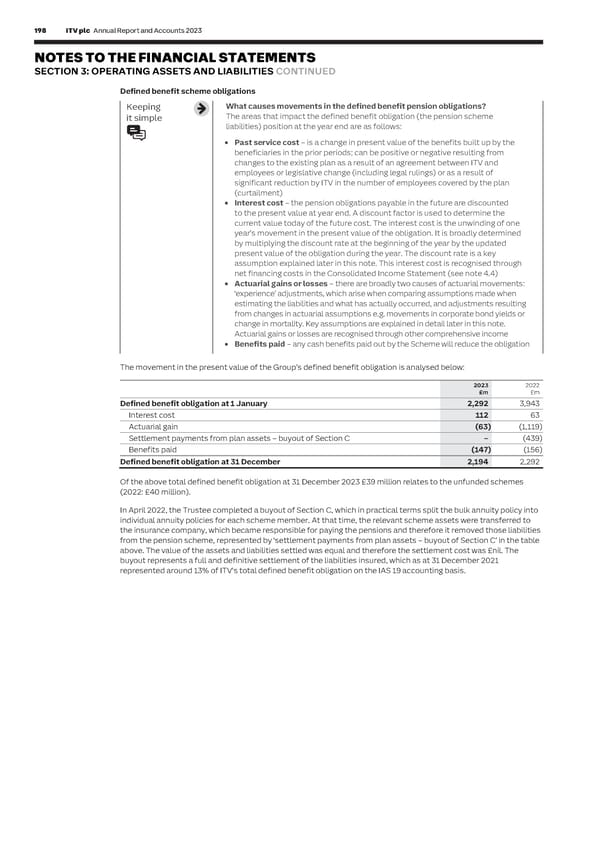

198 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 199 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 3: OPERATING ASSETS AND LIABILITIES CONTINUED C I AL Defined benefit scheme obligations Assumptions used to estimate the Scheme obligations S T A Keeping What causes movements in the defined benefit pension obligations? Keeping What are the main assumptions used to estimate the Scheme obligations? T E it simple The areas that impact the defined benefit obligation (the pension scheme it simple The main assumptions are: M E liabilities) position at the year end are as follows: N • An estimate of increases in pension payments and the effect of inflation T • Past service cost – is a change in present value of the benefits built up by the • The life expectancy of beneficiaries S beneficiaries in the prior periods; can be positive or negative resulting from • The discount rate used to estimate the present day fair value of these obligations changes to the existing plan as a result of an agreement between ITV and How do we determine the appropriate assumptions? employees or legislative change (including legal rulings) or as a result of The Group takes independent actuarial advice relating to the appropriateness of significant reduction by ITV in the number of employees covered by the plan the assumptions used. (curtailment) • Interest cost – the pension obligations payable in the future are discounted IFRS requires that we estimate a discount rate by reference to high-quality to the present value at year end. A discount factor is used to determine the fixed income investments in the UK that match the estimated term of the current value today of the future cost. The interest cost is the unwinding of one pension obligations. year’s movement in the present value of the obligation. It is broadly determined by multiplying the discount rate at the beginning of the year by the updated The inflation assumption has been set by looking at the difference between the present value of the obligation during the year. The discount rate is a key yields on fixed and index-linked government bonds. The inflation assumption is assumption explained later in this note. This interest cost is recognised through used as a basis for the remaining financial assumptions, except where caps have net financing costs in the Consolidated Income Statement (see note 4.4) been implemented. • Actuarial gains or losses – there are broadly two causes of actuarial movements: The discount rate has therefore been obtained using the yields available on AA rated ‘experience’ adjustments, which arise when comparing assumptions made when corporate bonds, which match projected cash flows. The Group’s estimate of the estimating the liabilities and what has actually occurred, and adjustments resulting weighted average term of the liabilities is 12 years (2021: 15 years). from changes in actuarial assumptions e.g. movements in corporate bond yields or change in mortality. Key assumptions are explained in detail later in this note. Actuarial gains or losses are recognised through other comprehensive income The principal assumptions used in the Schemes’ valuations at the year end were: • Benefits paid – any cash benefits paid out by the Scheme will reduce the obligation 2023 2022 Discount rate 4.75% 5.05% The movement in the present value of the Group’s defined benefit obligation is analysed below: Inflation assumption (RPI) 3.05% 3.15% 2023 2022 Deferred/ Deferred/ £m £m Pensioner Pensioner Defined benefit obligation at 1 January 2,292 3,943 Rate of increase in pension payment (LPI* 5% pension increases) 2.80%/3.00% 2.80%/3.00% Interest cost 112 63 Rate of increase to deferred pensions (CPI) 2.50% 2.50% Actuarial gain (63) (1,119) * Limited Price Index. Settlement payments from plan assets – buyout of Section C – (439) Benefits paid (147) (156) From February 2030 onwards, increases in the RPI will be aligned with those under the Consumer Prices Index (CPI). Defined benefit obligation at 31 December 2,194 2,292 For Defined Benefit schemes, it means that members with RPI-linked pension increases will see future retirement benefits increase more slowly from 2030 than they otherwise would. The Group’s approach to setting RPI and CPI Of the above total defined benefit obligation at 31 December 2023 £39 million relates to the unfunded schemes inflation assumptions is as follows: (2022: £40 million). • The Group continued to set RPI inflation in line with the market break-even expectations for inflation less an inflation risk premium of 0.3% In April 2022, the Trustee completed a buyout of Section C, which in practical terms split the bulk annuity policy into • The assumptions linked to RPI and CPI as at 31 December 2023 have been determined by weighting the cash individual annuity policies for each scheme member. At that time, the relevant scheme assets were transferred to flows to which the link applies the insurance company, which became responsible for paying the pensions and therefore it removed those liabilities The table below reflects published mortality investigation data in conjunction with the results of investigations into from the pension scheme, represented by ‘settlement payments from plan assets – buyout of Section C’ in the table the mortality experience of Scheme beneficiaries. The assumed life expectations on retirement for Section A are: above. The value of the assets and liabilities settled was equal and therefore the settlement cost was £nil. The buyout represents a full and definitive settlement of the liabilities insured, which as at 31 December 2021 2023 2023 2022 2022 represented around 13% of ITV's total defined benefit obligation on the IAS 19 accounting basis. Retiring today at age 60 65 60 65 Males 25.7 21.1 26.2 21.6 Females 27.3 22.6 28.9 24.1 Retiring in 20 years at age 60 65 60 65 Males 27.1 22.3 27.5 22.7 Females 28.9 24.0 30.4 25.5 The net pension surplus is sensitive to changes in assumptions. These are disclosed further in this note.

ITV Annual Report & Accounts Page 199 Page 201

ITV Annual Report & Accounts Page 199 Page 201