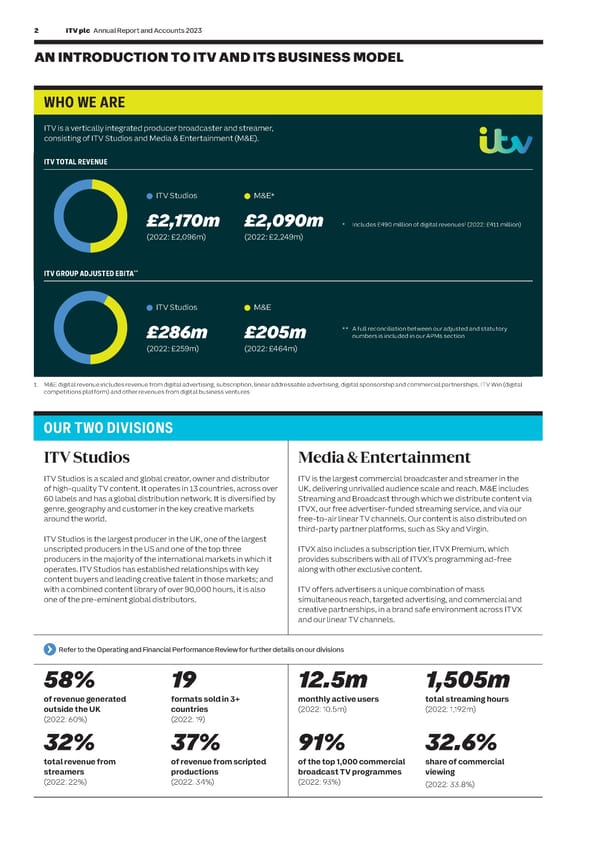

2 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 3 S T AN INTRODUCTION TO ITV AND ITS BUSINESS MODEL R A T E G I C R E WHO WE ARE OUR STRATEGIC ASSETS AND COMPETITIVE ADVANTAGES P O R T ITV is a vertically integrated producer broadcaster and streamer, ITV’s business model is based on a unique set of strategic assets and competitive advantages which enable us to grow our diversified consisting of ITV Studios and Media & Entertainment (M&E). revenue streams and create value for our shareholders. ITV TOTAL REVENUE By developing, owning, managing and distributing the rights to content, ITV can maximise the value of its programme brands across ITV Studios, Streaming and Broadcast. This ensures ITV is a more diversified business and enables it to drive value from different revenue models. ITV Studios M&E* Group ITV Studios ITV Media & Entertainment £2,170m £2,090m 1 * I ncludes £490 million of digital revenues (2022: £411 million) • Integrated producer, broadcaster • Creates and owns the rights to • M&E is differentiated from global (2022: £2,096m) (2022: £2,249m) and streamer model creates world-class content streamers with primarily valuable synergies • Broad global customer base with uniquelyBritish content • Strong, trusted brand, products major networks, streamers and • Deep commercial relationships and culture broadcasters with advertisers ** ITV GROUP ADJUSTED EBITA • A high-performing, agile and • Owns Planet V, an intuitive diverseworkforce self-serveaddressable advertisingplatform ITV Studios M&E • Strong data capabilities with one of the largest first-party ** A full reconciliation between our adjusted and statutory datasets in the UK £286m £205m numbers is included in our APMs section (2022: £259m) (2022: £464m) USING OUR STRATEGIC ASSETS AND COMPETITIVE ADVANTAGES WE AIM TO GROW… 1. M&E digital revenue includes revenue from digital advertising, subscription, linear addressable advertising, digital sponsorship and commercial partnerships, ITV Win (digital competitions platform) and other revenues from digital business ventures OUR DIVERSIFIED REVENUE STREAMS OUR TWO DIVISIONS ITV Studios Media & Entertainment Originalproduction Advertising ITV Studios Media & Entertainment We create and produce original scripted and unscripted content ITVX and our free-to-air linear TV channels drive significant commissions for a diverse customer base of global streamers, digital and linear advertising revenues due to our ability to deliver ITV Studios is a scaled and global creator, owner and distributor ITV is the largest commercial broadcaster and streamer in the major networks and local free-to-air and pay TV broadcasters mass simultaneous audiences and targeted advertising at scale. of high-quality TV content. It operates in 13 countries, across over UK, delivering unrivalled audience scale and reach. M&E includes and operators across our production bases. 60 labels and has a global distribution network. It is diversified by Streaming and Broadcast through which we distribute content via Commercial and creative partnerships genre, geography and customer in the key creative markets ITVX, our free advertiser-funded streaming service, and via our Formats Using the power of our brands we help advertisers engage with around the world. free-to-air linear TV channels. Our content is also distributed on We create some of the world’s most successful unscripted audiences in different ways. We provide unique and innovative third-party partner platforms, such as Sky and Virgin. formats which we license globally to maximise the value from commercial and creative partnerships across ITVX and our ITV Studios is the largest producer in the UK, one of the largest our programme rights. free-to-air linear TV channels. These include sponsorship, unscripted producers in the US and one of the top three ITVX also includes a subscription tier, ITVX Premium, which product placement and advertiser-funded programming. producers in the majority of the international markets in which it provides subscribers with all of ITVX’s programming ad-free Distribution operates. ITV Studios has established relationships with key along with other exclusive content. We own the rights to a significant catalogue of programmes that Subscription, competitions and third-party revenues content buyers and leading creative talent in those markets; and we license to broadcasters and streamers internationally through In the UK, we generate streaming subscription revenue through with a combined content library of over 90,000 hours, it is also ITV offers advertisers a unique combination of mass our global distribution network. our ad-free tier, ITVX Premium. We monetise our consumer one of the pre-eminent global distributors. simultaneous reach, targeted advertising, and commercial and interactions through competitions associated with our creative partnerships, in a brand safe environment across ITVX programme brands. We also receive third-party revenue from and our linear TV channels. distributing our channels and streaming services to other platforms and services. Refer to the Operating and Financial Performance Review for further details on our divisions SUPPORTED BY OUR… 58% 19 12.5m 1,505m of revenue generated formats sold in 3+ monthly active users total streaming hours RISK MANAGEMENTFRAMEWORK outside the UK countries (2022: 10.5m) (2022: 1,192m) (2022: 60%) (2022: 19) ITV operates in an increasingly complex Management and the Board can adapt Our business model enables us to create business environment and our risk the strategy to ensure we are striking the value for all our key stakeholders, see page 32% 37% 91% 32.6% management framework provides the rightbalance between risk-takingandrisk 6 for further detail. business with the tools to identify, mitigation, that any underlying risks in the total revenue from of revenue from scripted of the top 1,000 commercial share of commercial assess, manage and continually review strategy are being appropriately managed st reamers productions broadcast TV programmes viewing our risks. and therefore enabling the successful (2022: 22%) (2022: 34%) (2022: 93%) (2022: 33.8%) delivery of the strategy.

ITV Annual Report & Accounts Page 3 Page 5

ITV Annual Report & Accounts Page 3 Page 5