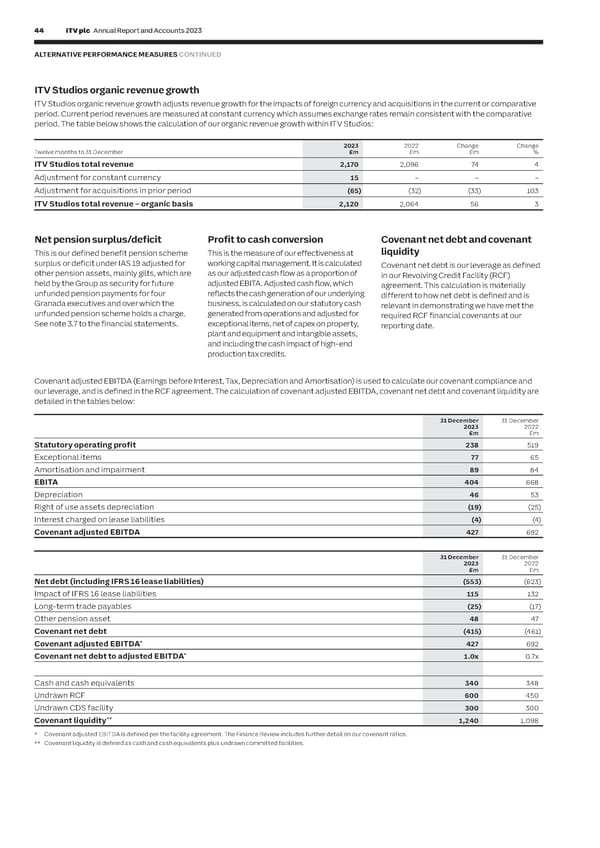

44 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 45 S ALTERNATIVE PERFORMANCE MEASURES CONTINUED T FINANCE REVIEW R A T E G I ITV Studios organic revenue growth C R E ITV Studios organic revenue growth adjusts revenue growth for the impacts of foreign currency and acquisitions in the current or comparative P O period. Current period revenues are measured at constant currency which assumes exchange rates remain consistent with the comparative R period. The table below shows the calculation of our organic revenue growth within ITV Studios: T 2 0 2 3 2 0 2 2 Change Change Twelve months to 31 December £m £m £m % ITV Studios total revenue 2,170 2,096 74 4 Adjustment for constant currency 15 – – – Adjustment for acquisitions in prior period (65) (32) (33) 103 ITV Studios total revenue – organic basis 2,120 2,064 56 3 CHRIS KENNEDY GROUP CHIEF FINANCIAL OFFICER AND CHIEF OPERATING OFFICER Net pension surplus/deficit Profit to cash conversion Covenant net debt and covenant This is our defined benefit pension scheme This is the measure of our effectiveness at liquidity surplus or deficit under IAS 19 adjusted for working capital management. It is calculated Covenant net debt is our leverage as defined other pension assets, mainly gilts, which are as our adjusted cash flow as a proportion of in our Revolving Credit Facility (RCF) This Finance Review focuses on the more technical aspects of our financial results held by the Group as security for future adjusted EBITA. Adjusted cash flow, which agreement. This calculation is materially while the operating and financial performance of the Group, M&E and ITV Studios unfunded pension payments for four reflects the cash generation of our underlying different to how net debt is defined and is Granada executives and over which the business, is calculated on our statutory cash relevant in demonstrating we have met the has been discussed within the Operating and Financial Performance Review. unfunded pension scheme holds a charge. generated from operations and adjusted for required RCF financial covenants at our See note 3.7 to the financial statements. exceptional items, net of capex on property, reporting date. plant and equipment and intangible assets, and including the cash impact of high-end Our Alternative Performance Measures (APMs) section, explains the adjustments we make to our statutory results. This enables focus on the production tax credits. key measures that we report on and use as KPIs across the business. See earlier sections for further details. 2023 2022 Change Change Covenant adjusted EBITDA (Earnings before Interest, Tax, Depreciation and Amortisation) is used to calculate our covenant compliance and Twelve months to 31 December £m £m £m % our leverage, and is defined in the RCF agreement. The calculation of covenant adjusted EBITDA, covenant net debt and covenant liquidity are ITV Studios total revenue 2,170 2,096 74 4 detailed in the tables below: Total advertising revenue 1,778 1,931 (153) (8) 31 December 31 December M&E non-advertising revenue 312 318 (6) (2) 2023 2022 £m £m M&E total revenue 2,090 2,249 (159) (7) Statutory operating profit 238 519 Total non-advertising revenue 2,482 2,414 68 3 Exceptional items 77 65 Total group revenue 4,260 4,345 (85) (2) Amortisation and impairment 89 84 Internal supply (636) (617) (19) (3) EBITA 404 668 Group external revenue 3,624 3,728 (104) (3) Depreciation 46 53 Group adjusted EBITA 489 717 (228) (32) Right of use assets depreciation (19) (25) Group adjusted EBITA margin 13% 19% (6) Interest charged on lease liabilities (4) (4) Covenant adjusted EBITDA 427 692 Statutory operating profit 238 519 (281) (54) Adjusted EPS 7.8p 13.2p (5.4p) (41) 31 December 31 December Statutory EPS 5.2p 10.7p (5.5p) (51) 2023 2022 Dividend per share 5.0p 5.0p £m £m Net debt (including IFRS 16 lease liabilities) (553) (623) Net debt as at 31 December (553) (623) 70 11 Impact of IFRS 16 lease liabilities 115 132 Long-term trade payables (25) (17) Other pension asset 48 47 Exceptional items Covenant net debt (415) (461) 2023 2022 Twelve months to 31 December £m £m * Covenant adjusted EBITDA 427 692 Acquisition-related expenses (24) (4) * Covenant net debt to adjusted EBITDA 1.0x 0.7x Restructuring and transformation costs (25) (28) Property costs (10) (24) Cash and cash equivalents 340 348 Costs relating to the passing of Her Majesty Queen Elizabeth II – (16) Undrawn RCF 600 450 Sports rights impairment reversal – 5 Undrawn CDS facility 300 300 Covenant liquidity** 1,240 1,098 Pension related costs – (4) Employee-related tax provision 3 (10) * Covenant adjusted EBITDA is defined per the facility agreement. The Finance Review includes further detail on our covenant ratios. ** Covenant liquidity is defined as cash and cash equivalents plus undrawn committed facilities. Insured trade receivable 3 23 Legal settlements (13) – Legal and other costs (11) (7) Operating exceptional items (77) (65) Total exceptional items (77) (65)

ITV Annual Report & Accounts Page 45 Page 47

ITV Annual Report & Accounts Page 45 Page 47