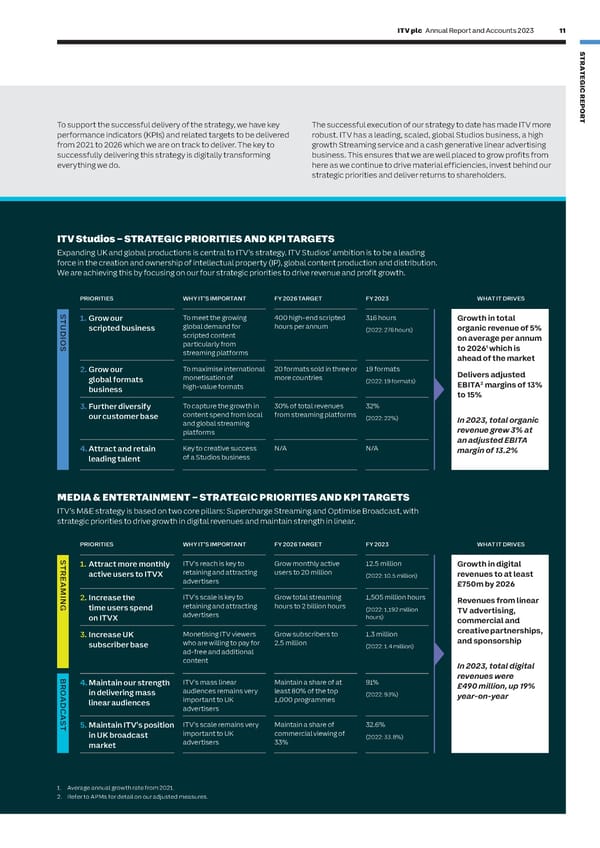

10 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 11 S CHIEF EXECUTIVE’S STATEMENT CONTINUED T R A T E G I Media & Entertainment (M&E) C R E P ITV M&E is the largest commercial OUR MORE THAN TV STRATEGY O R broadcaster and streamer in the UK, Our strategy is focused on three strategic pillars 1) Expand Studios; 2) Supercharge To support the successful delivery of the strategy, we have key The successful execution of our strategy to date has made ITV more T delivering unrivalled audience scale and Streaming; and 3) Optimise Broadcast. These pillars are underpinned by a number of performance indicators (KPIs) and related targets to be delivered robust. ITV has a leading, scaled, global Studios business, a high reach. It is underpinned by two strategic priorities (detailed below) to ensure that ITV is best placed to capitalise on the from 2021 to 2026 which we are on track to deliver. The key to growth Streaming service and a cash generative linear advertising pillars; Supercharge Streaming and opportunities presented by the rapidly changing viewing, content production and successfully delivering this strategy is digitally transforming business. This ensures that we are well placed to grow profits from Optimise Broadcast.advertising environments. These pillars are not independent. They work together – everything we do. here as we continue to drive material efficiencies, invest behind our reinforcing each other, creating synergies and delivering value. strategic priorities and deliver returns to shareholders. By Supercharging Streaming, we aim to drive digital revenues through ITVX and Planet V (ITV’s proprietary, self-service programmatic addressable advertising platform). We launched ITVX on time and our investment is on plan and on budget. In our first full year 2026 STUDIOS ITV Studios – STRATEGIC PRIORITIES AND KPI TARGETS of ITVX we delivered a step change in viewing TARGETExpanding UK and global productions is central to ITV’s strategy. ITV Studios’ ambition is to be a leading and digital revenues were up 19%. We Grow total organic force in the creation and ownership of intellectual property (IP), global content production and distribution. increased the number of monthly active users revenues by 5% on We are achieving this by focusing on our four strategic priorities to drive revenue and profit growth. by almost 20%, up to 12.5 million and those average per annum to 2026 – which is ahead users are spending more time engaging with of the market at a the platform with streaming hours up 26% PRIORITIES WHY IT’S IMPORTANT FY 2026 TARGET FY 2023 WHAT IT DRIVES margin of 13% to 15% to 1.5 billion hours. Brand awareness is now expandSTU1. Grow our To meet the growing 400 high-end scripted 316 hours Growth in total up to over 90% and we have seen a significant global demand for hours per annum scripted business organic revenue of 5% increase in streaming hours for light viewers STUDIOSD (2022: 276 hours) I scripted content who are harder to reach, up 65%, and our key O on average per annum Further expanding by genre, S particularly from 1 target audience of 25-54s which was up 47%. streaming platforms to 2026 which is geography and customer and ahead of the market growing faster than market To maximise international 20 formats sold in three or 19 formats The key focus of ITVX is our ad-funded 2. Grow our Delivers adjusted global formats monetisation of more countries (2022: 19 formats) proposition which is where we have EBITA2 business high-value formats margins of 13% channelled our efforts and resources in to 15% its launch year. In addition, we have ITVX 3. Further diversify To capture the growth in 30% of total revenues 32% Premium, a subscription service, which is superchargeour