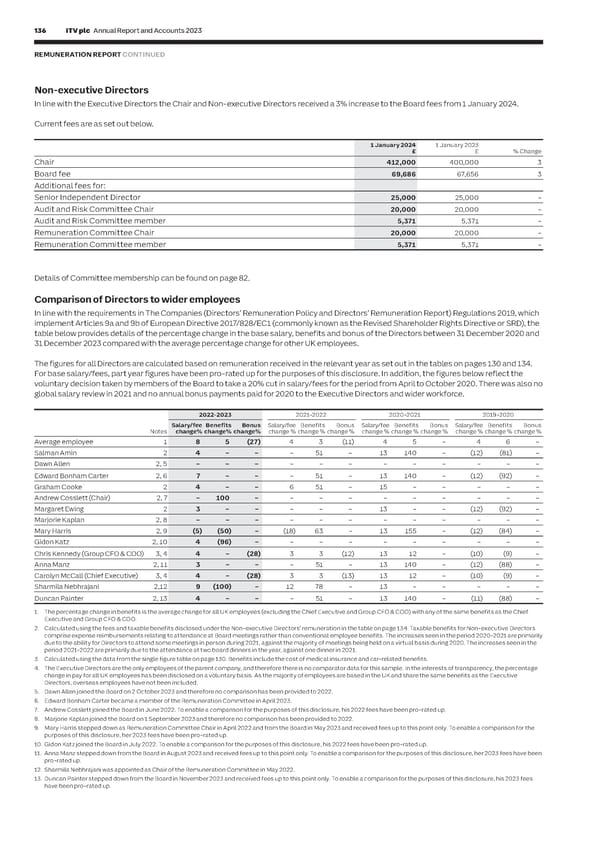

136 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 137 REMUNERATION REPORT CONTINUED G O VE R NAN Non‑executive Directors CEO pay ratio C In line with the Executive Directors the Chair and Non‑executive Directors received a 3% increase to the Board fees from 1 January 2024. E Year Methodology 25th percentile pay ratio Median pay ratio 75th percentile pay ratio 2023 Option A 70.1 52:1 38.1 Current fees are as set out below. 2022 Option A 93:1 69:1 50.1 2021 Option A 92:1 68:1 49:1 1 January 2024 1 January 2023 £ £ % Change 2020 Option A 33:1 24:1 18:1 Chair 412,000 400,000 3 2019 Option A 89:1 66:1 49:1 Board fee 69,686 67,656 3 Additional fees for: Senior Independent Director 25,000 25,000 – The employee at the 25th percentile, median and 75th percentile was determined based on the single figure of total remuneration for every Audit and Risk Committee Chair 20,000 20,000 – UK employee at 31 December 2023, Option A in the Reporting Regulations. This method is the most statistically accurate approach and aligned Audit and Risk Committee member 5,371 5,371 – with majority practice in the FTSE 250. Remuneration Committee Chair 20,000 20,000 – Our 2022 ratios have been updated to reflect the final actual 2022 remuneration values for the CEO and all other employees. Our 2023 pay Remuneration Committee member 5,371 5,371 – ratios are based on the current CEO single figure and the indicative value of share awards that were subject to performance measured to 31 December, based on the average share price over the final quarter of the year. The 2023 ratios will be restated in the 2024 Remuneration Report to reflect the updated CEO single figure and the actual value of shares on the vesting date. Details of Committee membership can be found on page 82. The total remuneration of each comparator employee has been calculated using the actual values received in respect of the full financial year Comparison of Directors to wider employees and in accordance with the methodology used to calculate the single figure of remuneration for the CEO. We have not omitted any component from their pay and benefits and no adjustments have been made to their actual remuneration. In line with the requirements in The Companies (Directors’ Remuneration Policy and Directors’ Remuneration Report) Regulations 2019, which implement Articles 9a and 9b of European Directive 2017/828/EC1 (commonly known as the Revised Shareholder Rights Directive or SRD), the The full-time equivalent remuneration values for the individuals in the table above are as follows: table below provides details of the percentage change in the base salary, benefits and bonus of the Directors between 31 December 2020 and 31 December 2023 compared with the average percentage change for other UK employees. 2023 The figures for all Directors are calculated based on remuneration received in the relevant year as set out in the tables on pages 130 and 134. CEO 25th percentile Median 75th percentile For base salary/fees, part year figures have been pro‑rated up for the purposes of this disclosure. In addition, the figures below reflect the Salary £1,010,416 £36,450 £46,339 £71,055 voluntary decision taken by members of the Board to take a 20% cut in salary/fees for the period from April to October 2020. There was also no Total remuneration £2,881,440 £41,448 £55,393 £76,714 global salary review in 2021 and no annual bonus payments paid for 2020 to the Executive Directors and wider workforce. 2022‑2023 2021‑2022 2020‑2021 2019‑2020 2022 Salary/fee Benefits Bonus Salary/fee B e n e f i t s B o n u s Salary/fee Benefits B o n u s Salary/fee B e n e f i t s Bonus Notes change% change% change% change % change % change % change % change % change % change % change % change % CEO 25th percentile Median 75th percentile Average employee 1 85(27) 43(11) 45–46– Salary £971,554 £31,502 £46,891 £64,771 Salman Amin 2 4––– 51 – 13 140 – (12) (81) – Total remuneration £3,689,906 £39,849 £53,485 £73,558 Dawn Allen 2, 5 –––––––––––– Edward Bonham Carter 2, 6 7––– 51 – 13 140 – (12) (92) – Graham Cooke 2 4––6 51 – 15 ––––– The median pay ratio for 2023 is considered to be consistent with the pay, reward and progression policies during the year for the Company’s Andrew Cosslett (Chair) 2, 7 – 100 – ––––––––– UK employees taken as a whole. Our UK headcount and the total remuneration values for the comparator employees have both increased Margaret Ewing 2 3–––––13 ––(12) (92) – year-on-year. We implemented Company-wide annual pay review increases of 4-6% in January 2023, with the higher increases made to Marjorie Kaplan 2, 8 –––––––––––– employees at lower pay levels. We also remain committed to ensuring colleagues earn at least the real Living Wage or higher. Mary Harris 2, 9 (5) (50) – (18) 63 – 13 155 – (12) (84) – Gidon Katz 2, 10 4 (96) – ––––––––– To help our employees manage with the rising cost of living, over 80% of UK employees received a payment of £1,000 each in January 