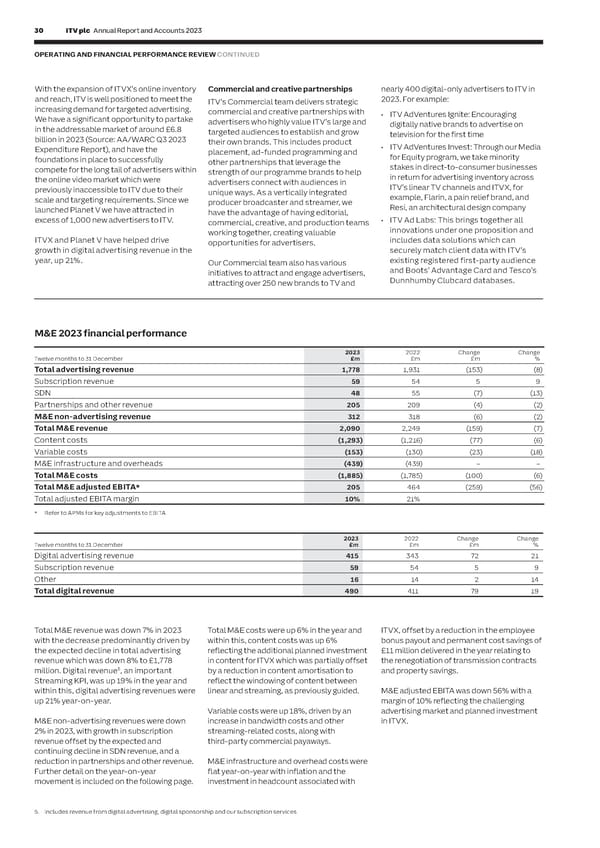

30 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 31 S OPERATING AND FINANCIAL PERFORMANCE REVIEW CONTINUED T R A T E G I With the expansion of ITVX’s online inventory Commercial and creative partnerships nearly 400 digital-only advertisers to ITV in Partnerships and other revenue declined by C R and reach, ITV is well positioned to meet the 2023. For example: 2% in the year mainly driven by lower E ITV’s Commercial team delivers strategic P increasing demand for targeted advertising. competition revenue. O commercial and creative partnerships with • ITV AdVentures Ignite: Encouraging R We have a significant opportunity to partake advertisers who highly value ITV’s large and digitally native brands to advertise on T in the addressable market of around £6.8 targeted audiences to establish and grow television for the first time We expect Partnerships and other revenues billion in 2023 (Source: AA/WARC Q3 2023 their own brands. This includes product to decline in 2024 following our decision to Expenditure Report), and have the placement, ad-funded programming and • ITV AdVentures Invest: Through our Media revise our partnership agreements to allow foundations in place to successfully other partnerships that leverage the for Equity program, we take minority ITVX viewers to watch in HD, and allow ITV to compete for the long tail of advertisers within strength of our programme brands to help stakes in direct-to-consumer businesses target ads to a much larger proportion of the online video market which were advertisers connect with audiences in in return for advertising inventory across those viewers, using Planet V. previously inaccessible to ITV due to their unique ways. As a vertically integrated ITV’s linear TV channels and ITVX, for scale and targeting requirements. Since we producer broadcaster and streamer, we example, Flarin, a pain relief brand, and BritBox International launched Planet V we have attracted in have the advantage of having editorial, Resi, an architectural design company excess of 1,000 new advertisers to ITV. • ITV Ad Labs: This brings together all On 01 March 2024, ITV announced the sale of commercial, creative, and production teams its 50% shareholding in BritBox International working together, creating valuable innovations under one proposition and to the BBC Studios for £255 million. ITV ITVX and Planet V have helped drive opportunities for advertisers. includes data solutions which can Studios will continue to receive an ongoing growth in digital advertising revenue in the securely match client data with ITV’s revenue stream from BritBox International year, up 21%. Our Commercial team also has various existing registered first-party audience similar to current levels for the use of ITV initiatives to attract and engage advertisers, and Boots’ Advantage Card and Tesco’s content under new extended licensing attracting over 250 new brands to TV and Dunnhumby Clubcard databases. agreements. Prior to this date, BritBox International was THE MASKED SINGER continues to drive mass audiences ITV’s joint venture with the BBC, providing and returned for its fifth series in January 2024. an ad-free subscription streaming service M&E 2023 financial performance offering the most comprehensive collection of British content available in the US, 2023 2022 Change Change Total advertising revenue (TAR) Subscription revenue Canada, Australia, South Africa and the Twelve months to 31 December £m £m £m % Total advertising revenue 1,778 1,931 (153) (8) TAR was down 8% year-on-year in 2023 Subscription revenue is generated directly Nordics (made up of Sweden, Finland, Subscription revenue 59 54 5 9 which was in line with our expectations. from the premium tier of ITVX, our Denmark and Norway). Subscribers on standalone BritBox UK app, and BritBox UK 31 December 2023 were 3.7 million. SDN 48 55 (7) (13) (31 December 2022: 3.0 million). BritBox Partnerships and other revenue 205 209 (4) (2) The start of 2023 saw TAR down 10% in Q1 and ITV Catch Up services on Amazon Prime and down 11% in Q2 against tough Video Channels. It does not include BritBox International revenue and profit or loss, M&E non-advertising revenue 312 318 (6) (2) comparatives and the challenging International, which is included within JVs is included in share of profits/losses on Total M&E revenue 2,090 2,249 (159) (7) macroeconomic environment. Q3 was up 1% and Associates. JVs and not within M&E adjusted EBITA. Content costs (1,293) (1,216) (77) (6) and Q4 was down 9% with October up 2%, Variable costs (153) (130) (23) (18) November down 15% and December down In 2023, subscription revenue increased by M&E infrastructure and overheads (439) (439) – – 14% against strong comparatives in 2022 9% due to the annualisation of subscribers in OUTLOOK Total M&E