customer base content spend from local from streaming platforms primarily an ad-free offering for viewers. The (2022: 22%) In 2023, total organic Vertically and global streaming number of paid-for UK subscribers declined STREAMINGIntegrated platforms revenue grew 3% at marginally year on year as we started Driving digital viewing and Producer an adjusted EBITA transitioning subscribers from our standalone revenue through ITVX and Planet V, Broadcaster 4. Attract and retain Key to creative success N/A N/A margin of 13.2% ITV’s leading addressable and Streamer leading talent of a Studios business app, BritBox UK, into ITVX Premium, combined with the closure of the ITV Catch Up service advertising platform on Amazon Prime Video Channels. In 2024, the BritBox UK service on Amazon optimiseMEDIA & ENTERTAINMENT – STRATEGIC PRIORITIES AND KPI TARGETS Prime Video Channels and the Britbox UK ITV’s M&E strategy is based on two core pillars: Supercharge Streaming and Optimise Broadcast, with standalone app will close as we further BROADCASTstrategic priorities to drive growth in digital revenues and maintain strength in linear. simplify our offering. This will consolidate Digitally transforming as we all our subscribers under one ITVX Premium continue to attract commercial PRIORITIES WHY IT’S IMPORTANT FY 2026 TARGET FY 2023 WHAT IT DRIVES brand and will give us complete ownership broadcast audiences of unparalleled scale S of the subscriber base. The closure of these TR1. Attract more monthly ITV’s reach is key to Grow monthly active 12.5 million Growth in digital retaining and attracting users to 20 million services is expected to impact subscriber E active users to ITVX (2022: 10.5 million) revenues to at least numbers and subscription revenues in 2024.A advertisers £750m by 2026 2026 M&E TARGET MI Grow digital revenues N 2. Increase the ITV’s scale is key to Grow total streaming 1,505 million hours Revenues from linear Planet V is the platform enabling the to at least £750m Gtime users spend retaining and attracting hours to 2 billion hours (2022: 1,192 million TV advertising, growth of ITV’s digital advertising – it is a across M&Eon ITVX advertisers hours) market-leading addressable advertising commercial and platform which creates and delivers Increase UK Monetising ITV viewers Grow subscribers to 1.3 million creative partnerships, 3. targeted advertising at scale. subscriber base who are willing to pay for 2.5 million and sponsorship (2022: 1.4 million) ad-free and additional It enables us to create sophisticated content In 2023, total digital audience segments and serve ads directly B revenues were to them. All the major agencies are using R4. Maintain our strength ITV’s mass linear Maintain a share of at 91% £490 million, up 19% Planet V and see it as an intuitive, easy-to-OAin delivering mass audiences remains very least 80% of the top (2022: 93%) year-on-year important to UK 1,000 programmes buy self-serve platform, allowing them to D linear audiences C advertisers streamline their approach to planning and A S buying. ITV has one of the largest first-party T5. Maintain ITV’s position ITV’s scale remains very Maintain a share of 32.6% data sets in the UK, with over 40 million in UK broadcast important to UK commercial viewing of (2022: 33.8%) registered users on ITVX. Agencies and market advertisers 33% advertisers can make use of this alongside their own data and other first and third-party datasets, to create more precise addressable campaigns. Advertisers are prepared to pay 1. Average annual growth rate from 2021. more for this increasingly sophisticated and 2. Refer to APMs for detail on our adjusted measures. valuable ad inventory.

ITV Annual Report & Accounts Page 12 Page 14

ITV Annual Report & Accounts Page 12 Page 14