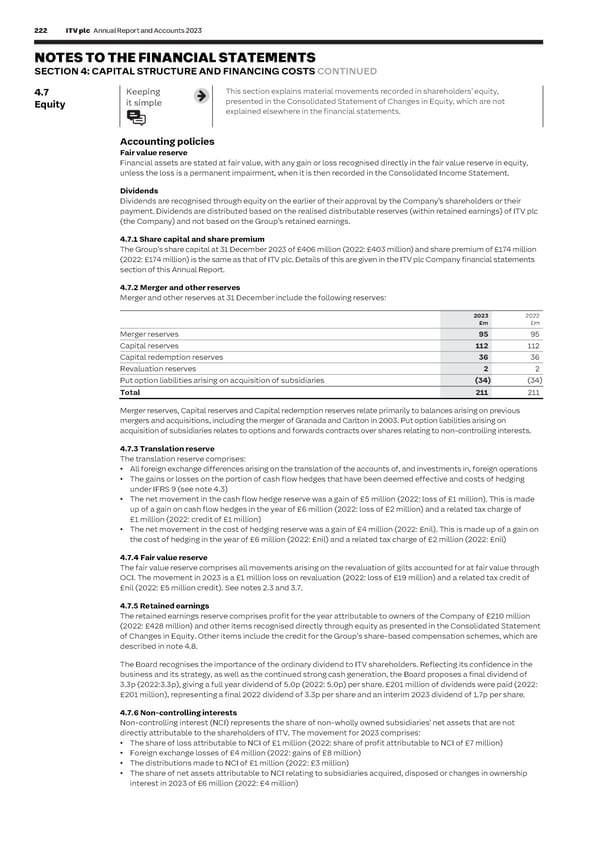

222 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 223 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL 4.7 Keeping This section explains material movements recorded in shareholders’ equity, 4.8 Keeping The Group utilises share award schemes as part of its employee remuneration S T it simple presented in the Consolidated Statement of Changes in Equity, which are not it simple packages, and therefore operates a number of share-based compensation A Equity Share-based T explained elsewhere in the financial statements. schemes, namely the Deferred Share Award (DSA), Executive Share Plan (ESP), E compensation M Performance Share Plan (PSP), Long Term Incentive Plan (LTIP) and Save As You E N Earn (SAYE) schemes. The share-based compensation is not pensionable. T Accounting policies S Fair value reserve A transaction will be classed as share-based compensation where the Group Financial assets are stated at fair value, with any gain or loss recognised directly in the fair value reserve in equity, receives services from employees and pays for these in shares or similar equity unless the loss is a permanent impairment, when it is then recorded in the Consolidated Income Statement. instruments. If the Group incurs a liability linked to the price or value of the Group’s shares, this will also fall under a share-based transaction. Dividends Dividends are recognised through equity on the earlier of their approval by the Company’s shareholders or their Accounting policies payment. Dividends are distributed based on the realised distributable reserves (within retained earnings) of ITV plc For each of the Group’s share-based compensation schemes, the fair value of the equity instrument granted is (the Company) and not based on the Group’s retained earnings. measured at grant date and spread over the vesting period via a charge to the Consolidated Income Statement with 4.7.1 Share capital and share premium a corresponding increase in equity. The Group’s share capital at 31 December 2023 of £406 million (2022: £403 million) and share premium of £174 million The fair value of the share options and awards is measured using either market price at grant date or, for the SAYE scheme, (2022: £174 million) is the same as that of ITV plc. Details of this are given in the ITV plc Company financial statements a Black–Scholes model, taking into account the terms and conditions of the individual scheme. Expected volatility is based section of this Annual Report. on the historical volatility of ITV plc shares over a three or five year period, based on the life of the options. 4.7.2 Merger and other reserves Vesting conditions are limited to service conditions and performance conditions. For performance-based schemes, Merger and other reserves at 31 December include the following reserves: the relevant Group performance measures are projected to the end of the performance period in order to determine 2023 2022 the number of options expected to vest. This estimate of the performance measures is used to determine the option £m £m fair value, discounted to present value. The Group revises the number of options that are expected to vest, including Merger reserves 95 95 an estimate of forfeitures at each reporting date based on forecast performance measures. The impact of the Capital reserves 112 112 revision to original estimates, if any, is recognised in the Consolidated Income Statement, with a corresponding Capital redemption reserves 36 36 adjustment to equity. Revaluation reserves 2 2 Exercises of share options granted to employees can be satisfied by market purchase or issue of new shares. No new Put option liabilities arising on acquisition of subsidiaries (34) (34) shares may be issued to satisfy exercises under the terms of the DSA. During the year, exercises were satisfied by Total 211 211 using shares purchased in the market and held in the ITV Employees’ Benefit Trust as well as the issue of new shares. Merger