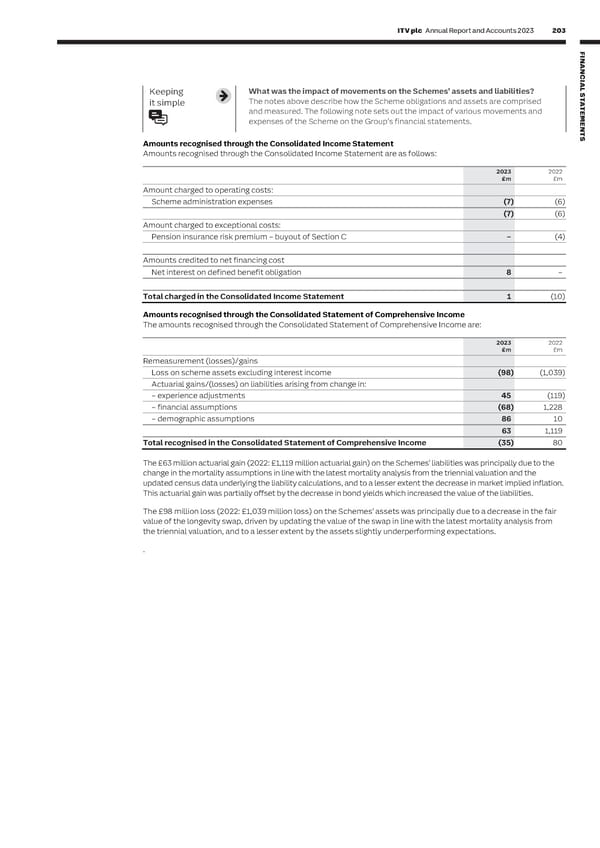

202 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 203 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL Defined pension deficit sensitivities Keeping What was the impact of movements on the Schemes’ assets and liabilities? S T it simple The notes above describe how the Scheme obligations and assets are comprised A Keeping Which assumptions have the biggest impact on the Scheme? T and measured. The following note sets out the impact of various movements and E it simple It is important to note that comparatively small changes in the assumptions used M expenses of the Scheme on the Group’s financial statements. E may have a significant effect on the Consolidated Income Statement and N T Consolidated Statement of Financial Position. This ‘sensitivity’ to change is Amounts recognised through the Consolidated Income Statement S analysed below to demonstrate how small changes in assumptions can have a large impact on the estimation of the defined benefit pension obligation. The Trustee Amounts recognised through the Consolidated Income Statement are as follows: manages the investment, mortality and inflation risks to ensure the pension obligations are met as they fall due. 2023 2022 £m £m The investment strategy is aimed at the Trustee’s actuarial valuation liabilities Amount charged to operating costs: rather than IAS 19 defined pension liabilities. As such, the effectiveness of the risk Scheme administration expenses (7) (6) hedging strategies on a valuation basis will not be the same as on an accounting (7) (6) basis. Those hedging strategies have significant impact on the movement in the net Amount charged to exceptional costs: pension deficit as assumptions change, offsetting the impacts on the obligation Pension insurance risk premium – buyout of Section C – (4) disclosed below. In practice, changes in one assumption may be accompanied by offsetting changes Amounts credited to net financing cost in another assumption (although this is not always the case). Changes in the Net interest on defined benefit obligation 8 – assumptions may occur at the same time as changes in the market value of Scheme assets, which may or may not offset the changes in assumptions. Total charged in the Consolidated Income Statement 1 (10) Changes in assumptions have a different level of impact as the value of the net pension surplus/(deficit) fluctuates, because the relationship between them is not linear. Amounts recognised through the Consolidated Statement of Comprehensive Income The amounts recognised through the Consolidated Statement of Comprehensive Income are: The analysis below considers the impact of a single change in principal assumptions on the defined benefit obligation 2023 2022 while keeping the other assumptions unchanged and does not take into account any risk hedging strategies: £m £m Remeasurement (losses)/gains Assumption Change in assumption Impact on defined benefit obligation Loss on scheme assets excluding interest income (98) (1,039) Discount rate Increase by 0.1% Decrease by £25 million Actuarial gains/(losses) on liabilities arising from change in: Decrease by 0.1% Increase by £25 million – experience adjustments 45 (119) Increase by 0.5% Decrease by £115 million – financial assumptions (68) 1,228 Decrease by 0.5% Increase by £125 million – demographic assumptions 86 10 Rate of inflation Increase by 0.1% Increase by £10 million 63 1,119 (Retail Price Index) Decrease by 0.1% Decrease by £10 million Rate of inflation Increase by 0.1% Increase by £5 million Total recognised in the Consolidated Statement of Comprehensive Income (35) 80 (Consumer Price Index) Decrease by 0.1% Decrease by £5 million The £63 million actuarial gain (2022: £1,119 million actuarial gain) on the Schemes’ liabilities was principally due to the Life expectancies Increase by one year Increase by £70 million change in the mortality assumptions in line with the latest mortality analysis from the triennial valuation and the updated census data underlying the liability calculations, and to a lesser extent the decrease in market implied inflation. The sensitivity analysis has been determined by extrapolating the impact on the defined benefit obligation at the This actuarial gain was partially offset by the decrease in bond yields which increased the value of the liabilities. year end with changes in key assumptions that might reasonably occur. The £98 million loss (2022: £1,039 million loss) on the Schemes’ assets was principally due to a decrease in the fair While the Schemes’ risk hedging strategy is aimed at a valuation basis, the Directors estimate that on an accounting value of the longevity swap, driven by updating the value of the swap in line with the latest mortality analysis from basis any change in asset values would significantly offset the above impact on the defined benefit obligation. the triennial valuation, and to a lesser extent by the assets slightly underperforming expectations. In particular, while an increase in assumption of life expectancies by one year would increase the defined benefit . obligation by £70 million, the assets would benefit from an estimated increase of the value of the longevity swap by £60 million, resulting in a net increase in the defined pension deficit of £10 million. Further, the ITV Pension Scheme invests in UK government bonds and interest rate and inflation swap contracts and therefore movements in the defined benefit obligation are typically offset, to an extent, by asset movements.

ITV Annual Report & Accounts Page 204 Page 206

ITV Annual Report & Accounts Page 204 Page 206