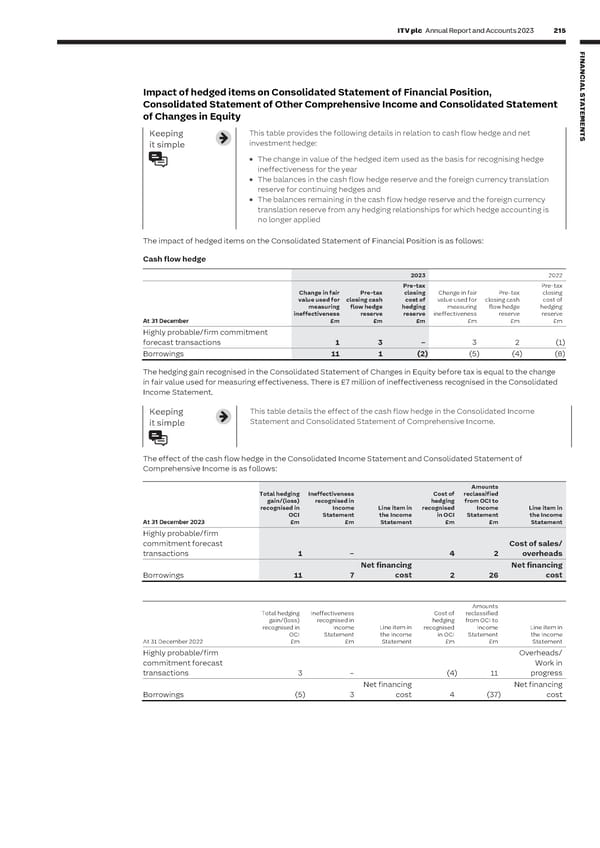

214 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 215 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED C I AL Less than Between Between Greater than Impact of hedged items on Consolidated Statement of Financial Position, S At 31 December 2022 1 year 1 to 2 years 2 to 5 years 5 years Total T A Consolidated Statement of Other Comprehensive Income and Consolidated Statement T Foreign exchange forward contracts and swaps E of Changes in Equity M Notional amount (£m) (5) – – – (5) E N Average forward rate (AUD/EUR) 1.5688 – – – Keeping This table provides the following details in relation to cash flow hedge and net T Foreign exchange forward contracts and swaps investment hedge: S it simple Notional amount (£m) (4) (12) (16) – (32) • The change in value of the hedged item used as the basis for recognising hedge Average forward rate (AUD/GBP) 1.7205 1.7967 1.7909 – ineffectiveness for the year Foreign exchange forward contracts and swaps • The balances in the cash flow hedge reserve and the foreign currency translation Notional amount (£m) 7 3 – – 10 reserve for continuing hedges and Average forward rate (CAD/GBP) 1.7155 1.6446 – – • The balances remaining in the cash flow hedge reserve and the foreign currency Foreign exchange forward contracts and swaps translation reserve from any hedging relationships for which hedge accounting is Notional amount (£m) (2) – – – (2) no longer applied Average forward rate (CAD/USD) 1.2400 – – – The impact of hedged items on the Consolidated Statement of Financial Position is as follows: Foreign exchange forward contracts and swaps Notional amount (£m) (1) – – – (1) Cash flow hedge Average forward rate (DKK/GBP) 8.3506 – – – 2023 2022 Foreign exchange forward contracts and swaps Pre-tax Pre-tax Notional amount (£m) (241) (14) – – (255) Change in fair Pre-tax closing Change in fair Pre-tax closing Average forward rate (EUR/GBP) 1.1097 1.1485 – – value used for closing cash cost of value used for closing cash cost of measuring flow hedge hedging measuring flow hedge hedging Foreign exchange forward contracts and swaps ineffectiveness reserve reserve ineffectiveness reserve reserve At 31 December £m £m £m £m £m £m Notional amount (£m) (6) – – – (6) Highly probable/firm commitment Average forward rate (EUR/USD) 0.8859 – – – forecast transactions 1 3 – 3 2 (1) Foreign exchange forward contracts and swaps Borrowings 11 1 (2) (5) (4) (8) Notional amount (£m) 8 – – – 8 Average forward rate (NOK/GBP) 12.0018 – – – The hedging gain recognised in the Consolidated Statement of Changes in Equity before tax is equal to the change Foreign exchange forward contracts and swaps in fair value used for measuring effectiveness. There is £7 million of ineffectiveness recognised in the Consolidated Notional amount (£m) (4) – – – (4) Income Statement. Average forward rate (ZAR/AUD) 11.7780 – – – This table details the effect of the cash flow hedge in the Consolidated Income Keeping Foreign exchange forward contracts and swaps Statement and Consolidated Statement of Comprehensive Income. it simple Notional amount (£m) 67 16 – – 83 Average forward rate (USD/GBP) 1.2627 1.1389 – – Foreign exchange forward contracts and swaps The effect of the cash flow hedge in the Consolidated Income Statement and Consolidated Statement of Notional amount (£m) (1) – – – (1) Comprehensive Income is as follows: Average forward rate (ZAR/GBP) 20.8998 – – – Cross-currency interest rate swaps Amounts Total hedging Ineffectiveness Cost of reclassified Notional amount (£m) – – 539 – 539 gain/(loss) recognised in hedging from OCI to Average hedge rate (EUR/GBP) – – 1.1253 – recognised in Income Line item in recognised Income Line item in OCI Statement the Income in OCI Statement the Income At 31 December 2023 £m £m Statement £m £m Statement Highly probable/firm commitment forecast Cost of sales/ transactions 1 – 4 2 overheads Net financing Net financing Borrowings 11 7 cost 2 26 cost Amounts Total hedging Ineffectiveness Cost of reclassified gain/(loss) recognised in hedging from OCI to recognised in Income Line item in recognised Income Line item in OCI Statement the Income in OCI Statement the Income At 31 December 2022 £m £m Statement £m £m Statement Highly probable/firm Overheads/ commitment forecast Work in transactions progress 3 – (4) 11 Net financing Net financing Borrowings (5) 3 cost 4 (37) cost

ITV Annual Report & Accounts Page 216 Page 218

ITV Annual Report & Accounts Page 216 Page 218