2023. Chris Kennedy (Group CFO & COO) 3, 4 4–(28) 33(12) 13 12 – (10) (9) – This followed a previous payment of £1,000 that was made in October 2022. An annual bonus arrangement extends to all employees who don’t Anna Manz 2, 11 3––– 51 – 13 140 – (12) (88) – participate in a management or sales bonus scheme and is paid in March each year. The 2023 employee bonus opportunity was up to £2,000, Carolyn McCall (Chief Executive) 3, 4 4–(28) 33(13) 13 12 – (10) (9) – based on ITV plc EBITA performance, and the actual payout was up to £764 for every eligible employee. All comparator employees identified in Sharmila Nebhrajani 2,12 9 (100) – 12 78 – 13 ––––– the pay ratio calculations were eligible for the employee bonus and the cost of living payment. Duncan Painter 2, 13 4 – – – 51 – 13 140 – (11) (88) – Our 2023 pay ratios have reduced because the total remuneration figure for the CEO is lower than in previous years. A significant proportion 1. The percentage change in benefits is the average change for all UK employees (excluding the Chief Executive and Group CFO & COO) with any of the same benefits as the Chief of the remuneration for the CEO is performance related and the level of actual performance outcomes has a corresponding effect on the Executive and Group CFO & COO. CEO pay ratios. The total remuneration values for the comparator employees have also all increased year-on-year. 2. Calculated using the fees and taxable benefits disclosed under the Non‑executive Directors’ remuneration in the table on page 134. Taxable benefits for Non‑executive Directors comprise expense reimbursements relating to attendance at Board meetings rather than conventional employee benefits. The increases seen in the period 2020‑2021 are primarily due to the ability for Directors to attend some meetings in person during 2021, against the majority of meetings being held on a virtual basis during 2020. The increases seen in the Other Disclosures period 2021‑2022 are primarily due to the attendance at two board dinners in the year, against one dinner in 2021. 3. Calculated using the data from the single figure table on page 130. Benefits include the cost of medical insurance and car‑related benefits. Shareholder views 4. The Executive Directors are the only employees of the parent company, and therefore there is no comparator data for this sample. In the interests of transparency, the percentage The Committee maintains regular and transparent communication with shareholders. We believe that it is important to regularly meet with change in pay for all UK employees has been disclosed on a voluntary basis. As the majority of employees are based in the UK and share the same benefits as the Executive our key shareholders to understand their views on our remuneration arrangements and what they would like to see going forward. We welcome Directors, overseas employees have not been included. 5. Dawn Allen joined the Board on 2 October 2023 and therefore no comparison has been provided to 2022. feedback from shareholders at any time during the year. 6. Edward Bonham Carter became a member of the Remuneration Committee in April 2023. 7. Andrew Cosslett joined the Board in June 2022. To enable a comparison for the purposes of this disclosure, his 2022 fees have been pro‑rated up. Where we are proposing to make any significant changes to the remuneration framework or the manner in which the framework is operated 8. Marjorie Kaplan joined the Board on 1 September 2023 and therefore no comparison has been provided to 2022. we would seek major shareholders’ views and take these into account. In recent years, the Committee has consulted with major shareholders 9. Mary Harris stepped down as Remuneration Committee Chair in April 2022 and from the Board in May 2023 and received fees up to this point only. To enable a comparison for the regarding both the design and operation of the Policy. purposes of this disclosure, her 2023 fees have been pro‑rated up. 10. Gidon Katz joined the Board in July 2022. To enable a comparison for the purposes of this disclosure, his 2022 fees have been pro‑rated up. 11. Anna Manz stepped down from the Board in August 2023 and received fees up to this point only. To enable a comparison for the purposes of this disclosure, her 2023 fees have been Prior to the finalisation of the 2024 Remuneration Policy, the Committee consulted with major shareholders to consider their views. We intend pro‑rated up. to maintain a dialogue with our shareholders in future years, particularly when the Committee anticipates any substantial change to the 12. Sharmila Nebhrajani was appointed as Chair of the Remuneration Committee in May 2022. remuneration framework. 13. Duncan Painter stepped down from the Board in November 2023 and received fees up to this point only. To enable a comparison for the purposes of this disclosure, his 2023 fees have been pro‑rated up.

ITV Annual Report & Accounts Page 137 Page 139

ITV Annual Report & Accounts Page 137 Page 139