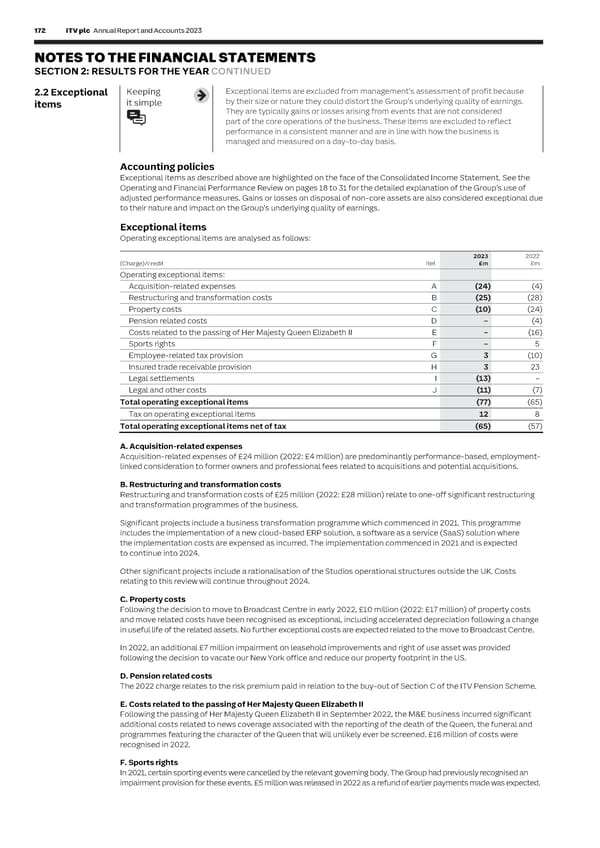

172 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 173 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 2: RESULTS FOR THE YEAR CONTINUED C I AL 2.2 Exceptional Keeping Exceptional items are excluded from management’s assessment of profit because G. Employee-related tax provisions S T it simple by their size or nature they could distort the Group’s underlying quality of earnings. From April 2021 the responsibility for undertaking IR35 employment status assessments, and where necessary A items T They are typically gains or losses arising from events that are not considered withholding PAYE and paying NICs, passed to the employer, rather than remaining with individuals and their personal E M part of the core operations of the business. These items are excluded to reflect service companies. HMRC have issued assessments on the Group for several individuals engaged by the Group E N performance in a consistent manner and are in line with how the business is during the tax years 2016/17 to 2018/19 as employed for tax purposes. This is a complex area and the Group has T managed and measured on a day-to-day basis. been in continuous discussion with HMRC on this matter throughout 2023. S In 2023, HMRC advised that certain individuals were no longer of interest to them and the related provision Accounting policies previously classified as exceptional was released. Exceptional items as described above are highlighted on the face of the Consolidated Income Statement. See the Operating and Financial Performance Review on pages 18 to 31 for the detailed explanation of the Group’s use of Due to ongoing reviews by HMRC and court cases in this matter, the final amount payable could be significantly adjusted performance measures. Gains or losses on disposal of non-core assets are also considered exceptional due different to amounts currently provided. to their nature and impact on the Group’s underlying quality of earnings. H. Insured trade receivable provision Exceptional items In 2017, the Group recorded a bad debt provision of US$41 million related to trade receivables for The Voice of China. Operating exceptional items are analysed as follows: Subsequently, US$34 million of cash was received from the licensee and the corresponding bad debt provision was released. The Directors anticipated recovering the remainder of the trade receivable from the trade credit insurance. 2023 2022 (Charge)/credit Ref. £m £m In 2023, a settlement of the claim was agreed with the insurers resulting in an exceptional credit of US$5 million Operating exceptional items: (£3 million). No further recovery of the remaining trade receivable is expected. Acquisition-related expenses A (24) (4) Restructuring and transformation costs B (25) (28) I. Legal settlements Legal settlements of £13 million (2022: £nil) relate to settlements or proposed settlements on a number of Property costs C (10) (24) significant legal cases which are considered outside the normal course of business. Pension related costs D – (4) Costs related to the passing of Her Majesty Queen Elizabeth II E – (16) J. Legal and other costs Sports rights F – 5 Legal and other costs of £11 million (2022: £7 million) relates primarily to legal costs for matters considered to be Employee-related tax provision G 3 (10) outside the normal course of business, including Box Clever, The Voice of Holland, the UK Competition and Markets Insured trade receivable provision H 3 23 Authority (CMA) investigations and the Phillip Schofield KC Review. Legal settlements I (13) – Legal and other costs J (11) (7) Total operating exceptional items (77) (65) Tax on operating exceptional items 12 8 Total operating exceptional items net of tax (65) (57) A. Acquisition-related expenses Acquisition-related expenses of £24 million (2022: £4 million) are predominantly performance-based, employment- linked consideration to former owners and professional fees related to acquisitions and potential acquisitions. B. Restructuring and transformation costs Restructuring and transformation costs of £25 million (2022: £28 million) relate to one-off significant restructuring and transformation programmes of the business. Significant projects include a business transformation programme which commenced in 2021. This programme includes the implementation of a new cloud-based ERP solution, a software as a service (SaaS) solution where the implementation costs are expensed as incurred. The implementation commenced in 2021 and is expected to continue into 2024. Other significant projects include a rationalisation of the Studios operational structures outside the UK. Costs relating to this review will continue throughout 2024. C. Property costs llion) of property costs Following the decision to move to Broadcast Centre in early 2022, £10 million (2022: £17 mi and move related costs have been recognised as exceptional, including accelerated depreciation following a change in useful life of the related assets. No further exceptional costs are expected related to the move to Broadcast Centre. In 2022, an additional £7 million impairment on leasehold improvements and right of use asset was provided following the decision to vacate our New York office and reduce our property footprint in the US. D. Pension related costs The 2022 charge relates to the risk premium paid in relation to the buy-out of Section C of the ITV Pension Scheme. E. Costs related to the passing of Her Majesty Queen Elizabeth II Following the passing of Her Majesty Queen Elizabeth II in September 2022, the M&E business incurred significant additional costs related to news coverage associated with the reporting of the death of the Queen, the funeral and programmes featuring the character of the Queen that will unlikely ever be screened. £16 million of costs were recognised in 2022. F. Sports rights In 2021, certain sporting events were cancelled by the relevant governing body. The Group had previously recognised an impairment provision for these events. £5 million was released in 2022 as a refund of earlier payments made was expected.

ITV Annual Report & Accounts Page 173 Page 175

ITV Annual Report & Accounts Page 173 Page 175