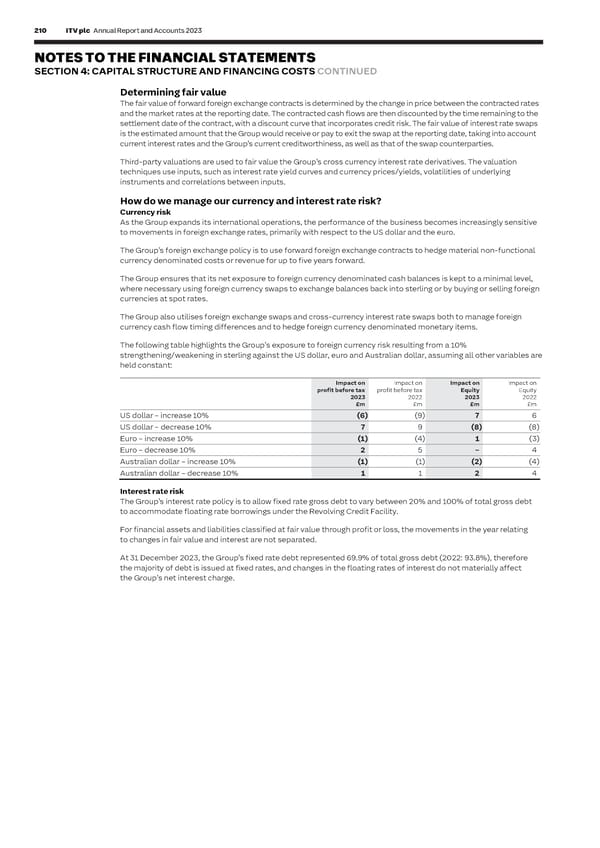

210 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 211 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Determining fair value What is the value of our derivative financial instruments? S T The fair value of forward foreign exchange contracts is determined by the change in price between the contracted rates The following table shows the fair value of derivative financial instruments analysed by type of contract. Interest rate A T E and the market rates at the reporting date. The contracted cash flows are then discounted by the time remaining to the swap fair values exclude accrued interest. M settlement date of the contract, with a discount curve that incorporates credit risk. The fair value of interest rate swaps E N is the estimated amount that the Group would receive or pay to exit the swap at the reporting date, taking into account Assets Liabilities T current interest rates and the Group’s current creditworthiness, as well as that of the swap counterparties. At 31 December 2023 £m £m S Current Third-party valuations are used to fair value the Group’s cross currency interest rate derivatives. The valuation Foreign exchange forward contracts and swaps – cash flow hedges 3 (1) techniques use inputs, such as interest rate yield curves and currency prices/yields, volatilities of underlying Foreign exchange forward contracts and swaps – fair value through profit or loss 1 – instruments and correlations between inputs. Non-current How do we manage our currency and interest rate risk? Cross-currency interest swaps – cash flow hedges – (15) Currency risk Foreign exchange forward contracts and swaps – cash flow hedges 1 (1) As the Group expands its international operations, the performance of the business becomes increasingly sensitive 5 (17) to movements in foreign exchange rates, primarily with respect to the US dollar and the euro. The Group’s foreign exchange policy is to use forward foreign exchange contracts to hedge material non-functional Assets Liabilities currency denominated costs or revenue for up to five years forward. At 31 December 2022 £m £m Current The Group ensures that its net exposure to foreign currency denominated cash balances is kept to a minimal level, Foreign exchange forward contracts and swaps – cash flow hedges 2 (6) where necessary using foreign currency swaps to exchange balances back into sterling or by buying or selling foreign Foreign exchange forward contracts and swaps – fair value through profit or loss – (1) currencies at spot rates. Non-current The Group also utilises foreign exchange swaps and cross-currency interest rate swaps both to manage foreign Cross-currency interest swaps – cash flow hedges – (8) currency cash flow timing differences and to hedge foreign currency denominated monetary items. Foreign exchange forward contracts and swaps – cash flow hedges 2 – 4 (15) The following table highlights the Group’s exposure to foreign currency risk resulting from a 10% strengthening/weakening in sterling against the US dollar, euro and Australian dollar, assuming all other variables are Cash flow hedges held constant: The Group applies hedge accounting for certain foreign currency firm commitments and highly probable cash flows where the underlying cash flows are payable within the next five years. In order to fix the sterling cash outflows Impact on Impact on Impact on Impact on associated with the commitments and interest payments – which are mainly denominated in US dollars or euros – profit before tax profit before tax Equity Equity the Group has taken out forward foreign exchange contracts and cross-currency interest rate swaps for the same 2023 2022 2023 2022 £m £m £m £m foreign currency amount and maturity date as the expected foreign currency outflow. US dollar – increase 10% (6) (9) 7 6 US dollar – decrease 10% 7 9 (8) (8) There is an economic relationship between the hedged items (being between 60% to 100% of the total exposure) and Euro – increase 10% (1) (4) 1 (3) the hedging instruments as the terms of the foreign exchange forward contracts and cross-currency interest rate swaps Euro – decrease 10% 2 5 – 4 match the terms of the expected highly probable forecast transactions or firm commitments (i.e. % notional amount Australian dollar – increase 10% (1) (1) (2) (4) and expected receipt or payment date). The Group has established a hedge ratio of 1:1 for the hedging relationships as the underlying risk of the foreign exchange forward contracts are identical to the hedged risk components. Australian dollar – decrease 10% 1 1 2 4 Sources of ineffectiveness include: Interest rate risk • Different interest rate curve applied to discounting the hedged items and hedging instruments The Group’s interest rate policy is to allow fixed rate gross debt to vary between 20% and 100% of total gross debt • Differences in the timing of the cash flows of the hedged items and the hedging instruments to accommodate floating rate borrowings under the Revolving Credit Facility. • The counterparties’ credit risk differently impacting the fair value movements of the hedging instruments and For financial assets and liabilities classified at fair value through profit or loss, the movements in the year relating hedged items and to changes in fair value and interest are not separated. • Changes to the forecasted amount of cash flows of hedged items and hedging instruments At 31 December 2023, the Group’s fixed rate debt represented 69.9% of total gross debt (2022: 93.8%), therefore The Group uses the hedge relationship, credit risk and hedge ratio to measure the hedge effectiveness. the majority of debt is issued at fixed rates, and changes in the floating rates of interest do not materially affect The amount recognised in other comprehensive income during the year all relates to the effective portion of the the Group’s net interest charge. revaluation loss associated with these contracts. A cumulative loss of £28 million (2022: £33 million of cumulative gain) was recycled to the Consolidated Income statement to off-set movements on the hedged item, a residual £7 million loss (2022: £3 million loss) remained on the income statement which were not offset. Under IFRS 9, the Group has adopted the ‘cost of hedging’ approach which allows the recognition of the value of the currency basis at inception of the hedge to be recorded on the Consolidated Statement of Financial Position and amortised through net financing costs in the Consolidated Income Statement over the life of the bond. Any mark-to- market change in fair value of the currency basis is recognised in ‘cost of hedging’ in the Consolidated Statement of Comprehensive Income. Net investment hedges ro denominated debt to hedge against the change in The Group ceased net investment hedging in May 2022 using eu the sterling value of its euro denominated net assets due to movements in foreign exchange rates. A change to the risk management objective meant that the remaining euro denominated monetary items on the Consolidated Statement of Financial Position could be considered in isolation on a net basis and therefore manage the remaining foreign exchange volatility in a more efficient way. The amount relating to discontinued hedges is a loss of £19 million at 31 December 2023 (2022: £19 million loss).

ITV Annual Report & Accounts Page 211 Page 213

ITV Annual Report & Accounts Page 211 Page 213