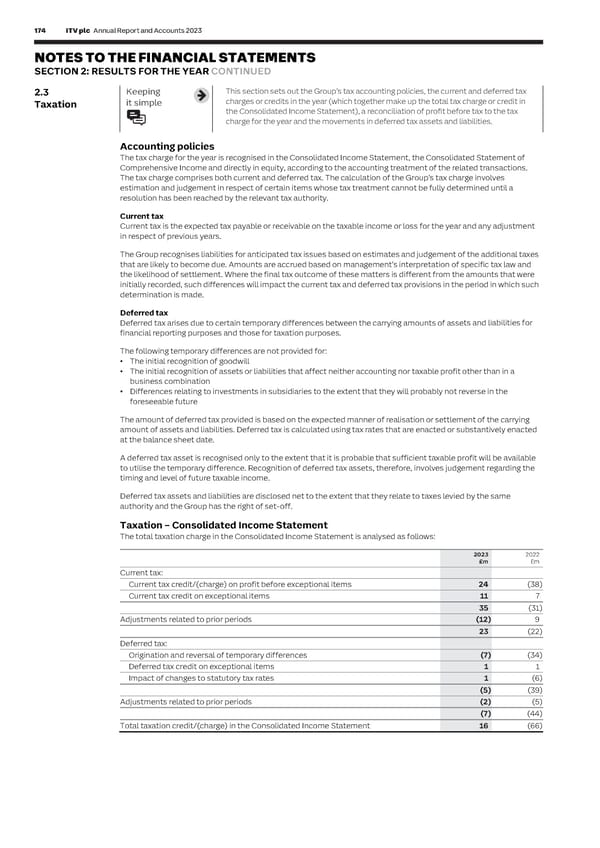

174 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 175 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 2: RESULTS FOR THE YEAR CONTINUED C I AL 2.3 Keeping This section sets out the Group’s tax accounting policies, the current and deferred tax In order to understand how, in the Consolidated Income Statement, a tax credit of £16 million (2022: £66 million S T it simple charges or credits in the year (which together make up the total tax charge or credit in charge) arises on a profit before tax of £193 million (2022: £501 million), the taxation charge that would arise at the A Taxation T the Consolidated Income Statement), a reconciliation of profit before tax to the tax standard rate of UK corporation tax is reconciled to the actual tax credit as follows: E M charge for the year and the movements in deferred tax assets and liabilities. E 2023 2022 N T £m £m S Accounting policies Profit before tax 193 501 The tax charge for the year is recognised in the Consolidated Income Statement, the Consolidated Statement of Notional taxation charge at UK corporation tax rate of 23.5% (2022: 19%) on profit Comprehensive Income and directly in equity, according to the accounting treatment of the related transactions. before tax (45) (95) The tax charge comprises both current and deferred tax. The calculation of the Group’s tax charge involves Non-taxable income/non-deductible expenses (10) (15) estimation and judgement in respect of certain items whose tax treatment cannot be fully determined until a Prior year adjustments (14) 4 resolution has been reached by the relevant tax authority. Other taxes (8) (8) Current tax Previously unrecognised deferred tax assets 6 – Current tax is the expected tax payable or receivable on the taxable income or loss for the year and any adjustment Current year losses not recognised (17) (8) in respect of previous years. Impact of overseas tax rates 2 (1) The Group recognises liabilities for anticipated tax issues based on estimates and judgement of the additional taxes Impact of changes in tax rates 1 (6) that are likely to become due. Amounts are accrued based on management’s interpretation of specific tax law and Movement on tax provisions (1) (1) the likelihood of settlement. Where the final tax outcome of these matters is different from the amounts that were Production tax credits 102 64 initially recorded, such differences will impact the current tax and deferred tax provisions in the period in which such Statutory taxation credit/(charge) in the Consolidated Income Statement 16 (66) determination is made. Non-deductible expenses are expenses that are not expected to be allowable for tax purposes. Similarly, non- Deferred tax taxable income is income that is not expected to be taxable. Deferred tax arises due to certain temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and those for taxation purposes. Adjustments to prior periods primarily arise where an outcome is obtained on certain tax matters, which differs from expectations held when the related provision was made. Where the outcome is more favourable than the provision The following temporary differences are not provided for: made, the difference is released, lowering the current year tax charge. Where the outcome is less favourable than our • The initial recognition of goodwill provision, an additional charge to current year tax will occur. The total current tax credit of £23 million (2022: £22 • The initial recognition of assets or liabilities that affect neither accounting nor taxable profit other than in a million charge) includes a £12 million charge (2022: £9 million credit) relating to prior years, and the deferred tax business combination charge of £7 million (2022: £44 million charge) includes a £2 million charge (2022: £5 million charge) relating to prior • Differences relating to investments in subsidiaries to the extent that they will probably not reverse in the years. This adjustment has arisen following changes in estimates of taxes that have already become due, or will foreseeable future become due in the future. The amount of deferred tax provided is based on the expected manner of realisation or settlement of the carrying Other taxes of £8 million charge (2022: £8 million charge) includes state taxes of £3 million in the US, local taxes of amount of assets and liabilities. Deferred tax is