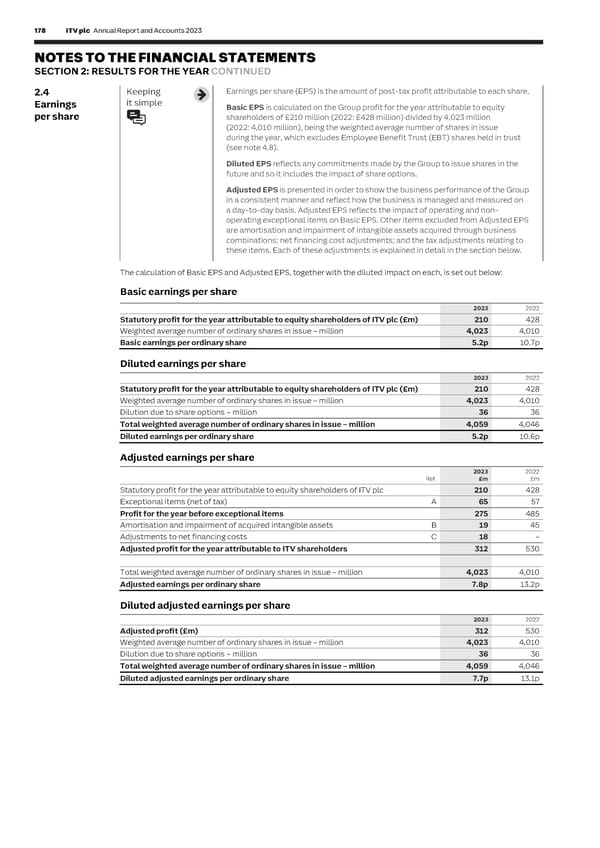

178 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 179 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 2: RESULTS FOR THE YEAR CONTINUED C I AL 2.4 Keeping Earnings per share (EPS) is the amount of post-tax profit attributable to each share. Details of the adjustments to earnings are as follows: S T it simple A Earnings Basic EPS is calculated on the Group profit for the year attributable to equity T A. Exceptional items (net of tax) £65 million (2022: £57 million) E per share shareholders of £210 million (2022: £428 million) divided by 4,023 million Exceptional items of £77 million (2022: £65 million), net of related tax credit of £12 million (2022: £8 million). M E (2022: 4,010 million), being the weighted average number of shares in issue N The exceptional items have been taxed in accordance with the tax treatment of the underlying transaction at the T during the year, which excludes Employee Benefit Trust (EBT) shares held in trust tax rate of the jurisdiction to which they relate. The £77 million exceptional charge comprises exceptional costs of S (see note 4.8). £88 million and an exceptional credit of £11 million. £26 million of the net exceptional costs were disallowed for tax Diluted EPS reflects any commitments made by the Group to issue shares in the purposes and so there is no associated tax credit. See note 2.2 for the detailed composition of exceptional items. future and so it includes the impact of share options. B. Amortisation and impairment of acquired intangible assets (net of tax) of £19 million (2022: £45 million) Adjusted EPS is presented in order to show the business performance of the Group Amortisation and impairment of assets acquired through business combinations and investments of £89 million in a consistent manner and reflect how the business is managed and measured on (2022: £84 million), excluding amortisation of software licences and development of £64 million (2022: £27 million), a day-to-day basis. Adjusted EPS reflects the impact of operating and non- net of related tax credit of £6 million (2022: £12 million). operating exceptional items on Basic EPS. Other items excluded from Adjusted EPS are amortisation and impairment of intangible assets acquired through business C. Adjustments to net financing costs (net of tax) £18 million (2022: £nil) combinations; net financing cost adjustments; and the tax adjustments relating to Net financing costs of £45 million (2022: £26 million), is adjusted to reflect the underlying cash cost of interest for the these items. Each of these adjustments is explained in detail in the section below. business. These adjustments of £16 million (2022: £nil) relates principally to finance costs on acquisitions, imputed pension interest and other financial gains and losses that do not reflect the relevant interest cash cost to the business and are not yet realised balances. The tax charge in relation to these adjustments is £2 million (2022: £nil). The calculation of Basic EPS and Adjusted EPS, together with the diluted impact on each, is set out below: Basic earnings per share 2023 2022 Statutory profit for the year attributable to equity shareholders of ITV plc (£m) 210 428 Weighted average number of ordinary shares in issue – million 4,023 4,010 Basic earnings per ordinary share 5.2p 10.7p Diluted earnings per share 2023 2022 Statutory profit for the year attributable to equity shareholders of ITV plc (£m) 210 428 Weighted average number of ordinary shares in issue – million 4,023 4,010 Dilution due to share options – million 36 36 Total weighted average number of ordinary shares in issue – million 4,059 4,046 Diluted earnings per ordinary share 5.2p 10.6p Adjusted earnings per share 2023 2022 Ref. £m £m Statutory profit for the year attributable to equity shareholders of ITV plc 210 428 Exceptional items (net of tax) A 65 57 Profit for the year before exceptional items 275 485 Amortisation and impairment of acquired intangible assets B 19 45 Adjustments to net financing costs C 18 – Adjusted profit for the year attributable to ITV shareholders 312 530 Total weighted average number of ordinary shares in issue – million 4,023 4,010 Adjusted earnings per ordinary share 7.8p 13.2p Diluted adjusted earnings per share 2023 2022 Adjusted profit (£m) 312 530 Weighted average number of ordinary shares in issue – million 4,023 4,010 Dilution due to share options – million 36 36 Total weighted average number of ordinary shares in issue – million 4,059 4,046 Diluted adjusted earnings per ordinary share 7.7p 13.1p

ITV Annual Report & Accounts Page 179 Page 181

ITV Annual Report & Accounts Page 179 Page 181