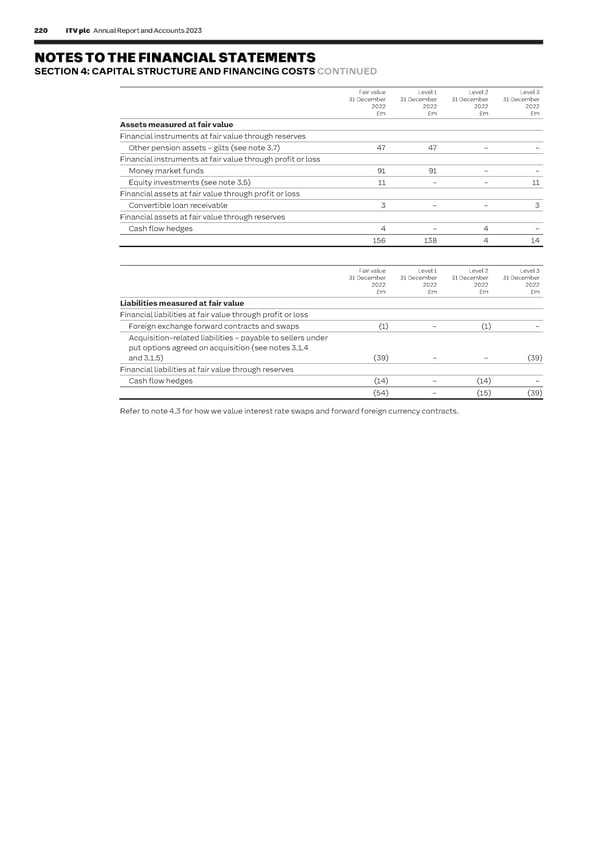

220 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 221 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Fair value Level 1 Level 2 Level 3 4.6 Keeping The Group accounts for operating leases under IFRS 16 ‘Leases’. Lease liabilities S 31 December 31 December 31 December 31 December T it simple representing the discounted future lease payments and right of use assets A 2022 2022 2022 2022 Lease T £m £m £m £m are recognised in the Consolidated Statement of Financial Position. Lease costs E liabilities M such as property rent are now recognised in the form of depreciation and interest in E Assets measured at fair value N the Consolidated Income Statement. T Financial instruments at fair value through reserves S Other pension assets – gilts (see note 3.7) 47 47 – – Financial instruments at fair value through profit or loss Accounting policies Money market funds 91 91 – – Lease liabilities represent the discounted future lease payments. Discount rates are calculated for similar assets, Equity investments (see note 3.5) 11 – – 11 in similar economic environments, taking into account the length of the lease. The unwinding of the discounting is Financial assets at fair value through profit or loss recognised in net financing costs in the Consolidated Income Statement. The following table outlines the maturity analysis of the lease liabilities: Convertible loan receivable 3 – – 3 Financial assets at fair value through reserves 2023 2022 Cash flow hedges 4 – 4 – £m £m 156 138 4 14 Contractual discounted cash flows Less than one year 18 21 Fair value Level 1 Level 2 Level 3 Two to five years 57 55 31 December 31 December 31 December 31 December More than five years 40 56 2022 2022 2022 2022 £m £m £m £m Liabilities measured at fair value Lease liabilities at 31 December 115 132 Financial liabilities at fair value through profit or loss Foreign exchange forward contracts and swaps (1) – (1) – Acquisition-related liabilities – payable to sellers under Currency and put options agreed on acquisition (see notes 3.1.4 1 January non-cash 31 December 2023 Net cash flow movements 2023 and 3.1.5) (39) – – (39) £m £m £m £m Financial liabilities at fair value through reserves Lease liabilities (132) 26 (9) (115) Cash flow hedges (14) – (14) – Total lease liabilities (132) 26 (9) (115) (54) – (15) (39) Refer to note 4.3 for how we value interest rate swaps and forward foreign currency contracts. Currency and 1 January non-cash 31 December 2022 Net cash flow movements 2022 £m £m £m £m Lease liabilities (92) 26 (66) (132) Total lease liabilities (92) 26 (66) (132) The following amounts have been included in the Consolidated Income Statement: 2023 2022 £m £m Interest expense on lease liabilities (4) (4) Amounts recognised in the Consolidated Income Statement (4) (4) The Group has elected not to recognise right of use assets and lease liabilities for short-term leases (i.e. lease term less than 12 months) or low-value assets (i.e. under £5,000). The Group will continue to expense the lease payments associated with these leases on a straight-line basis over the lease term. At 31 December 2023, this was less than £1 million (2022: less than £1 million). Variable lease payments that depend on an index or a rate are also less than £1 million (2022: less than £1 million). Some property leases contain extension options beyond the non-cancellable period. The Group assesses at the lease commencement date whether it is reasonably certain to exercise the extension options. The lease liability at 31 December 2023 includes one such extension which resulted in an increase in the lease liability of £2 million. There are no other significant extension options. The Group signed a subleasing arrangement, which is classified as a finance lease in accordance with IFRS 16 ‘Leases’. In accordance with the standard, the right of use asset with a net book value of £8 million was derecognised and replaced by a net investment in the sublease which has been recognised within other receivables. See note 3.2. This arrangement does not impact the lease liabilities arising from the original lease which have been included in this note.

ITV Annual Report & Accounts Page 221 Page 223

ITV Annual Report & Accounts Page 221 Page 223