are the Schemes’ assets invested? S T At 31 December 2023, the Schemes’ assets were invested in a diversified portfolio that consisted primarily of A Keeping The Scheme holds assets across a number of different classes, which are managed T debt securities, infrastructure, property and insurance policies matching pensions due to certain beneficiaries. E it simple by the Trustee, who consults with the Group on changes to its investment policy. M The Trustee is responsible for deciding the investment strategy for the Schemes’ assets, although changes in E N What are the Pension Scheme assets? investment policies require consultation with the Group. The assets are invested in different classes to hedge T At 31 December 2023, the Schemes’ assets were invested in a diversified portfolio against unfavourable movements in the funding obligation. When selecting the mix of assets to hold, and S that consisted primarily of debt securities, infrastructure, property and insurance considering their related risks and returns, the Trustee will weigh up the variability of returns against the target policies matching the pensions due to certain beneficiaries. The tables below set long-term rate of return on the overall portfolio. out the major categories of assets. The fair value of the Schemes’ assets is shown in the following table by major category: Financial instruments are in place in order to provide protection against changes in market factors (interest rates and inflation), which could act to increase the net Market value Quoted Market value Market value Quoted Market value pension surplus/deficit. 2023 2023 2023 2022 2022 2022 £m £m % £m £m % One such instrument is the longevity swap, which the Scheme transacted in 2011 to Liability hedging assets obtain protection against the effect of increases in the life expectancy of the majority Fixed interest gilts 449 449 365 365 of pensioner beneficiaries at that date. Under the swap, the Trustee agreed to make Index-linked interest gilts 516 516 788 786 pre-determined payments in return for payments to meet the specified pension Interest rate and inflation hedging obligations as they fall due, irrespective of how long the beneficiaries and their derivatives dependants live. The difference in the present values of these two streams of (swaps and repos) (112) (142) (375) (401) payments is reflected in the Scheme assets. The swap had a nil valuation at inception 853 823 36% 778 750 32% and, using market-based assumptions, is subsequently adjusted for changes in the market life expectancy and market discount rates, in line with its fair value. Other bonds 1,456 62 62% 1,447 58 59% How do we measure the pension Scheme assets? Defined benefit scheme assets are measured at their fair value and can change due Return seeking investments to the following: Infrastructure 175 174 • Interest income on scheme assets – this is determined by multiplying the fair Property 149 171 value of the Scheme assets by the discount rate, both taken as of the beginning 324 14% 345 14% of the year. This is recognised through net financing costs in the Consolidated Other investments Income Statement • Return on assets arise from differences between the actual return and interest Cash and cash equivalents 41 121 income on Scheme assets and are recognised in the Consolidated Statement of Insurance policies 41 17 Other Comprehensive Income Longevity swap fair value (360) (271) • Employer’s contributions are paid into the Scheme to be managed and invested, (278) (12%) (133) (5%) and Total Scheme assets 2,355 885 100% 2,437 808 100% • Benefits and administrative expenses paid out by the Schemes will lower the fair value of the Schemes’ assets Included in the above are overseas assets of £24 million (2022: £315 million). None of these assets are quoted. The movement in the fair value of the defined benefit schemes’ assets is analysed below: The Trustee entered into a longevity swap in 2011, which hedges the risk of increasing life expectancy over the next 70 years for 11,700 current pensioners at inception covering £1.7 billion of the pension obligation. The fair value of the 2023 2022 longevity swap is negative due to declining mortality assumptions and equals the discounted value of the projected £m £m net cash flows resulting from the contract. The fair value loss has increased in 2023 due to the latest mortality Fair value of Scheme assets at 1 January 2,437 3,873 analysis from the triennial valuation. Interest income on Scheme assets 120 63 Loss on assets, excluding interest income (98) (1,039) Employer contributions 50 145 Settlement payments from plan assets – buyout of Section C – (439) Benefits paid (147) (156) Administrative expenses paid (7) (6) Pension insurance risk premium – buyout of Section C – (4) Fair value of Scheme assets at 31 December 2,355 2,437

ITV Annual Report & Accounts Page 202 Page 204

ITV Annual Report & Accounts Page 202 Page 204