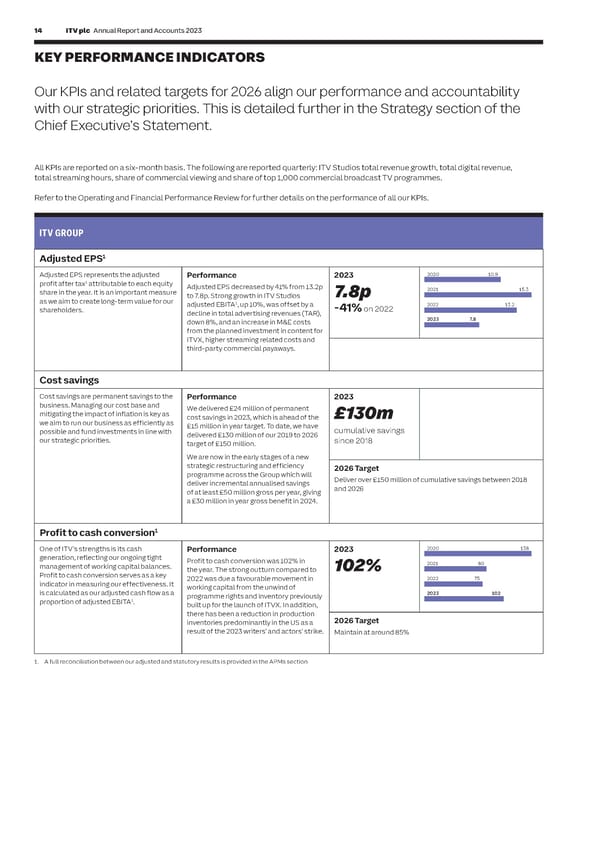

14 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 15 S T KEY PERFORMANCE INDICATORS R A T E G I Our KPIs and related targets for 2026 align our performance and accountability C R E EXPAND STUDIOS P with our strategic priorities. This is detailed further in the Strategy section of the UK AND GLOBAL PRODUCTION O R Chief Executive’s Statement. T ITV Studios total organic revenue growth2 ITV Studios total organic revenue growth Performance 2023 2021 31 measures the scale and success of our Total organic revenue was up 3% following a global studios business. It includes +3% on 2022 2022 14 All KPIs are reported on a six-month basis. The following are reported quarterly: ITV Studios total revenue growth, total digital revenue, strong 2022 which was up 14%. Organic total streaming hours, share of commercial viewing and share of top 1,000 commercial broadcast TV programmes. revenues from programmes sold to M&E, revenue excludes the benefit of our 2023 3 which as a vertically integrated producer, acquisitions of Plimsoll Productions and broadcaster and streamer, is an important Lingo Pictures in 2022, and the Note: 2020 was down 25% due to the Refer to the Operating and Financial Performance Review for further details on the performance of all our KPIs. part of our business. impact of the COVID-19 pandemic. unfavourable impact of a £15 million foreign exchange movement. 2026 Target ITV Studios total revenue grew 4% to ITV GROUP £2,170 million. Grow by 5% on average per annum (from 2021) Adjusted EPS1 2 ITV Studios adjusted EBITA margin % Adjusted EPS represents the adjusted Performance 2023 2020 10.9 1 This is the key profitability measure used Performance 2023 2020 11 profit after tax attributable to each equity Adjusted EPS decreased by 41% from 13.2p share in the year. It is an important measure 2021 15.3 across the ITV Studios business. The to 7.8p. Strong growth in ITV Studios 7.8p ITV Studios adjusted EBITA margin was 2021 12 as we aim to create long-term value for our 1 margin is calculated on ITV Studios total 13.2% (2022: 12.4%), which is restored 13.2% adjusted EBITA , up 10%, was offset by a 2022 13.2 shareholders. decline in total advertising revenues (TAR), -41% on 2022 revenue. within the targeted range. +0.8 basis points 2022 12.4 down 8%, and an increase in M&E costs 2023 7.8 on 2022 2023 13.2 from the planned investment in content for ITVX, higher streaming related costs and third-party commercial payaways. 2026 Target Deliver in the 13% to 15% range Cost savings Total high-end scripted hours Cost savings are permanent savings to the Performance 2023 business. Managing our cost base and Total high-end scripted hours is an Performance 2023 2020 112 We delivered £24 million of permanent important measure in assessing the mitigating the impact of inflation is key as cost savings in 2023, which is ahead of the £130m The number of high-end scripted hours success of our strategic priority, to grow our 2021 175 we aim to run our business as efficiently as £15 million in year target. To date, we have produced by ITV Studios increased by 14% 316hrs possible and fund investments in line with cumulative savings scripted business. High-end scripted hours delivered £130 million of our 2019 to 2026 to 316 hours in 2023 driven by titles such as +14% on 2022 2022 276 our strategic priorities. ince 2018 include new commissions or returning target of £150 million. s Big Beasts, Fool Me Once and Love Island franchises that have a higher cost per hour in the UK, and Twin Love and Physical 2023 316 We are now in the early stages of a new than continuing drama. in the US. strategic restructuring and efficiency 2026 Target programme across the Group which will 2026 Target deliver incremental annualised savings Deliver over £150 million of cumulative savings between 2018 and 2026 Grow to 400 hours of at least £50 million gross per year, giving a £30 million in year gross benefit in 2024. Number of formats sold in three or more countries3 The Studios business is focused on Performance 2023 2020 14 Profit to cash conversion1 maximising the international monetisation The number of formats sold in three or 2021 15 of high-value formats. A good measure of more countries was 19, which was flat 19 One of ITV’s strengths is its cash Performance 2023 2020 138 international success is when a format is generation, reflecting our ongoing tight year-on-year. Recent formats that have 2022 19 Profit to cash conversion was 102% in 2021 80 commissioned in three or more countries in sold in three or more countries include; formats management of working capital balances. the year. The strong outturn compared to 102% the year. 2023 19 Profit to cash conversion serves as a key My Mum, Your Dad; Pranked; and flat on 2022 2022 was due a favourable movement in 2022 75 Song of my Life. indicator in measuring our effectiveness. It working capital from the unwind of is calculated as our adjusted cash flow as a programme rights and inventory previously 2023 102 2026 Target proportion of adjusted EBITA1. built up for the launch of ITVX. In addition, Grow to 20 formats there has been a reduction in production inventories predominantly in the US as a 2026 Target result of the 2023 writers’ and actors’ strike. Maintain at around 85% % of ITV Studios total revenue from streaming platforms Over the medium term, the key driver of Performance 2023 2020 10 growth in the global content market is The percentage of ITV Studios total 1. A full reconciliation between our adjusted and statutory results is provided in the APMs section expected to be from streaming platforms. 32% 2021 13 revenue from streaming platforms grew to The percentage of ITV Studios total 32%, hitting the target three years early. +10 basis points 2022 22 revenue from streaming platforms is an Meeting this target is impacted by the important measure of delivering its phasing of deliveries and therefore our on 2022 2023 32 strategic priority of further diversifying its target is to maintain at least 30%. Notable customer base and meeting its 2026 total deliveries to streaming platforms in 2023 organic revenue growth target. included: Squid Games: The Challenge 2026 Target and One Piece for Netflix, and Franklin for Grow to 30% of ITV Studios total revenue Apple TV+. 2. Our APMs are defined within the APMs section of this report. It also includes a full reconciliation between our adjusted and statutory results 3. Spin-offs such as Love Island Games, are considered distinct from the original format (i.e. Love Island) for the purpose of this indicator

ITV Annual Report & Accounts Page 15 Page 17

ITV Annual Report & Accounts Page 15 Page 17