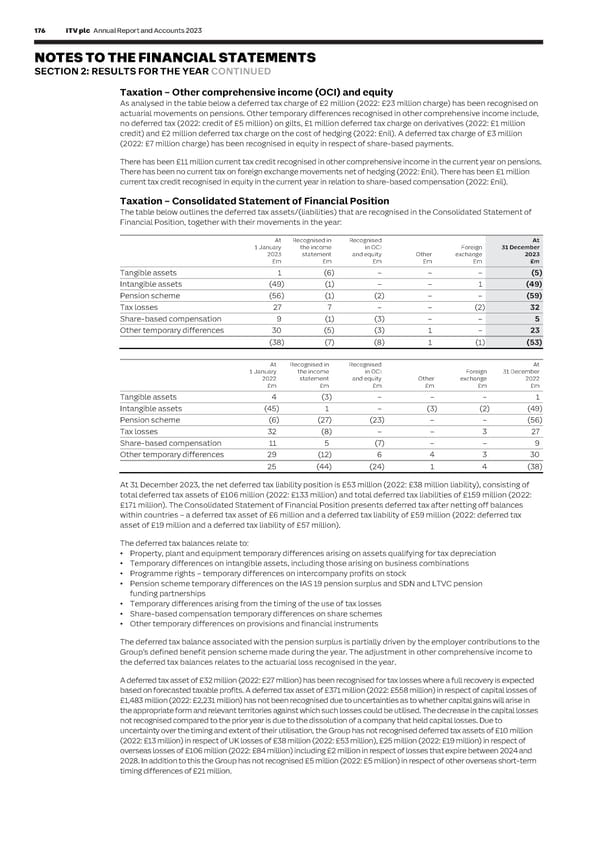

176 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 177 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 2: RESULTS FOR THE YEAR CONTINUED C I AL Taxation – Other comprehensive income (OCI) and equity Subsidiaries of ITV plc Group have undistributed earnings of £42 million (2022: £26 million) which, if paid out as S T As analysed in the table below a deferred tax charge of £2 million (2022: £23 million charge) has been recognised on dividends, would be subject to tax in the hands of the recipient. An assessable temporary difference exists, but no A T deferred tax liability has been recognised as ITV plc Group is able to control the timing of the distributions from E actuarial movements on pensions. Other temporary differences recognised in other comprehensive income include, M no deferred tax (2022: credit of £5 million) on gilts, £1 million deferred tax charge on derivatives (2022: £1 million these subsidiaries and is not expected to distribute these profits in the foreseeable future. E N credit) and £2 million deferred tax charge on the cost of hedging (2022: £nil). A deferred tax charge of £3 million T (2022: £7 million charge) has been recognised in equity in respect of share-based payments. Finance (No 2) Bill and Pillar Two impact on financial statements S the UK, introducing a global minimum On 20 June 2023, Finance (No.2) Act 2023 was substantively enacted in There has been £11 million current tax credit recognised in other comprehensive income in the current year on pensions. effective tax rate of 15% for large groups and for financial years beginning on or after 31 December 2023. Taxation There has been no current tax on foreign exchange movements net of hedging (2022: £nil). There has been £1 million balances are adjusted for a change in tax law if the change has been substantively enacted by the balance sheet date current tax credit recognised in equity in the current year in relation to share-based compensation (2022: £nil). however the amendments to IAS 12 ‘Income Taxes’ Pillar Two income taxes provides an exemption from the requirement to recognise and disclose deferred taxes arising from enacted or substantively enacted tax law that Taxation – Consolidated Statement of Financial Position implements the Pillar Two model rules. Statement of The table below outlines the deferred tax assets/(liabilities) that are recognised in the Consolidated Financial Position, together with their movements in the year: Based on an initial analysis of the current year financial data, most territories in which the Group operates are expected to qualify for one of the safe harbour exemptions such that top-up taxes should not apply. In territories At Recognised in Recognised At where this is not the case there is the potential for Pillar Two taxes to apply, but these are not expected to be 1 January the income in OCI Foreign 31 December material. The Group continues to refine this assessment and analyse the future consequences of these rules. 2023 statement and equity Other exchange 2023 £m £m £m £m £m £m Changes to the current UK system of Audio-visual tax credits Tangible assets 1 (6) – – – (5) the current system of Audio-Visual On 29 November 2023, the UK government issued final legislation to reform Intangible assets (49) (1) – – 1 (49) Expenditure Credit (AVEC) tax credits to merge the four existing AVEC schemes (Film, High-End Television (HETV), Pension scheme (56) (1) (2) – – (59) Children’s Television and Animation) into a single scheme and has reviewed the qualifying criteria. The AVEC legislation Tax losses 27 7 – – (2) 32 was substantively enacted on 5 February 2024 and can be claimed on expenditure incurred from 1 January 2024. Share-based compensation 9 (1) (3) – – 5 The