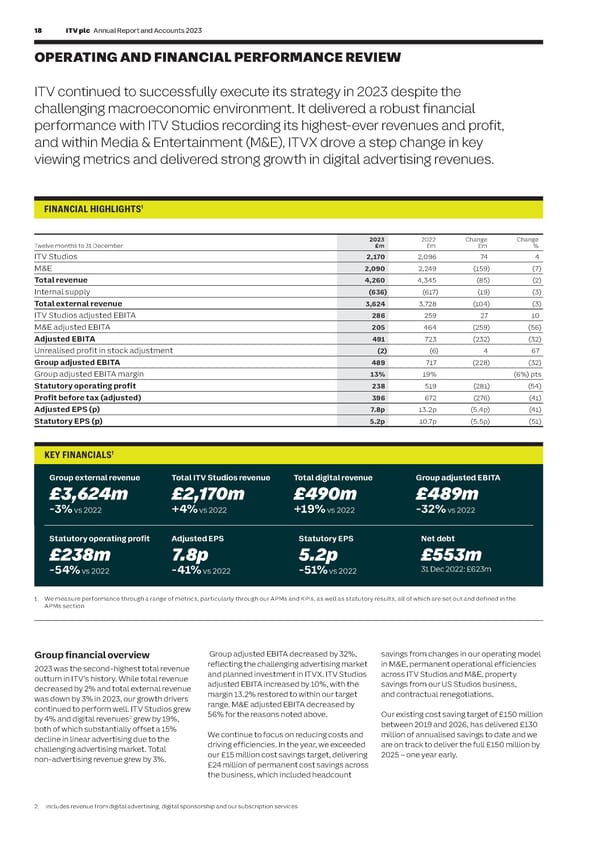

18 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 19 S T OPERATING AND FINANCIAL PERFORMANCE REVIEW R A T E G I ITV continued to successfully execute its strategy in 2023 despite the We are now in the early stages of a new At 31 December 2023 we had £361 million (2022: 5.0p). The Board remains committed C R strategic restructuring and efficiency of free cash flow (31 December 2022: to paying a full year ordinary dividend of at E P challenging macroeconomic environment. It delivered a robust financial programme across the Group to reshape the £280 million), our net debt was £553 million least 5.0p in 2024, which it expects to grow O R performance with ITV Studios recording its highest-ever revenues and profit, cost base, enhance profitability, and support (31 December 2022: £623 million) and our over the medium term, whilst balancing T the growth drivers of Studios and Streaming. net debt to adjusted EBITDA was 1.0x further investment in our strategy and our and within Media & Entertainment (M&E), ITVX drove a step change in key We are building on the foundations we have (31 December 2022: 0.8x). Refer to the commitment to investment grade metrics established in digital and data and the Finance Review for more detail. over the medium term. viewing metrics and delivered strong growth in digital advertising revenues. significant progress we have made in transforming ITV from a linear broadcaster to We have good access to liquidity. On 01 March 2024 ITV announced the sale of a multi-platform broadcaster and streamer. At 31 December 2023, we had cash and its 50% shareholding in BritBox International committed undrawn facilities totalling to BBC Studios for a cash consideration of Savings will come mainly from technology £1,240 million, including total cash of £340 £255 million. The Board intends to return the FINANCIAL HIGHLIGHTS1 and operational efficiencies, organisational million (31 December 2022: £1,098 million, entire net proceeds to shareholders through redesign across Group, M&E and ITV Studios, including total cash of £348 million). a £235 million share buyback which will be and permanent reductions in discretionary completed within the next 18 months. 2023 2022 Change Change spend across the Group. We have a clear capital allocation policy Twelve months to 31 December £m £m £m % and our priorities remain unchanged We remain focused on managing our cash ITV Studios 2,170 2,096 74 4 By the end of 2024 we expect the programme (see the Finance Review for further details). and costs while continuing to invest in M&E 2,090 2,249 (159) (7) to have delivered incremental annualised delivering our strategic priorities. Our robust Total revenue 4,260 4,345 (85) (2) savings of at least £50 million gross per year, The Board recognises the importance of the balance sheet allows us to do this while Internal supply (636) (617) (19) (3) giving a £30 million in year gross benefit in ordinary dividend to ITV shareholders. delivering returns to shareholders Total external revenue 3,624 3,728 (104) (3) 2024. There will be c.£50 million of one-off Reflecting its confidence in the business and ITV Studios adjusted EBITA 286 259 27 10 costs to deliver these savings. The ongoing its strategy, as well as the continued strong A range of scenarios reflecting ITV’s principal programme is designed to deliver further cash generation, the Board has declared a risks has been modelled and considered in M&E adjusted EBITA 205 464 (259) (56) incremental material savings over a number final dividend of 3.3p, giving a full year the assessment of ITV’s longer-term viability. Adjusted EBITA 491 723 (232) (32) of years which will further build ITV’s ordinary dividend of 5.0p per share for 2023, Refer to page 72 for further details. Unrealised profit in stock adjustment (2) (6) 4 67 resilience. We will provide further which is a total return of c.