reserves, Capital reserves and Capital redemption reserves relate primarily to balances arising on previous Share-based compensation charges totalled £16 million in 2023 (2022: £19 million). mergers and acquisitions, including the merger of Granada and Carlton in 2003. Put option liabilities arising on Share options outstanding acquisition of subsidiaries relates to options and forwards contracts over shares relating to non-controlling interests. The table below summarises the movements in the number of share options outstanding for the Group and their 4.7.3 Translation reserve weighted average exercise price: The translation reserve comprises: • All foreign exchange differences arising on the translation of the accounts of, and investments in, foreign operations 2023 2022 • The gains or losses on the portion of cash flow hedges that have been deemed effective and costs of hedging Weighted Weighted Number average Number average under IFRS 9 (see note 4.3) of options exercise price of options exercise price • The net movement in the cash flow hedge reserve was a gain of £5 million (2022: loss of £1 million). This is made (‘000) (pence) (‘000) (pence) up of a gain on cash flow hedges in the year of £6 million (2022: loss of £2 million) and a related tax charge of Outstanding at 1 January 104,729 24.74 98,934 24.98 £1 million (2022: credit of £1 million) Granted during the year – nil priced 20,993 – 17,238 – • The net movement in the cost of hedging reserve was a gain of £4 million (2022: £nil). This is made up of a gain on Granted during the year – other 16,395 59.21 13,814 62.85 the cost of hedging in the year of £6 million (2022: £nil) and a related tax charge of £2 million (2022: £nil) Forfeited during the year (4,210) 68.61 (3,095) 56.49 4.7.4 Fair value reserve Exercised during the year – nil priced (15,551) – (6,201) – The fair value reserve comprises all movements arising on the revaluation of gilts accounted for at fair value through Exercised during the year – other (12,954) 49.31 (110) 50.61 OCI. The movement in 2023 is a £1 million loss on revaluation (2022: loss of £19 million) and a related tax credit of Expired during the year (19,168) 15.57 (15,851) 35.87 £nil (2022: £5 million credit). See notes 2.3 and 3.7. Outstanding at 31 December 90,234 25.88 104,729 24.74 4.7.5 Retained earnings Exercisable at 31 December 12,933 34.88 4,383 30.63 The retained earnings reserve comprises profit for the year attributable to owners of the Company of £210 million The average share price during 2023 was 73.10 pence (2022: 78.32 pence). (2022: £428 million) and other items recognised directly through equity as presented in the Consolidated Statement of Changes in Equity. Other items include the credit for the Group’s share-based compensation schemes, which are described in note 4.8. The Board recognises the importance of the ordinary dividend to ITV shareholders. Reflecting its confidence in the business and its strategy, as well as the continued strong cash generation, the Board proposes a final dividend of 3.3p (2022:3.3p), giving a full year dividend of 5.0p (2022: 5.0p) per share. £201 million of dividends were paid (2022: £201 million), representing a final 2022 dividend of 3.3p per share and an interim 2023 dividend of 1.7p per share. 4.7.6 Non-controlling interests Non-controlling interest (NCI) represents the share of non-wholly owned subsidiaries’ net assets that are not directly attributable to the shareholders of ITV. The movement for 2023 comprises: • The share of loss attributable to NCI of £1 million (2022: share of profit attributable to NCI of £7 million) • Foreign exchange losses of £4 million (2022: gains of £8 million) • The distributions made to NCI of £1 million (2022: £3 million) • The share of net assets attributable to NCI relating to subsidiaries acquired, disposed or changes in ownership interest in 2023 of £6 million (2022: £4 million)

ITV Annual Report & Accounts Page 223 Page 225

ITV Annual Report & Accounts Page 223 Page 225