new scheme is one of expenditure credits as opposed to corporate tax relief, requiring a change to the accounting Other temporary differences 30 (5) (3) 1 – 23 treatment to include them within statutory operating profit rather than within the consolidated tax charge. The effect (38) (7) (8) 1 (1) (53) of this change in legislation will therefore be to increase our EBITA, adjusted EBITA, adjusted EBITA margin, profit before tax and tax expense but will leave our profit after tax unchanged, compared to the previous HETV tax credit accounting treatment. We continue to assess the impact on the Group and do not anticipate there to be a material change in their At Recognised in Recognised At net economic value. 1 January the income in OCI Foreign 31 December 2022 statement and equity Other exchange 2022 £m £m £m £m £m £m Tangible assets 4 (3) – – – 1 Intangible assets (45) 1 – (3) (2) (49) Pension scheme (6) (27) (23) – – (56) Tax losses 32 (8) – – 3 27 Share-based compensation 11 5 (7) – – 9 Other temporary differences 29 (12) 6 4 3 30 25 (44) (24) 1 4 (38) At 31 December 2023, the net deferred tax liability position is £53 million (2022: £38 million liability), consisting of total deferred tax assets of £106 million (2022: £133 million) and total deferred tax liabilities of £159 million (2022: £171 million). The Consolidated Statement of Financial Position presents deferred tax after netting off balances within countries – a deferred tax asset of £6 million and a deferred tax liability of £59 million (2022: deferred tax asset of £19 million and a deferred tax liability of £57 million). The deferred tax balances relate to: • Property, plant and equipment temporary differences arising on assets qualifying for tax depreciation • Temporary differences on intangible assets, including those arising on business combinations • Programme rights – temporary differences on intercompany profits on stock • Pension scheme temporary differences on the IAS 19 pension surplus and SDN and LTVC pension funding partnerships • Temporary differences arising from the timing of the use of tax losses • Share-based compensation temporary differences on share schemes • Other temporary differences on provisions and financial instruments The deferred tax balance associated with the pension surplus is partially driven by the employer contributions to the Group’s defined benefit pension scheme made during the year. The adjustment in other comprehensive income to the deferred tax balances relates to the actuarial loss recognised in the year. A deferred tax asset of £32 million (2022: £27 million) has been recognised for tax losses where a full recovery is expected based on forecasted taxable profits. A deferred tax asset of £371 million (2022: £558 million) in respect of capital losses of £1,483 million (2022: £2,231 million) has not been recognised due to uncertainties as to whether capital gains will arise in the appropriate form and relevant territories against which such losses could be utilised. The decrease in the capital losses not recognised compared to the prior year is due to the dissolution of a company that held capital losses. Due to uncertainty over the timing and extent of their utilisation, the Group has not recognised deferred tax assets of £10 million (2022: £13 million) in respect of UK losses of £38 million (2022: £53 million), £25 million (2022: £19 million) in respect of overseas losses of £106 million (2022: £84 million) including £2 million in respect of losses that expire between 2024 and 2028. In addition to this the Group has not recognised £5 million (2022: £5 million) in respect of other overseas short-term timing differences of £21 million.

ITV Annual Report & Accounts Page 177 Page 179

ITV Annual Report & Accounts Page 177 Page 179