£200 million Group adjusted EBITA 489 717 (228) (32) information as the programme progresses. Group adjusted EBITA margin 13% 19% (6%) pts Statutory operating profit 238 519 (281) (54) Total operating exceptional items were £77 million (2022: £65 million) which included Profit before tax (adjusted) 396 672 (276) (41) £24 million of acquisition-related expenses Adjusted EPS (p) 7.8p 13.2p (5.4p) (41) and £25 million of restructuring and Statutory EPS (p) 5.2p 10.7p (5.5p) (51) transformation costs. This stems from the Group-wide commitment to reduce the overhead cost base, and includes KEY FINANCIALS1 restructuring and transformation programme costs to deliver our strategy (see note 2.2 to the financial statements Group external revenue Total ITV Studios revenue Total digital revenue Group adjusted EBITA for further detail). £3,624m £2,170m £490m £489m Adjusted financing costs were up year-on- -3% vs 2022 +4% vs 2022 +19% vs 2022 -32% vs 2022 year at £29 million (2022: £26 million) largely due to higher market interest rates at similar levels of debt. Statutory net financing costs Statutory operating profit Adjusted EPS Statutory EPS Net debt were £45 million, up year-on-year (2022: £26 £238m 7.8p 5.2p £553m million) due to charges related to acquisition- related put and call options. -54% vs 2022 -41% vs 2022 -51% vs 2022 31 Dec 2022: £623m Our adjusted effective tax rate was 21.5% (2022: 20.1%) and the statutory effective tax 1. We measure performance through a range of metrics, particularly through our APMs and KPIs, as well as statutory results, all of which are set out and defined in the rate was (8.3%) (2022: 13.2%). The lower APMs section statutory effective tax rate in the year was due to higher HETV tax credits relative to the tax charge, and a proportionally lower profit before tax in the year compared to 2022. Group financial overview Group adjusted EBITA decreased by 32%, savings from changes in our operating model 2023 was the second-highest total revenue reflecting the challenging advertising market in M&E, permanent operational efficiencies Adjusted EPS for the year was 7.8p (2022: outturn in ITV’s history. While total revenue and planned investment in ITVX. ITV Studios across ITV Studios and M&E, property 13.2p), with statutory EPS decreasing from decreased by 2% and total external revenue adjusted EBITA increased by 10%, with the savings from our US Studios business, 10.7p to 5.2p. See the Finance Review for was down by 3% in 2023, our growth drivers margin 13.2% restored to within our target and contractual renegotiations. further detail. continued to perform well. ITV Studios grew range. M&E adjusted EBITA decreased by 2 56% for the reasons noted above. Our existing cost saving target of £150 million Our profit to cash conversion (which is an by 4% and digital revenues grew by 19%, between 2019 and 2026, has delivered £130 APM) in 2023 was high at 102% (2022: 75%). both of which substantially offset a 15% We continue to focus on reducing costs and million of annualised savings to date and we Conversion in 2023 has been distorted by the decline in linear advertising due to the driving efficiencies. In the year, we exceeded are on track to deliver the full £150 million by writers’ and actors’ strike in the US, and it will challenging advertising market. Total our £15 million cost savings target, delivering 2025 – one year early. also impact 2024. In 2023 there was a release non-advertising revenue grew by 3%. £24 million of permanent cost savings across in working capital which will reverse in 2024 the business, which included headcount as we resume US scripted productions. Across the two years we expect profit to cash conversion to be at the normal levels of 2. Includes revenue from digital advertising, digital sponsorship and our subscription services around 80%. ARCHIE is a drama based on the life of Cary Grant. It was produced for ITVX by ITV Studios and Britbox International.

ITV Annual Report & Accounts Page 19 Page 21

ITV Annual Report & Accounts Page 19 Page 21