calculated using tax rates that are enacted or substantively enacted £1 million in Italy and France plus £4 million of irrecoverable withholding tax in the UK. at the balance sheet date. A previously unrecognised deferred tax asset of £6 million relating to historical capital losses, has been recognised A deferred tax asset is recognised only to the extent that it is probable that sufficient taxable profit will be available in 2023, as they will be utilised against the capital profits realised on the sale of BritBox International, announced to utilise the temporary difference. Recognition of deferred tax assets, therefore, involves judgement regarding the on 1 March 2024. timing and level of future taxable income. The tax impact of current year losses not recognised is £17 million (2022: £8 million), this relates to £2 million in Deferred tax assets and liabilities are disclosed net to the extent that they relate to taxes levied by the same Australia, £1 million in France, £13 million in Italy and £1 million in other overseas jurisdictions. No deferred tax on authority and the Group has the right of set-off. these losses has been recognised as we do not have certainty over future taxable profits in those jurisdictions nor are they suitable taxable temporary differences against which the losses can unwind. Taxation – Consolidated Income Statement The total taxation charge in the Consolidated Income Statement is analysed as follows: The impact of overseas tax rates reflects the fact that some of our profits are earned in territories other than the UK and taxed at rates different from the UK corporation tax rate. In 2023, the total impact is £2 million credit 2023 2022 (2022: £1 million charge) due to profits arising in lower tax jurisdictions. £m £m Current tax: The UK corporation tax rate increased from 19% to 25%, effective from 1 April 2023. The current year movement Current tax credit/(charge) on profit before exceptional items 24 (38) through the Consolidated Income Statement, on the deferred tax liability created in respect of the change in the tax Current tax credit on exceptional items 11 7 rate, is a £1 million credit (2022: £6 million charge). 35 (31) In line with our accounting policy on current tax, provisions are held on the balance sheet within current tax liabilities Adjustments related to prior periods (12) 9 in respect of uncertain tax positions where management believes that it is probable that future payments of tax will 23 (22) be required. Deferred tax: Origination and reversal of temporary differences (7) (34) The production tax credits included within the reconciliation above are UK High-End Television (HETV) tax credits and Children’s Television tax credits, which are part of a group of incentives provided to support the creative Deferred tax credit on exceptional items 1 1 industries in the UK. The ability to access these tax credits is fundamental when assessing the viability of investment Impact of changes to statutory tax rates 1 (6) decisions in the production of high-end drama and children’s programmes. Under IFRS, these production tax credits (5) (39) are reported within the total taxation charge in the Consolidated Income Statement. However, ITV considers them to Adjustments related to prior periods (2) (5) be a contribution to production costs, and therefore working capital in nature, and excludes them from its adjusted (7) (44) tax charge, including them instead within Adjusted EBITA. Total taxation credit/(charge) in the Consolidated Income Statement 16 (66) The effective tax rate is (8.3)% (2022: 13.2%), and is the statutory tax charge on the face of the Consolidated Income Statement expressed as a percentage of the statutory profit before tax. The tax rate is lower than in 2022 primarily due to significantly higher HETV tax credits compared to the profits. As explained in the Finance Review, the Group uses an adjusted tax rate to show how tax impacts total adjusted earnings in a way that is more aligned with the Group’s cash tax position. The adjusted tax rate is 21.5% (2022: 20.1%). In 2023, the current year movement recognised in the Consolidated Income Statement on origination and reversal of temporary differences (excluding exceptional items) is a charge of £7 million, compared with a charge of £34 million in 2022.

ITV Annual Report & Accounts Page 175 Page 177

ITV Annual Report & Accounts Page 175 Page 177