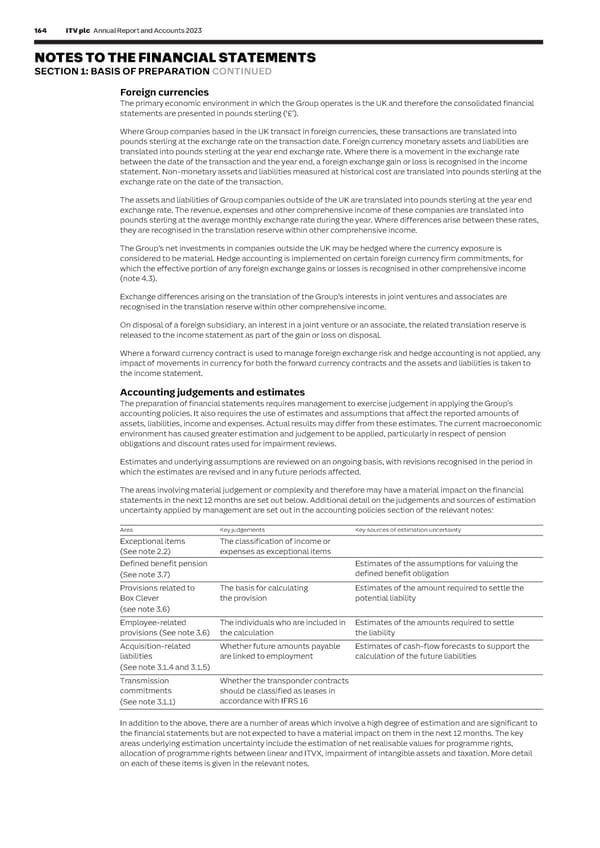

164 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 165 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 1: BASIS OF PREPARATION CONTINUED C I AL Foreign currencies The Directors recognise the climate crisis and the potential impact it may have on both the wider world and the S T The primary economic environment in which the Group operates is the UK and therefore the consolidated financial success of ITV. The threat continues to evolve and businesses globally have a responsibility to take meaningful A T action to mitigate and prevent further climate change. The Directors are committed to reducing the impact of ITV E statements are presented in pounds sterling (‘£’). M on the environment. Climate-related risks have been identified as an emerging business risk; however, the Directors E N Where Group companies based in the UK transact in foreign currencies, these transactions are translated into do not view them as a source of material estimation uncertainty for the Group. For further detail, see the Risks and T pounds sterling at the exchange rate on the transaction date. Foreign currency monetary assets and liabilities are Uncertainties section of the Strategic Report. S translated into pounds sterling at the year end exchange rate. Where there is a movement in the exchange rate between the date of the transaction and the year end, a foreign exchange gain or loss is recognised in the income New or amended accounting standards statement. Non-monetary assets and liabilities measured at historical cost are translated into pounds sterling at the The following new standards and/or amendments were effective 1 January 2023, but have not had a significant exchange rate on the date of the transaction. impact on the Group’s results or Consolidated Statement of Financial Position. The assets and liabilities of Group companies outside of the UK are translated into pounds sterling at the year end Accounting standard Requirement Impact on financial statements exchange rate. The revenue, expenses and other comprehensive income of these companies are translated into IFRS 17 ‘Insurance IFRS 17 ‘Insurance Contracts’ is a comprehensive new No material change to the pounds sterling at the average monthly exchange rate during the year. Where differences arise between these rates, Contracts’ and related accounting standard covering recognition, measurement, Group’s financial position they are recognised in the translation reserve within other comprehensive income. amendments presentation and disclosures. This standard replaces IFRS or performance. 4 ‘Insurance Contracts’. The Group’s net investments in companies outside the UK may be hedged where the currency exposure is considered to be material. Hedge accounting is implemented on certain foreign currency firm commitments, for Amendments to IAS 1 The amendments aim to help entities provide accounting No material change to the which the effective portion of any foreign exchange gains or losses is recognised in other comprehensive income ‘Presentation of Financial policy disclosures that are more useful by replacing the Group’s financial position (note 4.3). Statements’ and IFRS requirement for entities to disclose their ‘significant’ or performance. Practice Statement 2 accounting policies with a requirement to disclose their Exchange differences arising on the translation of the Group’s interests in joint ventures and associates are ‘Making Materiality ‘material’ accounting policies. The IFRS Practice Statement 2 recognised in the translation reserve within other comprehensive income. Judgements’ has been amended by adding guidance and examples to On disposal of a foreign subsidiary, an interest in a joint venture or an associate, the related translation reserve is explain and demonstrate the application of the ‘four-step released to the income statement as part of the gain or loss on disposal. materiality process’ in making decisions about accounting policy disclosures. Where a forward currency contract is used to manage foreign exchange risk and hedge accounting is not applied, any Amendments to IAS 8 The amendments introduce a new definition of accounting No material change to the impact of movements in currency for both the forward currency contracts and the assets and liabilities is taken to ‘Accounting Policies, estimates and clarify how entities use measurement Group’s financial position the income statement. Changes in Accounting techniques and inputs to develop accounting estimates. or performance. Accounting judgements and estimates Estimates and Errors’ The preparation of financial statements requires management to exercise judgement in applying the Group’s