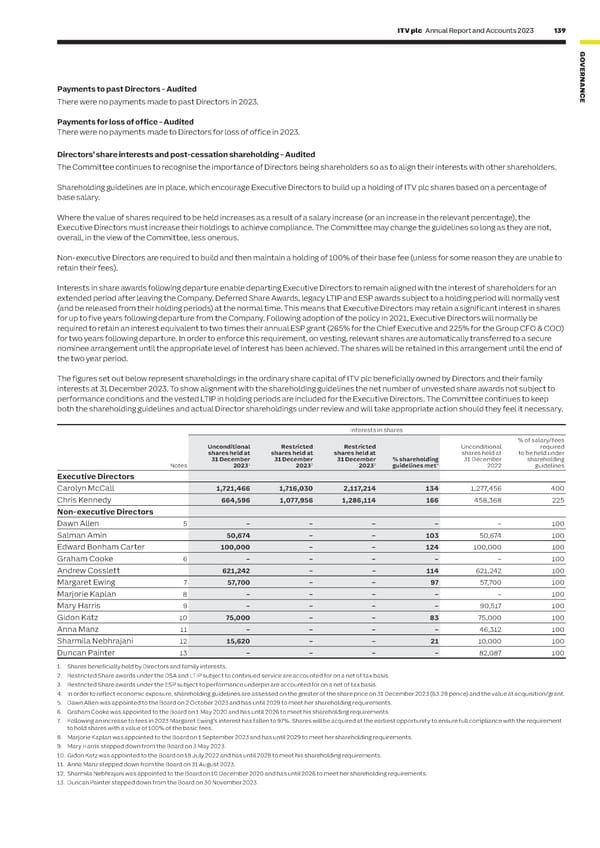

138 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 139 REMUNERATION REPORT CONTINUED G O VE R NAN Compliance with the 2018 Corporate Governance CodePayments to past Directors ‑ Audited C The table below shows how the Committee addressed the principles of clarity, simplicity, risk, predictability, proportionality and There were no payments made to past Directors in 2023. E alignment to culture when determining the Directors’ remuneration policy. The Committee notes the release by the FRC of the revised Corporate Governance Code 2024 and will work to ensure full compliance.Payments for loss of office ‑ Audited There were no payments made to Directors for loss of office in 2023. IMPACT OF THE 2018 CORPORATE GOVERNANCE CODEDirectors’ share interests and post‑cessation shareholding ‑ Audited Clarity The Committee continues to recognise the importance of Directors being shareholders so as to align their interests with other shareholders. Code provision: Remuneration • The presentation of the Remuneration Report is intended to provide clarity on the Company’s approachShareholding guidelines are in place, which encourage Executive Directors to build up a holding of ITV plc shares based on a percentage of arrangements should be transparent and • We aim to be completely transparent about our remuneration policy and arrangements and comply with promote effective engagement with certain disclosure requirements ahead of when we are required to do so for openness and transparencybase salary. shareholders and the workforce.• Great importance placed on engaging with our stakeholders, particularly with shareholders and the workforce on remuneration. The Chief People Officer attends all Committee meetings and our Workforce Engagement Where the value of shares required to be held increases as a result of a salary increase (or an increase in the relevant percentage), the Director, Graham Cooke, provides regular feedback. Employees also have the opportunity to comment Executive Directors must increase their holdings to achieve compliance. The Committee may change the guidelines so long as they are not, through the Ambassador network and employee surveys. This ensures the views of employees are considered overall, in the view of the Committee, less onerous. during Committee deliberations. Non-executive Directors are required to build and then maintain a holding of 100% of their base fee (unless for some reason they are unable to Simplicity retain their fees). Code provision: Remuneration structures The Company operates an approach to remuneration that is simple to understand and familiar to key should avoid complexity and their rationale stakeholders and has three key elements:Interests in share awards following departure enable departing Executive Directors to remain aligned with the interest of shareholders for an and operation should be easy to • Fixed element: comprising base salary, taxable benefits and a pension allowanceextended period after leaving the Company. Deferred Share Awards, legacy LTIP and ESP awards subject to a holding period will normally vest understand.• Short‑term element: an annual performance-related bonus with a selection of financial and non-financial (and be released from their holding periods) at the normal time. This means that Executive Directors may retain a significant interest in shares targets measured over the financial year, two-thirds paid in cash and one-third in shares deferred for a three for up to five years following departure from the Company. Following adoption of the policy in 2021, Executive Directors will normally be year period required to retain an interest equivalent to two times their annual ESP grant (265% for the Chief Executive and 225% for the Group CFO & COO) • Restricted share element: normally released after five years subject to achievement of a performance for two years following departure. In order to enforce this requirement, on vesting, relevant shares are automatically transferred to a secure underpin nominee arrangement until the appropriate level of interest has been achieved. The shares will be retained in this arrangement until the end of Risk the two year period. Code provision: Remuneration A combination of short and long-term incentives with the majority delivered in shares encourages Executive The figures set out below represent shareholdings in the ordinary share capital of ITV plc beneficially owned by Directors and their family arrangements should ensure reputational Directors to deliver long-term sustainable shareholder returns, discouraging decision-making that only focuses interests at 31 December 2023. To show alignment with the shareholding guidelines the net number of unvested share awards not subject to and other risks from excessive rewards, on the short term.performance conditions and the vested LTIP in holding periods are included for the Executive Directors. The Committee continues to keep and behavioural risks that might arise from The Committee retains flexibility to adjust payments through malus and clawback provisions, and an overriding both the shareholding guidelines and actual Director shareholdings under review