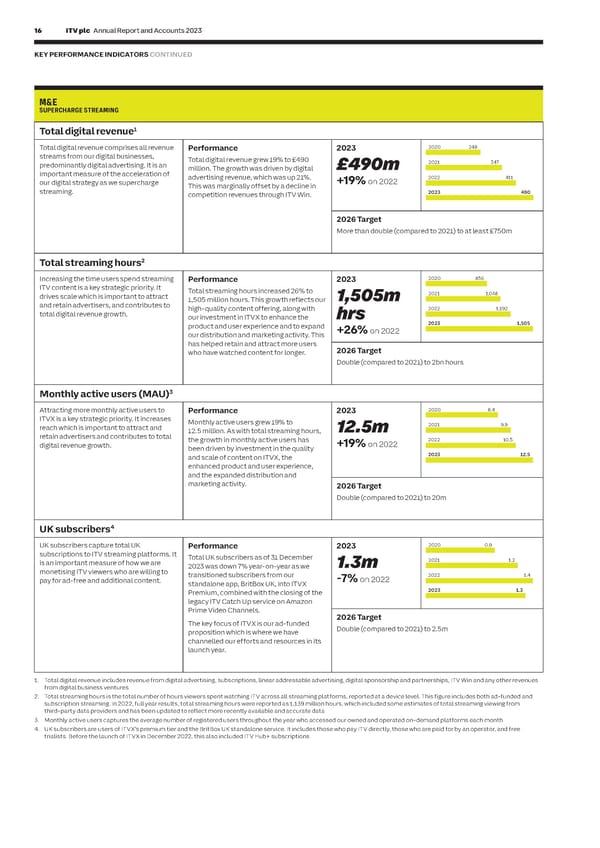

16 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 17 S KEY PERFORMANCE INDICATORS CONTINUED T R A T E G I C R E M&E M&E P SUPERCHARGE STREAMING OPTIMISE BROADCAST O R T Total digital revenue1 Share of top 1,000 commercial broadcast TV programmes5 Total digital revenue comprises all revenue Performance 2023 2020 248 Maintaining our strength in delivering mass Performance 2023 2020 93 streams from our digital businesses, Total digital revenue grew 19% to £490 commercial linear TV audiences enables Our 2023 share was 91%, which was down predominantly digital advertising. It is an £490m 2021 347 ITV to attract and retain advertisers and 91% 2021 93 million. The growth was driven by digital 2% points year-on-year, with 2022 important measure of the acceleration of 2022 411 command a premium from them. advertising revenue, which was up 21%. +19% on 2022 benefiting significantly from the FIFA World -2 basis points on 2022 93 our digital strategy as we supercharge This was marginally offset by a decline in Cup. In 2023, dramas such as Unforgotten streaming. 2023 490 022 2023 91 competition revenues through ITV Win. and The Bay, entertainment formats such 2 as Britain’s Got Talent and Saturday Night Takeaway and sporting events such as 2026 Target Rugby World Cup, helped to maintain ITV’s 2026 Target More than double (compared to 2021) to at least £750m strong commercial mass audience Maintain a share of at least 80% proposition. Total streaming hours2 Share of commercial viewing6 Increasing the time users spend streaming Performance 2023 2020 856 ITV content is a key strategic priority. It Total streaming hours increased 26% to 2021 1,048 Maintaining ITV’s number one position in Performance 2023 2020 32.8 drives scale which is important to attract 1,505 million hours. This growth reflects our 1,505m the UK broadcast market helps us attract and retain advertisers, and contributes to Share of commercial viewing decreased by 2021 33.1 high-quality content offering, along with 2022 1,192 and retain advertisers and is vital to 32.6% total digital revenue growth. our investment in ITVX to enhance the hrs 1.2% points to 32.6% in 2023, with strong maximising advertising revenues. viewing for the FIFA World Cup benefiting 2022 33.8 product and user experience and to expand 2023 1,505 -1.2 basis points on our distribution and marketing activity. This +26% on 2022 our share in 2022. 2022 2023 32.6 has helped retain and attract more users who have watched content for longer. 2026 Target Double (compared to 2021) to 2bn hours 2026 Target Maintain at 33% 3 Monthly active users (MAU) 5. The share of top 1,000 commercial broadcast TV programmes is measured by BARB based on viewing figures. This includes TV viewing from transmission and seven days Attracting more monthly active users to Performance 2023 2020 8.4 post-transmission on catch up, as well as six weeks prior to the transmission window. It excludes programmes with a duration of

ITV Annual Report & Accounts Page 17 Page 19

ITV Annual Report & Accounts Page 17 Page 19