Amendments to IAS 12 The amendments aim to narrow the scope of the initial No material change to the accounting policies. It also requires the use of estimates and assumptions that affect the reported amounts of ‘Income taxes’ – Initial recognition exception under IAS 12 so that it no longer Group’s financial position assets, liabilities, income and expenses. Actual results may differ from these estimates. The current macroeconomic recognition exception applies to transactions that give rise to equal taxable and or performance. environment has caused greater estimation and judgement to be applied, particularly in respect of pension deductible temporary differences. obligations and discount rates used for impairment reviews. Amendments to IAS 12 The amendments provide a temporary exception from The Group has applied the Estimates and underlying assumptions are reviewed on an ongoing basis, with revisions recognised in the period in ‘Income Taxes’- Pillar Two the requirement to recognise and disclose deferred taxes exception under IAS 12 to which the estimates are revised and in any future periods affected. income taxes arising from enacted or substantively enacted tax law recognising and disclosing that implements the Pillar Two model rules published by information about The areas involving material judgement or complexity and therefore may have a material impact on the financial the OECD, including tax law that implements qualified deferred tax assets and statements in the next 12 months are set out below. Additional detail on the judgements and sources of estimation domestic minimum top-up taxes described in those rules. liabilities related to top-up uncertainty applied by management are set out in the accounting policies section of the relevant notes: income taxes. Area Key judgements Key sources of estimation uncertainty Finance (No 2) Bill and Pillar Two impact on financial statements Exceptional items The classification of income or On 20 June 2023, Finance (No.2) Act 2023 was substantively enacted in the UK, introducing a global minimum (See note 2.2) expenses as exceptional items effective tax rate of 15% for large groups and for financial years beginning on or after 31 December 2023. Taxation Defined benefit pension Estimates of the assumptions for valuing the balances are adjusted for a change in tax law if the change has been substantively enacted by the balance sheet (See note 3.7) defined benefit obligation date, however the amendments to IAS 12 ‘Income Taxes’ Pillar Two income taxes provides an exemption from the Provisions related to The basis for calculating Estimates of the amount required to settle the requirement to recognise and disclose deferred taxes arising from enacted or substantively enacted tax law that Box Clever the provision potential liability implements the Pillar Two model rules. (see note 3.6) Based on an initial analysis of the current year financial data, most territories in which the Group operates are Employee-related The individuals who are included in Estimates of the amounts required to settle expected to qualify for one of the safe harbour exemptions such that top-up taxes should not apply. In territories provisions (See note 3.6) the calculation the liability where this is not the case there is the potential for Pillar Two taxes to apply, but these are not expected to be Acquisition-related Whether future amounts payable Estimates of cash-flow forecasts to support the material. The Group continues to refine this assessment and analyse the future consequences of these rules. liabilities are linked to employment calculation of the future liabilities Accounting standards effective in future periods (See note 3.1.4 and 3.1.5) The Directors have considered the impact on the Group of new and revised accounting standards, interpretations Transmission Whether the transponder contracts or amendments that are not yet effective and do not expect them to have a significant impact on the Group’s results commitments should be classified as leases in and Consolidated Statement of Financial Position. (See note 3.1.1) accordance with IFRS 16 In addition to the above, there are a number of areas which involve a high degree of estimation and are significant to the financial statements but are not expected to have a material impact on them in the next 12 months. The key areas underlying estimation uncertainty include the estimation of net realisable values for programme rights, allocation of programme rights between linear and ITVX, impairment of intangible assets and taxation. More detail on each of these items is given in the relevant notes.

ITV Annual Report & Accounts Page 165 Page 167

ITV Annual Report & Accounts Page 165 Page 167