costs (1,885) (1,785) (100) (6) from the FIFA World Cup. 2022, combined with new ITVX Premium We remain on track to deliver at least subscribers. This was partly offset by a £750 million of digital revenues by 2026. Total M&E adjusted EBITA* 205 464 (259) (56) As expected, most TAR categories were reduction in subscribers on our BritBox UK Total adjusted EBITA margin 10% 21% down year-on-year, with the largest being standalone app and the closure of ITV Catch We have had a good start to 2024 and * Refer to APMs for key adjustments to EBITA Finance, down 31% driven by online and retail Up on Amazon Prime Video Channels. will build on ITVX’s successful launch banks and insurance companies. Publishing year through continuous improvements and Broadcasting was down 28% with In 2024 the BritBox Amazon and the BritBox in content, product, distribution and 2023 2022 Change Change decreases from streaming platforms and direct to consumer service will close, which marketing. Twelve months to 31 December £m £m £m % Digital advertising revenue 415 343 72 21 social media sites, and Entertainment and will impact our number of subscribers and Leisure was down 18% with declines from subscription revenues in 2024. ITVX’s strong performance in 2023 has Subscription revenue 59 54 5 9 gaming, music and film companies. shown us that we can grow viewing Other 16 14 2 14 SDN significantly with slightly lower overall Total digital revenue 490 411 79 19 Categories that increased spend during the content spend. Therefore we expect to year included FMCGs, who used brand SDN generates revenue by licensing video streams to broadcast channels, radio stations marginally reduce our content cost in advertising to help push through price and data providers on digital terrestrial 2024 to around £1,275 million as we increases to consumers. Airlines and Travel television (DTT) or Freeview. SDN customers further optimise linear, evolve our Total M&E revenue was down 7% in 2023 Total M&E costs were up 6% in the year and ITVX, offset by a reduction in the employee were up 3%, driven by online holiday windowing strategy and improve with the decrease predominantly driven by within this, content costs was up 6% bonus payout and permanent cost savings of companies and overseas tourism boards. include ITV and third parties. SDN’s current licence has been renewed until 2034. personalisation. At the same time we the expected decline in total advertising reflecting the additional planned investment £11 million delivered in the year relating to will increase our marketing spend by revenue which was down 8% to £1,778 in content for ITVX which was partially offset the renegotiation of transmission contracts After many years of double digit growth, £15 million to drive both streaming and million. Digital revenue5, an important by a reduction in content amortisation to and property savings. e-commerce companies, excluding gambling, In 2023, external revenue (non-ITV) declined as expected by 13%. This decrease is linear viewing. We will continue to Streaming KPI, was up 19% in the year and reflect the windowing of content between decreased 29% driven by online car and retail evaluate content and marketing ROI within this, digital advertising revenues were linear and streaming, as previously guided. M&E adjusted EBITA was down 56% with a brands, as a result of the reduced availability primarily due to the renewal of long-term contracts with third parties at current market and adjust as necessary. up 21% year-on-year. margin of 10% reflecting the challenging of venture capital funding. Variable costs were up 18%, driven by an advertising market and planned investment rates, in the current and prior year. This trend is expected to continue. Compared to the same period in 2023, M&E non-advertising revenues were down increase in bandwidth costs and other in ITVX. TAR is expected to be up 3% in Q1 2024, 2% in 2023, with growth in subscription streaming-related costs, along with with continued strong growth in digital revenue offset by the expected and third-party commercial payaways. Partnerships and other revenue advertising revenues. continuing decline in SDN revenue, and a Partnerships and other revenue include reduction in partnerships and other revenue. M&E infrastructure and overhead costs were revenue from platforms, such as Sky and Further detail on the year-on-year flat year-on-year with inflation and the Virgin Media O2, competition revenue, movement is included on the following page. investment in headcount associated with third-party commission, e.g. for services we provide to STV, and commercial revenue from our creative partnerships. 5. Includes revenue from digital advertising, digital sponsorship and our subscription services

ITV Annual Report & Accounts Page 31 Page 33

ITV Annual Report & Accounts Page 31 Page 33