and will take appropriate action should they feel it necessary. target-based incentive plans, are identified discretion to depart from formulaic outcomes where behaviours may be viewed as inappropriate or criteria on and mitigated.which the award was based do not reflect the underlying performance of the Company. Interests in shares Predictability % of salary/fees Unconditional Restricted Restricted Unconditional required Code provision: The range of possible Shareholders are kept fully informed and consulted on the values that can be earned under the incentive plans shares held atshares held at shares held at shares held at to be held under 31 December 31 December 31 December % shareholding 31 December shareholding values of awards to individual directors and for different levels of performance. Notes 20231 20232 20233 guidelines met4 2022 guidelines any other limits or discretions should be The Remuneration Policy provides estimates of potential future reward in different performance scenarios.Executive Directors identified and explained at the time of Carolyn McCall 1,721,466 1,716,030 2,117,214 134 1,277,456 400 approving the policy. Chris Kennedy 664,596 1,077,956 1,286,114 166 458,368 225 Proportionality Non‑executive Directors Code provision: The link between The Restricted Share awards reward the creation of shareholder value, which ultimately focuses on the Dawn Allen 5– – – – – 100 individual awards, the delivery of strategy long-term achievement of strategic deliverables. Salman Amin 50,674 – – 103 50,674 100 and the long-term performance of the Performance measures and personal objectives in the bonus are designed to align with strategy and financial Company should be clear. Outcomes Edward Bonham Carter 100,000 – – 124 100,000 100 should not reward poor performance.performance and provide for a range of pay out levels which are dependent on and linked to Company Graham Cooke6– – – – – 100 performance. Deferral periods and holding periods (including in the bonus) help to further align incentive outcomes for Andrew Cosslett621,242 – – 114 621,242 100 executives to the shareholder experience in the long term.Margaret Ewing 7 57,700 – – 97 57,700 100 The Committee has overriding discretion over eventual outcomes when they do not reflect business Marjorie Kaplan8 – – – – – 100 performance, and/or shareholder experience, and ensures that poor performance would not be rewarded.Mary Harris9 – – – – 90,517 100 Alignment to culture Gidon Katz 10 75,000 – – 83 75,000 100 Anna Manz 11 – – – – 46,312 100 Code provision: Incentive schemes should When considering the alignment of incentive plans and culture the Committee considers the following: Sharmila Nebhrajani1215,620– – 21 10,000 100 drive behaviours consistent with company • Metrics: ensuring that performance targets are aligned to culture and do not drive the wrong behaviours purpose, values and strategy. Duncan Painter 13 – – – – 82,087 100 • Governance: ensuring adoption of best practice through a robust malus and clawback policy with a substantial list of relevant trigger events, such as corporate failure and reputational damage. The Committee 1. Shares beneficially held by Directors and family interests. also retains discretion under the plan rules to override formulaic vesting outcomes and to extend holding 2. Restricted Share awards under the DSA and LTIP subject to continued service are accounted for on a net of tax basis. periods. These elements enable the Committee to satisfy itself that the right steps have been taken to ensure 3. Restricted Share awards under the ESP subject to performance underpin are accounted for on a net of tax basis. executive remuneration is appropriate from a cultural context4. In order to reflect economic exposure, shareholding guidelines are assessed on the greater of the share price on 31 December 2023 (63.28 pence) and the value at acquisition/grant. • Engagement: understanding remuneration for the wider workforce and ensuring that pay decisions are 5. Dawn Allen was appointed to the Board on 2 October 2023 and has until 2029 to meet her shareholding requirements. aligned across the Group and wider engagement with our stakeholders, including our employees6. Graham Cooke was appointed to the Board on 1 May 2020 and has until 2026 to meet his shareholding requirements. 7. Following an increase to fees in 2023 Margaret Ewing’s interest has fallen to 97%. Shares will be acquired at the earliest opportunity to ensure full compliance with the requirement to hold shares with a value of 100% of the basic fees. 8. Marjorie Kaplan was appointed to the Board on 1 September 2023 and has until 2029 to meet her shareholding requirements. 9. Mary Harris stepped down from the Board on 3 May 2023. 10. Gidon Katz was appointed to the Board on 18 July 2022 and has until 2028 to meet his shareholding requirements. 11. Anna Manz stepped down from the Board on 31 August 2023. 12. Sharmila Nebhrajani was appointed to the Board on 10 December 2020 and has until 2026 to meet her shareholding requirements. 13. Duncan Painter stepped down from the Board on 30 November 2023.

ITV Annual Report & Accounts Page 140 Page 142

ITV Annual Report & Accounts Page 140 Page 142