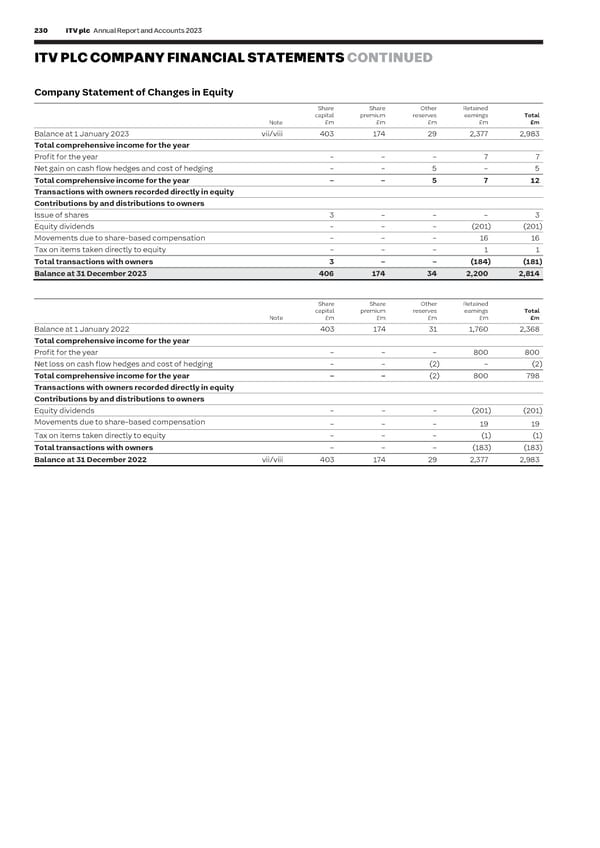

230 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 231 F I ITV PLC COMPANY FINANCIAL STATEMENTS CONTINUED NOTES TO THE ITV PLC COMPANY FINANCIAL STATEMENTS NAN C I AL Company Statement of Changes in Equity Note i In this This section sets out the notes to the ITV plc Company only financial S T section statements. Those statements form the basis of the dividend decisions made by A Share Share Other Retained Accounting T the Directors, as explained in detail in note viii below. The notes form part of the E capital premium reserves earnings Total policies M Note £m £m £m £m £m financial statements. E N Balance at 1 January 2023 vii/viii 403 174 29 2,377 2,983 T Total comprehensive income for the year S Profit for the year – – – 7 7 Basis of preparation Net gain on cash flow hedges and cost of hedging – – 5 – 5 The Company is a qualifying entity as it is a member of the ITV plc Group where ITV plc, the ultimate parent prepares publicly available consolidated financial statements. These financial statements were prepared in accordance with Total comprehensive income for the year – – 5 7 12 Financial Reporting Standard 101 ‘Reduced Disclosure Framework’ (‘FRS 101’). The Company is registered in England Transactions with owners recorded directly in equity and Wales. Contributions by and distributions to owners In preparing these financial statements, the Company applies the recognition, measurement and disclosure Issue of shares 3 – – – 3 requirements of international accounting standards in conformity with the requirements of the Companies Act 2006 Equity dividends – – – (201) (201) (‘Adopted IFRSs’), but makes amendments where necessary in order to comply with Companies Act 2006 and has Movements due to share-based compensation – – – 16 16 set out below where advantage of the FRS 101 disclosure exemptions has been taken. Tax on items taken directly to equity – – – 1 1 Total transactions with owners 3 – – (184) (181) Exemptions applied Balance at 31 December 2023 406 174 34 2,200 2,814 The following exemptions from the requirements of IFRS have been applied in the preparation of these financial statements, in accordance with FRS 101: Share Share Other Retained • Presentation of a Statement of Cash Flows and related notes capital premium reserves earnings Total • Disclosure in respect of capital management Note £m £m £m £m £m • Disclosure of related party transactions between wholly-owned subsidiaries and parents within a group Balance at 1 January 2022 403 174 31 1,760 2,368 • Disclosures required under IFRS 2 ‘Share Based Payments’ in respect of group settled share-based compensation Total comprehensive income for the year • Disclosures required by IFRS 7 ‘Financial Instruments: Disclosure’ Profit for the year – – – 800 800 • Certain disclosures required under IFRS 13 ‘Fair Value Measurement’ Net loss on cash flow hedges and cost of hedging – – (2) – (2) • Disclosure of information in relation to new standards not yet applied Total comprehensive income for the year – – (2) 800 798 The Company proposes to continue to apply the reduced disclosure framework of FRS 101 in its next financial statements. Transactions with owners recorded directly in equity Contributions by and distributions to owners The financial statements have been prepared on a going concern basis. Equity dividends – – – (201) (201) Changes in accounting policy Movements due to share-based compensation – – – 19 19 New accounting standards, interpretations and amendments that are effective from 1 January 2023 have not had Tax on items taken directly to equity – – – (1) (1) significant impact on the Company’s results or Statement of Financial Position. Total transactions with owners – – – (183) (183) Accounting standards effective in future periods Balance at 31 December 2022 vii/viii 403 174 29 2,377 2,983 The Directors have considered the impact on the Company of new and revised accounting standards, interpretations or amendments that are not yet effective and do not expect them to have a significant impact on the Company’s results and Statement of Financial Position. Accounting judgements and estimates The preparation of financial statements requires management to exercise judgement in applying the Company’s accounting policies. It also requires the use of estimates and assumptions that affect the reported amounts of assets, liabilities, income and expenses. Actual results may differ from these estimates. Expected credit losses on amounts due from subsidiary undertakings is considered a key source of estimation uncertainty. Subsidiaries Subsidiaries are entities that are directly or indirectly controlled by the Company. Control exists where the Company has the power to govern the financial and operating policies of the entity so as to obtain benefits from its activities. The investment in the Company’s subsidiaries is recorded at cost. Foreign currency transactions Transactions in foreign currencies are translated into sterling at the rate of exchange ruling at the date of the transaction. Foreign currency monetary assets and liabilities at the balance sheet date are translated into sterling at the rate of exchange ruling at that date. Foreign exchange differences arising on translation are recognised in the profit and loss account. Non-monetary assets and liabilities measured at historical cost are translated into sterling at the rate of exchange on the date of the transaction. Borrowings Borrowings are recognised initially at fair value including directly attributable transaction costs, with subsequent measurement at amortised cost using the effective interest rate method. The difference between initial fair value and the redemption value is recorded in the profit and loss account over the period of the liability on an effective interest basis.

ITV Annual Report & Accounts Page 231 Page 233

ITV Annual Report & Accounts Page 231 Page 233