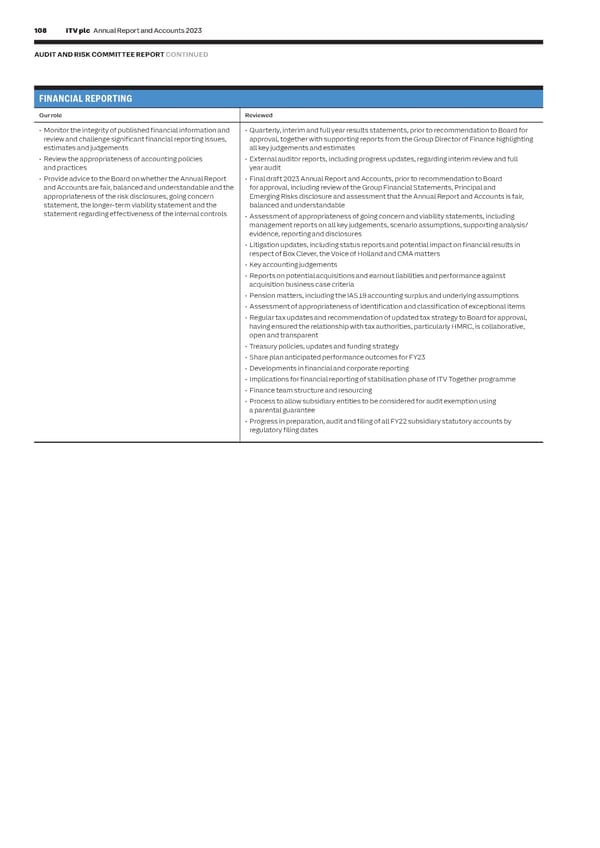

108 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 109 AUDIT AND RISK COMMITTEE REPORT CONTINUED G O VE R NAN C FINANCIAL REPORTING SIGNIFICANT AUDIT RISKS AND ACCOUNTING JUDGEMENTS E Our role Reviewed In planning its agenda and reviewing the audit plans of the internal and external auditors, the Committee has considered significant operational and financial issues and risks which may have had an impact on the Company’s financial statements, internal controls and/or the delivery and execution of the Company’s • Monitor the integrity of published financial information and • Quarterly, interim and full year results statements, prior to recommendation to Board for strategy (including changes in the nature and significance of some of the Group’s Principal Risks). review and challenge significant financial reporting issues, approval, together with supporting reports from the Group Director of Finance highlighting estimates and judgements all key judgements and estimates The Committee focused on assessing whether management had made appropriate judgements and estimates in preparing the Company’s financial • Review the appropriateness of accounting policies • External auditor reports, including progress updates, regarding interim review and full statements, particularly with regard to the significant issues listed below. These issues were subject to robust challenge and debate between management, and practices year audit the external auditor and the Committee. The Committee also reviewed detailed external auditor reports outlining work performed and any issues identified in respect of key judgements and estimates – see the Independent Auditor’s Report on pages 149 to 155. The Committee concluded there was no significant • Provide advice to the Board on whether the Annual Report • Final draft 2023 Annual Report and Accounts, prior to recommendation to Board disagreement or unresolved issue that required referral to the Board. and Accounts are fair, balanced and understandable and the for approval, including review of the Group Financial Statements, Principal and appropriateness of the risk disclosures, going concern Emerging Risks disclosure and assessment that the Annual Report and Accounts is fair, Risk of fraud (particularly in revenue recognition) statement, the longer-term viability statement and the balanced and understandable statement regarding effectiveness of the internal controls • Assessment of appropriateness of going concern and viability statements, including Issue Action taken by the Committee Outcome/future actions management reports on all key judgements, scenario assumptions, supporting analysis/ The nature of ITV’s business, Review of the work undertaken to update the GFO Finance In anticipation of the UK’s new corporate offence of evidence, reporting and disclosures including advertising and Fraud Prevention Framework following the implementation ‘failure to prevent fraud’, the Committee discussed ITV’s plan • Litigation updates, including status reports and potential impact on financial results in production, means that there of the Oracle Fusion platform and the subsequent impact to respond to the new legislation during 2024 including: respect of Box Clever, the Voice of Holland and CMA matters are potential risks of revenue on the controls in place to prevent and detect fraud across • Updating the Fraud Risk Management policy and the fraud • Key accounting judgements recognition and other fraud, all aspects of the Group, including the international risk assessment including collusion with studios businesses. • Reports on potential acquisitions and earnout liabilities and performance against advertisers, facilitation • Monitoring of high-risk financial controls acquisition business case criteria payments, fraudulent The Committee also considered the Group’s changing risk • Delivery of targeted training • Pension matters, including the IAS 19 accounting surplus and underlying assumptions payments to suppliers or landscape and the implications for non-financial fraud risk. • Reviewing ITV’s due diligence processes and • Assessment of appropriateness of identification and classification of exceptional items employees and manipulation In addition, the Committee reviewed the results of PwC’s contractual provisions • Regular tax updates and recommendation of updated tax strategy to Board for approval, of profits or hiding fraud by data auditing techniques for advertising