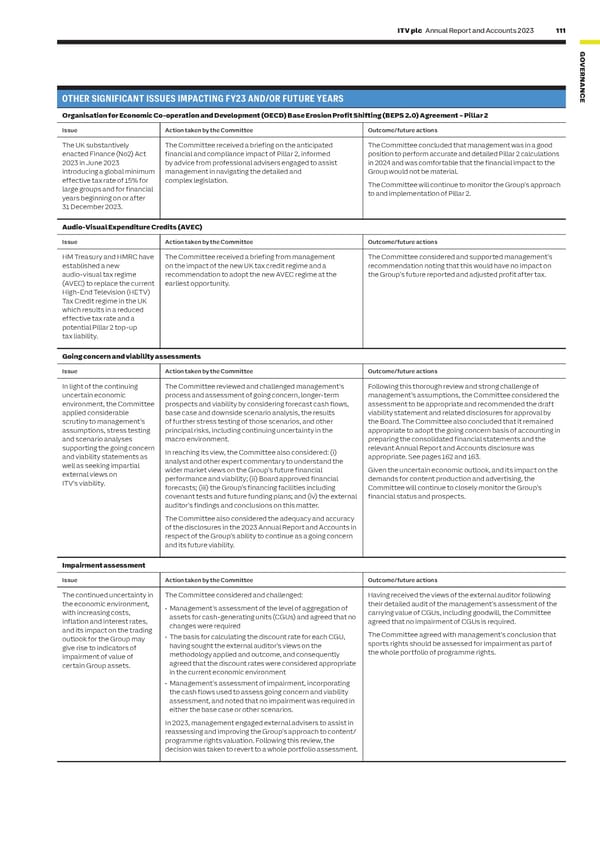

110 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 111 AUDIT AND RISK COMMITTEE REPORT CONTINUED G O VE R NAN C OTHER SIGNIFICANT ISSUES IMPACTING FY23 AND/OR FUTURE YEARS OTHER SIGNIFICANT ISSUES IMPACTING FY23 AND/OR FUTURE YEARS E Acquisitions and related liabilities Organisation for Economic Co-operation and Development (OECD) Base Erosion Profit Shifting (BEPS 2.0) Agreement – Pillar 2 IssueAction taken by the CommitteeOutcome/future actionsIssueAction taken by the Committee Outcome/future actions Acquisition liabilities are The Committee reviewed management’s process to The Committee agreed with management’s assessment The UK substantively The Committee received a briefing on the anticipated The Committee concluded that management was in a good amounts payable to former determine the expected future payments and the related of expected future payments for Plimsoll and other previous enacted Finance (No2) Act financial and compliance impact of Pillar 2, informed position to perform accurate and detailed Pillar 2 calculations owners of businesses year end liability, including the classification of those costs acquisitions.2023 in June 2023 by advice from professional advisers engaged to assist in 2024 and was comfortable that the financial impact to the acquired for remaining linked to employment as exceptional. The Committee was pleased to note that the integration introducing a global minimum management in navigating the detailed and Group would not be material. minority shareholdings. In 2022 the Group acquired a majority stake in Plimsoll of Plimsoll with ITV had been successful, including adoption effective tax rate of 15% for complex legislation.The Committee will continue to monitor the Group’s approach The payments are linked to Productions. During 2023, the Committee considered of ITV’s policies, a good controls environment and ongoing large groups and for financial to and implementation of Pillar 2. the financial and/or management’s post-acquisition review and, in light of the transition to ITV corporate network and systems. years beginning on or after operating performance of review, the appropriateness of the anticipated future 31 December 2023. the business over future payments. In addition, the Committee reviewed the periods and are usually conclusions of EY’s internal audit of Plimsoll’s production Audio-Visual Expenditure Credits (AVEC) linked to continued financial controls and compliance with ITV’s Group policies. employment. Issue Action taken by the Committee Outcome/future actions HM Treasury and HMRC have The Committee received a briefing from management The Committee considered and supported management’s Pensions risk managementestablished a new on the impact of the new UK tax credit regime and a recommendation noting that this would have no impact on IssueAction taken by the CommitteeOutcome/future actionsaudio-visual tax regime recommendation to adopt the new AVEC regime at the the Group’s future reported and adjusted profit after tax. (AVEC) to replace the current earliest opportunity. Managing the impact of The Committee received an update on the management of The Committee noted the update and was confident that High-End Television (HETV) economic turbulence in the the Group’s pension risks, with a focus on investment the actions taken meant that the risks identified continued Tax Credit regime in the UK year on the investment governance and strategy. Strong risk management and to be managed and maintained as previously agreed with which results in a reduced strategy of the ITV Pension maintaining the risk exposure in balance were fundamental the Committee. effective tax rate and a Scheme and the valuation of objectives.potential Pillar 2 top-up pension assets and liabilities.tax liability. Treasury and financial risk managementGoing concern and viability assessments IssueAction taken by the CommitteeOutcome/future actionsIssueAction taken by the Committee Outcome/future actions During 2023 the Committee The Committee reviewed the Group’s debt maturity profile The Committee considered, supported and approved In light of the continuing The Committee reviewed and challenged management’s Following this thorough review and strong challenge of considered updates from and the options to address the short-term refinancing needs management’s proposed policy changes and the actions uncertain economic process and assessment of going concern, longer-term management’s assumptions, the Committee considered the management on the impact of the business, with a term loan from relationship banks taken to mitigate other financial risk.environment, the Committee prospects and viability by considering forecast cash flows, assessment to be appropriate and recommended the draft of financial risks affecting being proposed. Subsequently, an assessment was The Committee also recommended to the Board the applied considerable