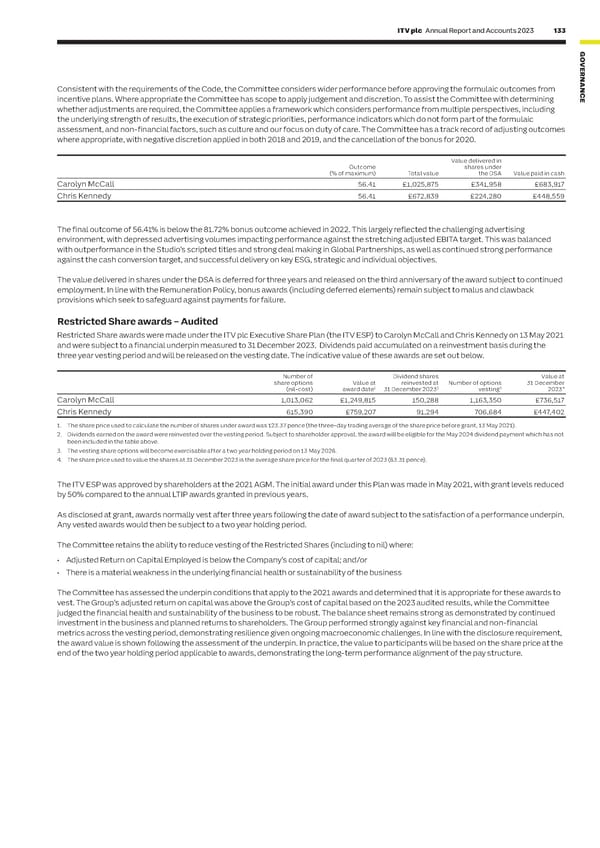

132 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 133 REMUNERATION REPORT CONTINUED G O VE R NAN The annual Social Purpose targets goals can be found on our website www.itvplc.com.Consistent with the requirements of the Code, the Committee considers wider performance before approving the formulaic outcomes from C incentive plans. Where appropriate the Committee has scope to apply judgement and discretion. To assist the Committee with determining E The Committee noted the progress that had been made against our ESG targets in 2023 and agreed that based on holistic assessment whether adjustments are required, the Committee applies a framework which considers performance from multiple perspectives, including against the balanced scorecard this element should deliver an outcome of 75% of maximum.the underlying strength of results, the execution of strategic priorities, performance indicators which do not form part of the formulaic assessment, and non-financial factors, such as culture and our focus on duty of care. The Committee has a track record of adjusting outcomes The remainder of the bonus (20%) was based upon the Committee’s assessment of the contribution each Executive Director made to where appropriate, with negative discretion applied in both 2018 and 2019, and the cancellation of the bonus for 2020. the overall strategy through the delivery of specific targets. The Committee applies suitable judgement when assessing performance in this regard. Value delivered in Outcome shares under (% of maximum) Total value the DSA Value paid in cash Carolyn McCall 56.41 £1,025,875 £341,958 £683,917 Area of focusAchievement Chris Kennedy 56.41 £672,839 £224,280 £448,559 Chief Executive objectivesMaximise the potential of ITV Studios globally: by working ITV Studios Iberia set up during the year to be the to identify, create and deliver opportunities to maximise exclusive home of ITV Studios’ formats in Spain, joining an scale and increase value.international production and distribution group that spans The final outcome of 56.41% is below the 81.72% bonus outcome achieved in 2022. This largely reflected the challenging advertising 13 countries. environment, with depressed advertising volumes impacting performance against the stretching adjusted EBITA target. This was balanced Overall, ITV Studios delivered total organic revenue with outperformance in the Studio’s scripted titles and strong deal making in Global Partnerships, as well as continued strong performance growth of 3% and adjusted EBITA margin of 13% in the against the cash conversion target, and successful delivery on key ESG, strategic and individual objectives. year. ITV Studios total revenue from streaming platforms grew to 32%, hitting the target three years early.The value delivered in shares under the DSA is deferred for three years and released on the third anniversary of the award subject to continued Continue to deliver the Digital Transformation agenda: Key achievements include the stabilisation and growth employment. In line with the Remuneration Policy, bonus awards (including deferred elements) remain subject to malus and clawback achieving key programme milestones with particular focus of ITVX, including across core partner platforms, and provisions which seek to safeguard against payments for failure. on digital culture and products. the delivery of Planet V and ITV’s data strategy in line with plans. Restricted Share awards – Audited Phase one of ITV Together went live, delivering changes Restricted Share awards were made under the ITV plc Executive Share Plan (the ITV ESP) to Carolyn McCall and Chris Kennedy on 13 May 2021 in core People and Finance activities.and were subject to a financial underpin measured to 31 December 2023. Dividends paid accumulated on a reinvestment basis during the Delivered the second series of ITV Fast Forward, three year vesting period and will be released on the vesting date. The indicative value of these awards are set out below. to build the digital and data capabilities of colleagues, with sessions exploring the use of generative AI, design thinking, machine learning and digital disruptors. Number of Dividend shares Value at share options Value at reinvested at Number of options 31 December 1 2 3 4 (nil-cost) award date 31 December 2023 vesting 2023 Develop the equity story: by evolving the external Regular engagement with investors and analysts to Carolyn McCall 1,013,062 £1,249,815 150,288 1,163,350 £736,517 positioning and communication of the successful execution update on key achievements and progress against the of the More Than TV Strategy. Highlight the value created by strategy, particularly focusing on the value created Chris Kennedy 615,390 £759,207 91,294 706,684 £447,402 the strategy through key delivery milestones and the through ITV’s digital transformation and digital 1. The share price used to calculate the number of shares under award was 123.37 pence (the three-day trading average of the share price before grant, 13 May 