revenue, journals use of accounting journals. and payroll as well as their conclusions relating to fraud risk The Committee agreed with management’s assessment that having ensured the relationship with tax authorities, particularly HMRC, is collaborative, the overall control framework remained effective and the open and transparent in revenue recognition. Group’s revenue recognition processes included a robust • Treasury policies, updates and funding strategy control framework to effectively mitigate the risk of material • Share plan anticipated performance outcomes for FY23 financial fraud. • Developments in financial and corporate reporting • Implications for financial reporting of stabilisation phase of ITV Together programme Exceptional items including Alternative Performance Measures • Finance team structure and resourcing Issue Action taken by the Committee Outcome/future actions • Process to allow subsidiary entities to be considered for audit exemption using a parental guarantee During 2023, management The Committee continued to closely scrutinise the The Committee concluded that the policy in respect of proposed a number of application of the Group’s policy on exceptional items, exceptional items and management’s approach to • Progress in preparation, audit and filing of all FY22 subsidiary statutory accounts by matters to be classified as spending considerable time reviewing the existing policy exceptional items were appropriate. regulatory filing dates exceptional items. (See and challenging management’s proposed classification. note 2.2 to the financial The Committee scrutinised in particular those exceptional The Committee also recognised that management had statements and page 172 items that recur over a number of years, such as exercised discipline on the categorisation of costs as for an explanation of the restructuring, transformation and property costs, or exceptional items, the policy had been applied consistently exceptional items policy). frequently occurred, e.g. legal costs, and considered the and the amounts were clearly disclosed in the Annual Report views of the external auditor. and Accounts. The Committee will continue to review the exceptional items policy and definitions regularly, consider evolving regulatory scrutiny and the impact of exceptional items on reported earnings. Review of legal cases Issue Action taken by the Committee Outcome/future actions ITV is subject to ongoing legal Throughout 2023, the Committee reviewed management’s Following considerable discussion and input from the disputes where the outcome updates on its various outstanding legal cases and any external auditor and legal adviser, the Committee agreed is not certain, including the potential liability that might arise from them. In addition, that the provision and disclosure made in respect of quantum of liability (actual or twice during the year, the Committee Chair met with the Box Clever was appropriate, given the status of discussions possible) in respect of the Company’s various external legal advisers to understand with the Pensions Regulator. See note 3.7 to the financial Box Clever pension scheme their perspectives on the status of the various legal cases. statements. deficit and the two separate In respect of Box Clever, the Committee considered the The Committee also agreed that the contingent liability UK Competitions and response from and management’s interactions with the disclosure proposed by management in relation to the CMA Markets Authority (CMA) Pensions Regulator, views of external actuarial and legal investigations was appropriate. investigations that advisers and the level of provision for the case and commenced in 2022 disclosure, given the high level of uncertainty of the final The Committee also considered other ongoing legal matters and 2023. outcome and the legal process, which could continue for and agreed with management’s proposed position and a number of years. related disclosures. With regards to the two separate CMA investigations, The Committee considered the contingent liability disclosure proposed by management and agreed with management’s conclusion that it is not possible to reliably quantify any liability that might result from the investigations due to the early stage of each of them. The Committee discussed the provisions held and related disclosures in respect of all other material legal cases.

ITV Annual Report & Accounts Page 109 Page 111

ITV Annual Report & Accounts Page 109 Page 111