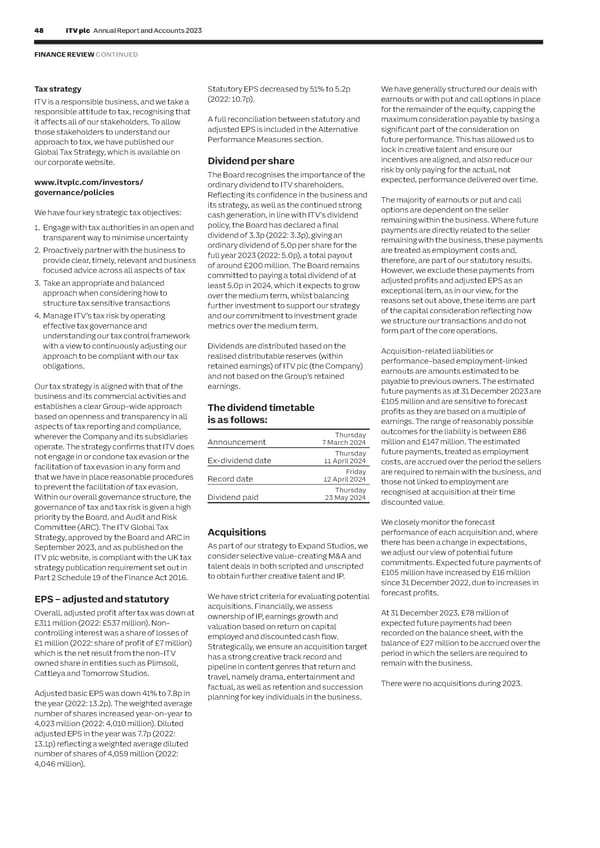

48 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 49 S FINANCE REVIEW CONTINUED T R A T E G I Tax strategy Statutory EPS decreased by 51% to 5.2p We have generally structured our deals with Cash generation C R (2022: 10.7p). earnouts or with put and call options in place E ITV is a responsible business, and we take a Profit to cash conversion P for the remainder of the equity, capping the O responsible attitude to tax, recognising that R it affects all of our stakeholders. To allow A full reconciliation between statutory and maximum consideration payable by basing a 2023 2022 T adjusted EPS is included in the Alternative significant part of the consideration on Twelve months to 31 December £m £m those stakeholders to understand our Adjusted EBITA 489 717 approach to tax, we have published our Performance Measures section. future performance. This has allowed us to Global Tax Strategy, which is available on lock in creative talent and ensure our Working capital movement 90 (150) our corporate website. Dividend per share incentives are aligned, and also reduce our Adjustment for The Voice of China cash received* – 23 The Board recognises the importance of the risk by only paying for the actual, not expected, performance delivered over time. Adjustment for production tax credits (47) (18) www.itvplc.com/investors/ ordinary dividend to ITV shareholders. ** governance/policies Reflecting its confidence in the business and Depreciation 46 53 its strategy, as well as the continued strong The majority of earnouts or put and call Share-based compensation 16 19 We have four key strategic tax objectives: cash generation, in line with ITV’s dividend options are dependent on the seller Acquisition of property, plant and equipment and intangible assets*** (70) (78) policy, the Board has declared a final remaining within the business. Where future 1. Engage with tax authorities in an open and payments are directly related to the seller Lease liability payments (including lease interest) (26) (26) transparent way to minimise uncertainty dividend of 3.3p (2022: 3.3p), giving an remaining with the business, these payments ordinary dividend of 5.0p per share for the Adjusted cash flow 498 540 2. Proactively partner with the business to full year 2023 (2022: 5.0p), a total payout are treated as employment costs and, Profit to cash ratio (adjusted EBITA/adjusted cash flow) 102% 75% provide clear, timely, relevant and business of around £200 million. The Board remains therefore, are part of our statutory results. focused advice across all aspects of tax However, we exclude these payments from * Cash received in 2018 and 2019 for The Voice of China was placed under review and treated as an exceptional cash receipt and excluded from the profit to cash conversion committed to paying a total dividend of at adjusted profits and adjusted EPS as an calculation. In 2022, the review completed and the cash was released. This adjustment shows the conversion of exceptional cash to operating cash. 3. Take an appropriate and balanced least 5.0p in 2024, which it expects to grow ** Depreciation of £46 million (2022: £53 million) includes £28 million (2022: £33 million) which relates to ITV Studios and £18 million (2022: £20 million) relating to Media & approach when considering how to over the medium term, whilst balancing exceptional item, as in our view, for the Entertainment. structure tax sensitive transactions further investment to support our strategy reasons set out above, these items are part *** Except where disclosed, management views the acquisition of property, plant and equipment and intangibles as business as usual capex, necessary to the ongoing investment of the capital consideration reflecting how in the business. 4. Manage ITV’s tax risk by operating and our commitment to investment grade we structure our transactions and do not effective tax governance and metrics over the medium term. form part of the core operations. understanding our tax control framework Cash generated from operations is reconciled to the adjusted cash flow as follows: with a view to continuously adjusting our Dividends are distributed based on the Acquisition-related liabilities or approach to be compliant with our tax realised distributable reserves (within performance-based employment-linked 2023 2022 obligations. retained earnings) of ITV plc (the Company) Twelve months to 31 December £m £m and not based on the Group’s retained earnouts are amounts estimated to be Cash generated from operations 488 537 Our tax strategy is aligned with that of the earnings. payable to previous owners. The estimated future payments as at 31 December 2023 are Cash outflow from exceptional items 68 53 business and its commercial activities and £105 million and are sensitive to forecast Cash generated from operations excluding exceptional items 556 590 establishes a clear Group-wide approach The dividend timetable profits as they are based on a