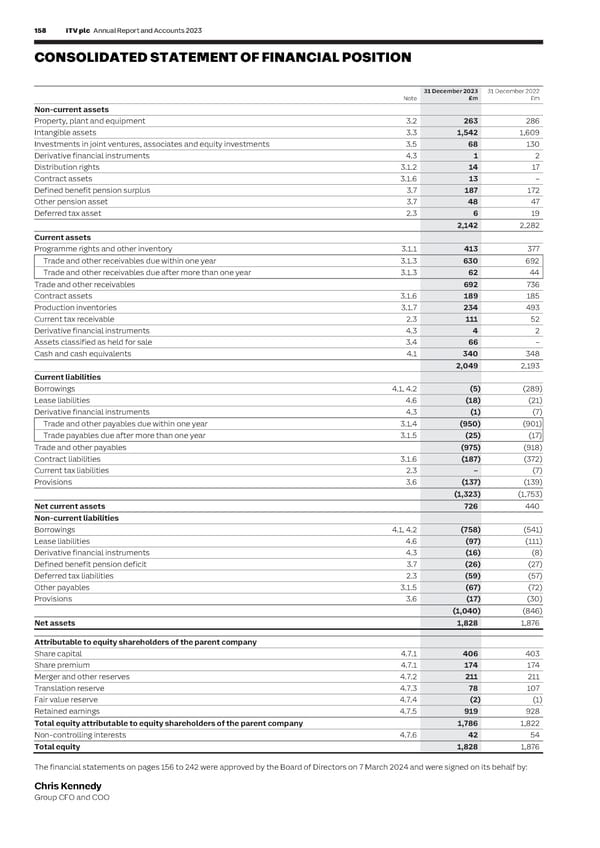

158 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 159 F I CONSOLIDATED STATEMENT OF FINANCIAL POSITION CONSOLIDATED STATEMENT OF CHANGES IN EQUITY NAN C I AL 31 December 2023 31 December 2022 Attributable to equity shareholders of the parent company S Note £m £m T Merger Non- A Share Share and other Translation Fair value Retained controlling Total T Non-current assets E capital premium reserves reserve* reserve earnings Total interests equity M Property, plant and equipment 3.2 263 286 Note £m £m £m £m £m £m £m £m £m E N Intangible assets 3.3 1,542 1,609 Balance at 1 January 2023 4.7 403 174 211 107 (1) 928 1,822 54 1,876 T Investments in joint ventures, associates and equity investments 3.5 68 130 S Total comprehensive Derivative financial instruments 4.3 1 2 income/(expense) Distribution rights 3.1.2 14 17 for the year Contract assets 3.1.6 13 – Profit/(loss) for the year – – – – – 210 210 (1) 209 Defined benefit pension surplus 3.7 187 172 Other comprehensive Other pension asset 3.7 48 47 (expense)/income Deferred tax asset 2.3 6 19 Revaluation of financial assets 4.7.4 – – – – (1) – (1) – (1) 2,142 2,282 Net gain on cash flow hedges and costs Current assets of hedging 4.7.3 – – – 12 – – 12 – 12 Programme rights and other inventory 3.1.1 413 377 Exchange differences on translation of foreign operations 4.7.3 – – – (38) – – (38) (4) (42) Trade and other receivables due within one year 3.1.3 630 692 Remeasurement loss on defined Trade and other receivables due after more than one year 3.1.3 62 44 benefit pension schemes 3.7 – – – – – (35) (35) – (35) Trade and other receivables 692 736 Income tax (charge)/credit on other Contract assets 3.1.6 189 185 comprehensive income/(expense) 2.3 – – – (3) – 9 6 – 6 Production inventories 3.1.7 234 493 Total other comprehensive expense – – – (29) (1) (26) (56) (4) (60) Current tax receivable 2.3 111 52 Total comprehensive Derivative financial instruments 4.3 4 2 (expense)/income for the year – – – (29) (1) 184 154 (5) 149 Assets classified as held for sale 3.4 66 – Transactions with owners, recorded Cash and cash equivalents 4.1 340 348 directly in equity 2,049 2,193 Contributions by and distributions Current liabilities to owners Borrowings 4.1, 4.2 (5) (289) Issue of shares 4.7.1 3 – – – – (2) 1 – 1 Lease liabilities 4.6 (18) (21) Equity dividends – – – – – (201) (201) (1) (202) Derivative financial instruments 4.3 (1) (7) Movements due to share-based Trade and other payables due within one year 3.1.4 (950) (901) compensation 4.8 – – – – – 16 16 – 16 Trade payables due after more than one year 3.1.5 (25) (17) Movements in the employee benefit Trade and other payables (975) (918) trust – – – – – (5) (5) – (5) Contract liabilities 3.1.6 (187) (372) Tax on items taken directly to equity 2.3 – – – – – (2) (2) – (2) Current tax liabilities 2.3 – (7) Total transactions with owners 3 – – – – (194) (191) (1) (192) Provisions 3.6 (137) (139) Changes in non-controlling interests 4.7.6 – – – – – 1 1 (6) (5) (1,323) (1,753) Balance at 31 December 2023 4.7 406 174 211 78 (2) 919 1,786 42 1,828 Net current assets 726 440 * See note 4.3 for further breakdown of Translation Reserve, including Hedging Reserve and Cost of Hedging Reserve Non-current liabilities Borrowings 4.1, 4.2 (758) (541) Lease liabilities 4.6 (97) (111) Derivative financial instruments 4.3 (16) (8) Defined benefit pension deficit 3.7 (26) (27) Deferred tax liabilities 2.3 (59) (57) Other payables 3.1.5 (67) (72) Provisions 3.6 (17) (30) (1,040) (846) Net assets 1,828 1,876 Attributable to equity shareholders of the parent company Share capital 4.7.1 406 403 Share premium 4.7.1 174 174 Merger and other reserves 4.7.2 211 211 Translation reserve 4.7.3 78 107 Fair value reserve 4.7.4 (2) (1) Retained earnings 4.7.5 919 928 Total equity attributable to equity shareholders of the parent company 1,786 1,822 Non-controlling interests 4.7.6 42 54 Total equity 1,828 1,876 The financial statements on pages 156 to 242 were approved by the Board of Directors on 7 March 2024 and were signed on its behalf by: Chris Kennedy Group CFO and COO

ITV Annual Report & Accounts Page 159 Page 161

ITV Annual Report & Accounts Page 159 Page 161