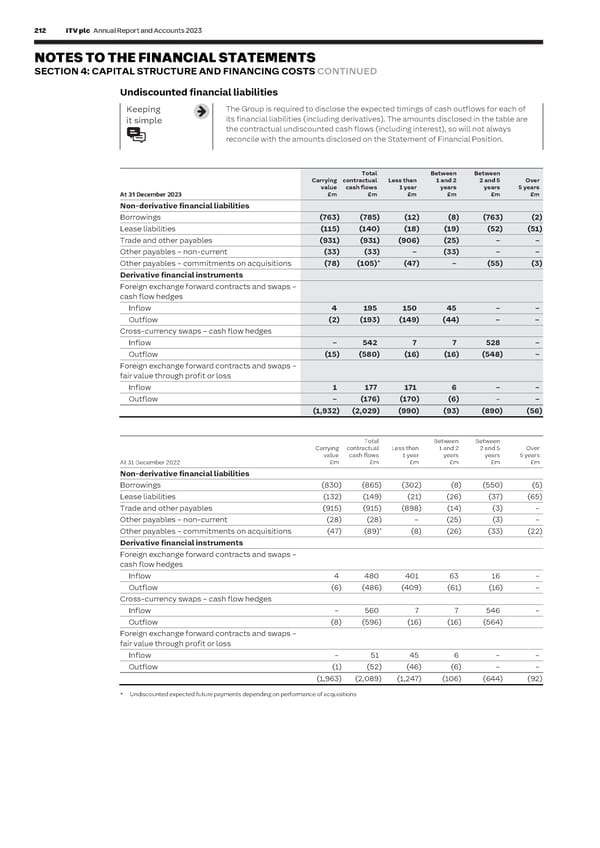

212 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 213 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Undiscounted financial liabilities Timing profile of hedging instrument S T A T Keeping The Group is required to disclose the expected timings of cash outflows for each of Keeping The Group is required to provide a breakdown that discloses a profile of the timing E its financial liabilities (including derivatives). The amounts disclosed in the table are of the nominal amount of the hedging instrument and if applicable, the average M it simple it simple E the contractual undiscounted cash flows (including interest), so will not always price or rate (for example strike or forward prices etc.) of the hedging instrument. N T reconcile with the amounts disclosed on the Statement of Financial Position. S The Group is holding the following foreign exchange and cross-currency interest rate swap contracts: Total Between Between Less than Between Between Greater than Carrying contractual Less than 1 and 2 2 and 5 Over At 31 December 2023 1 year 1 to 2 years 2 to 5 years 5 years Total value cash flows 1 year years years 5 years Foreign exchange forward contracts and swaps At 31 December 2023 £m £m £m £m £m £m Non-derivative financial liabilities Notional amount (£m) (5) – – – (5) Borrowings (763) (785) (12) (8) (763) (2) Average forward rate (AUD/EUR) 1.6933 – – – Lease liabilities (115) (140) (18) (19) (52) (51) Foreign exchange forward contracts and swaps Trade and other payables (931) (931) (906) (25) – – Notional amount (£m) (1) (11) – – (12) Other payables – non-current (33) (33) – (33) – – Average forward rate (AUD/GBP) 1.2773 1.7559 – – * Foreign exchange forward contracts and swaps Other payables – commitments on acquisitions (78) (105) (47) – (55) (3) Derivative financial instruments Notional amount (£m) 9 2 – – 11 Foreign exchange forward contracts and swaps – Average forward rate (CAD/GBP) 1.7711 1.6594 – – cash flow hedges Foreign exchange forward contracts and swaps Inflow 4 195 150 45 – – Notional amount (£m) (1) – – – (1) Outflow (2) (193) (149) (44) – – Average forward rate (DKK/GBP) 8.6515 – – – Cross-currency swaps – cash flow hedges Foreign exchange forward contracts and swaps Inflow – 542 7 7 528 – Notional amount (£m) 1 8 – – 9 Outflow (15) (580) (16) (16) (548) – Average forward rate (EUR/GBP) 1.1278 1.1272 – – Foreign exchange forward contracts and swaps – Foreign exchange forward contracts and swaps fair value through profit or loss Notional amount (£m) 1 – – – 1 Inflow 1 177 171 6 – – Average forward rate (ILS/GBP) 4.6398 – – – Outflow – (176) (170) (6) – – Foreign exchange forward contracts and swaps (1,932) (2,029) (990) (93) (890) (56) Notional amount (£m) (1) – – – (1) Average forward rate (SEK/GBP) 12.9636 – – – Foreign exchange forward contracts and swaps Total Between Between Notional amount (£m) 4 – – – 4 Carrying contractual Less than 1 and 2 2 and 5 Over value cash flows 1 year years years 5 years Average forward rate (NOK/GBP) 13.2027 – – – At 31 December 2022 £m £m £m £m £m £m Non-derivative financial liabilities Foreign exchange forward contracts and swaps Borrowings (830) (865) (302) (8) (550) (5) Notional amount (£m) (4) – – – (4) Lease liabilities (132) (149) (21) (26) (37) (65) Average forward rate (ZAR/AUD) 12.6830 – – – Trade and other payables (915) (915) (898) (14) (3) – Foreign exchange forward contracts and swaps Other payables – non-current (28) (28) – (25) (3) – Notional amount (£m) (56) 20 – – (36) * Average forward rate (USD/GBP) 1.3431 1.2188 – – Other payables – commitments on acquisitions (47) (89) (8) (26) (33) (22) Foreign exchange forward contracts and swaps Derivative financial instruments Notional amount (£m) (5) – – – (5) Foreign exchange forward contracts and swaps – Average forward rate (ZAR/EUR) 20.6262 – – – cash flow hedges Inflow 4 480 401 63 16 – Foreign exchange forward contracts and swaps Outflow (6) (486) (409) (61) (16) – Notional amount (£m) (1) – – – (1) Cross-currency swaps – cash flow hedges Average forward rate (ZAR/GBP) 23.0200 – – – Inflow – 560 7 7 546 – Cross-currency interest rate swaps Outflow (8) (596) (16) (16) (564) Notional amount (£m) – – 533 – 533 Foreign exchange forward contracts and swaps – Average hedge rate (EUR/GBP) – – 1.1264 – fair value through profit or loss Inflow – 51 45 6 – – Outflow (1) (52) (46) (6) – – (1,963) (2,089) (1,247) (106) (644) (92) * Undiscounted expected future payments depending on performance of acquisitions

ITV Annual Report & Accounts Page 213 Page 215

ITV Annual Report & Accounts Page 213 Page 215