multiple of based on openness and transparency in all is as follows: Adjustment for production tax credits 38 31 aspects of tax reporting and compliance, earnings. The range of reasonably possible Adjustment for The Voice of China cash received – 23 wherever the Company and its subsidiaries Thursday outcomes for the liability is between £86 Announcement 7 March 2024 million and £147 million. The estimated Acquisition of property, plant and equipment and intangible assets (70) (78) operate. The strategy confirms that ITV does future payments, treated as employment not engage in or condone tax evasion or the Thursday Lease liability payments (including lease interest) (26) (26) Ex-dividend date 11 April 2024 costs, are accrued over the period the sellers facilitation of tax evasion in any form and Friday are required to remain with the business, and Adjusted cash flow 498 540 that we have in place reasonable procedures Record date 12 April 2024 those not linked to employment are to prevent the facilitation of tax evasion. Thursday recognised at acquisition at their time One of ITV’s strengths is its cash generation, reflecting our ongoing tight management of working capital balances. We manage risk when Within our overall governance structure, the Dividend paid 23 May 2024 discounted value. making all investment decisions, particularly in scripted content and ITVX, through having a disciplined approach to cash and costs. Remaining governance of tax and tax risk is given a high focused on cash and costs means we are in a good position to continue to invest across the business in line with our strategic priorities. priority by the Board, and Audit and Risk We closely monitor the forecast Committee (ARC). The ITV Global Tax Acquisitions performance of each acquisition and, where In the year, we generated £498 million of operational cash (2022: £540 million) from £489 million of adjusted EBITA (2022: £717 million), Strategy, approved by the Board and ARC in there has been a change in expectations, resulting in a profit to cash ratio of 102% (2022: 75%). The increase in our profit to cash ratio year-on-year reflects a favourable movement in September 2023, and as published on the As part of our strategy to Expand Studios, we working capital due to the unwind of programme rights and inventory previously built up for the launch of ITVX. In addition, there has been a ITV plc website, is compliant with the UK tax consider selective value-creating M&A and we adjust our view of potential future talent deals in both scripted and unscripted commitments. Expected future payments of reduction in production inventories predominantly in the US as a result of the 2023 writers’ and actors’ strike. strategy publication requirement set out in £105 million have increased by £16 million Part 2 Schedule 19 of the Finance Act 2016. to obtain further creative talent and IP. Free cash flow since 31 December 2022, due to increases in We have strict criteria for evaluating potential forecast profits. 2023 2022 EPS – adjusted and statutory Twelve months to 31 December £m £m acquisitions. Financially, we assess Overall, adjusted profit after tax was down at ownership of IP, earnings growth and At 31 December 2023, £78 million of Adjusted cash flow 498 540 £311 million (2022: £537 million). Non- valuation based on return on capital expected future payments had been Net interest paid (excluding lease interest) (27) (37) controlling interest was a share of losses of employed and discounted cash flow. recorded on the balance sheet, with the £1 million (2022: share of profit of £7 million) balance of £27 million to be accrued over the Adjusted cash tax* (70) (86) Strategically, we ensure an acquisition target which is the net result from the non-ITV has a strong creative track record and period in which the sellers are required to Pension funding (40) (137) owned share in entities such as Plimsoll, pipeline in content genres that return and remain with the business. Free cash flow 361 280 Cattleya and Tomorrow Studios. travel, namely drama, entertainment and There were no acquisitions during 2023. * Adjusted cash tax of £70 million is total net cash tax paid of £32 million plus receipt of production tax credits of £38 million, which are included within adjusted cash flow from factual, as well as retention and succession operations, as these production tax credits relate directly to the production of programmes. Adjusted basic EPS was down 41% to 7.8p in planning for key individuals in the business. the year (2022: 13.2p). The weighted average number of shares increased year-on-year to Our free cash flow after payments for interest, cash tax and pension funding was £361 million (2022: £280 million). 4,023 million (2022: 4,010 million). Diluted adjusted EPS in the year was 7.7p (2022: 13.1p) reflecting a weighted average diluted number of shares of 4,059 million (2022: 4,046 million).

ITV Annual Report & Accounts Page 49 Page 51

ITV Annual Report & Accounts Page 49 Page 51