2021). achievement of KPIs.revenue growth.2. Dividends earned on the award were reinvested over the vesting period. Subject to shareholder approval, the award will be eligible for the May 2024 dividend payment which has not Implement People strategy: with a focus on retaining key 70% of colleagues participated in the 2023 engagement been included in the table above. talent and capabilities, and delivering a strong, diverse and culture survey, which resulted in an overall ITV 3. The vesting share options will become exercisable after a two year holding period on 13 May 2026. succession pipeline of talent, supporting inclusivity and the engagement score of 68% (1% higher than the last 4. The share price used to value the shares at 31 December 2023 is the average share price for the final quarter of 2023 (63.31 pence). delivery of ITV’s DEI plans and KPIs.survey in 2021). The Nominations Committee was satisfied with the The ITV ESP was approved by shareholders at the 2021 AGM. The initial award under this Plan was made in May 2021, with grant levels reduced talent and succession planning information shared by 50% compared to the annual LTIP awards granted in previous years. during the year in respect of the Management Board and Executive Leadership Team roles, including the As disclosed at grant, awards normally vest after three years following the date of award subject to the satisfaction of a performance underpin. diversity of identified successors.Any vested awards would then be subject to a two year holding period. Group CFO & COO objectivesCost – maintain continuous focus across all divisions and Delivered £24m of permanent cost savings in 2023, functions: by executing on current cost savings ahead of the £15m target set for the year. A new ongoing The Committee retains the ability to reduce vesting of the Restricted Shares (including to nil) where: programmes; by planning and beginning restructuring of strategic restructuring and efficiency programme has long-term cost base; and by focusing on different cost areas been established to deliver further cost savings in 2024. • Adjusted Return on Capital Employed is below the Company’s cost of capital; and/or to deliver 2023 cost saving target. • There is a material weakness in the underlying financial health or sustainability of the business Capital – review allocation and demonstrate clear Capital allocation improved in 2023 with a key focus on returns: by improving capital allocation across divisions; by returns and business case lead investment proposals.The Committee has assessed the underpin conditions that apply to the 2021 awards and determined that it is appropriate for these awards to demonstrating return on investment; by a focus on working vest. The Group’s adjusted return on capital was above the Group’s cost of capital based on the 2023 audited results, while the Committee capital management; and by ensuring effective Group judged the financial health and sustainability of the business to be robust. The balance sheet remains strong as demonstrated by continued Investment Committee and streamlining Group approvals investment in the business and planned returns to shareholders. The Group performed strongly against key financial and non-financial process. metrics across the vesting period, demonstrating resilience given ongoing macroeconomic challenges. In line with the disclosure requirement, Equity – ensure clarity of message and drive value Regular engagement with investors and analysts, focusing the award value is shown following the assessment of the underpin. In practice, the value to participants will be based on the share price at the creation: by creating communication plan and materials to on the value created by the growing global Studios end of the two year holding period applicable to awards, demonstrating the long-term performance alignment of the pay structure. provide clear and simple external messaging; by business and the digital transformation of M&E, through establishing ITVX and AVOD as lead KPIs for M&E; and by ITVX and Planet V. ITV Studios Iberia established during evaluating and executing options to increase scale and value the year, further increasing the scale of ITV Studios. for Studios. Digital – increase digital revenues and launch ITV Delivered total digital revenue growth of 19% to £490m, Together: by maximising revenue opportunities from ITVX; driven by digital advertising revenue, which was up 21%. by driving test and learn mantra using financial data and Launched the first phase of ITV Together in April 2023, insight; and by launching ITV Together and embedding new delivering changes in core People and Finance activities. ways of working across Finance. As noted above, there was strong achievement against the objectives set at the start of the year. The Committee therefore agreed that this element should deliver an outcome of 80% of maximum for the Chief Executive and 80% of maximum for the Group CFO & COO.

ITV Annual Report & Accounts Page 134 Page 136

ITV Annual Report & Accounts Page 134 Page 136