base case and downside scenario analysis, the results viability statement and related disclosures for approval by the business.considered on management of the longer-term financing approval of the financing proposals of management to scrutiny to management’s of further stress testing of those scenarios, and other the Board. The Committee also concluded that it remained requirements, which included a proposal to implement an ensure the Group retains appropriate liquidity to support assumptions, stress testing principal risks, including continuing uncertainty in the appropriate to adopt the going concern basis of accounting in Euro Medium Term Note programme (during H1 2024).delivery of the Group’s strategy, particularly in the current and scenario analyses macro environment. preparing the consolidated financial statements and the The annual review of treasury policies focused on mitigation uncertain and volatile economic and political environment.supporting the going concern In reaching its view, the Committee also considered: (i) relevant Annual Report and Accounts disclosure was of foreign exchange risk.and viability statements as analyst and other expert commentary to understand the appropriate. See pages 162 and 163. well as seeking impartial wider market views on the Group’s future financial Given the uncertain economic outlook, and its impact on the external views on performance and viability; (ii) Board approved financial demands for content production and advertising, the IR35 ITV’s viability. forecasts; (iii) the Group’s financing facilities including Committee will continue to closely monitor the Group’s IssueAction taken by the CommitteeOutcome/future actions covenant tests and future funding plans; and (iv) the external financial status and prospects. auditor’s findings and conclusions on this matter. From April 2021 the The Committee considered updates from management The Committee considered and supported management’s responsibility for on developments in the application of IR35 and status of proposed increased provision and proposed accounting The Committee also considered the adequacy and accuracy undertaking IR35 ongoing discussions with HMRC regarding the tax status and treatment, taking into account the external auditor’s views.of the disclosures in the 2023 Annual Report and Accounts in employment status treatment of ‘front of camera’ presenters who were not respect of the Group’s ability to continue as a going concern assessments, and where employees. The Committee noted that the outcome of ITV’s negotiations and its future viability. necessary withholding PAYE with HMRC and the implications for the relevant ‘front of and paying NICs, passed to During the latter part of 2023, the Committee considered camera’ individuals.Impairment assessment the employer, rather than management’s proposed changes to the provision recorded remaining with individuals at 30 June 2023, updated to reflect ongoing discussions and IssueAction taken by the Committee Outcome/future actions and their personal service agreements reached with HMRC, including the removal of companies. ITV has been in certain prior years no longer in scope. Management The continued uncertainty in The Committee considered and challenged:Having received the views of the external auditor following continuous discussion with proposed to classify those amounts related to prior years as the economic environment, • Management’s assessment of the level of aggregation of their detailed audit of the management’s assessment of the HMRC on this matter exceptional given their materiality and nature. with increasing costs, assets for cash-generating units (CGUs) and agreed that no carrying value of CGUs, including goodwill, the Committee throughout 2023. inflation and interest rates, changes were required agreed that no impairment of CGUs is required. and its impact on the trading The Committee agreed with management’s conclusion that outlook for the Group may • The basis for calculating the discount rate for each CGU, give rise to indicators of having sought the external auditor’s views on the sports rights should be assessed for impairment as part of impairment of value of methodology applied and outcome, and consequently the whole portfolio of programme rights. certain Group assets. agreed that the discount rates were considered appropriate in the current economic environment • Management’s assessment of impairment, incorporating the cash flows used to assess going concern and viability assessment, and noted that no impairment was required in either the base case or other scenarios. In 2023, management engaged external advisers to assist in reassessing and improving the Group’s approach to content/ programme rights valuation. Following this review, the decision was taken to revert to a whole portfolio assessment.

ITV Annual Report & Accounts Page 112 Page 114

ITV Annual Report & Accounts Page 112 Page 114