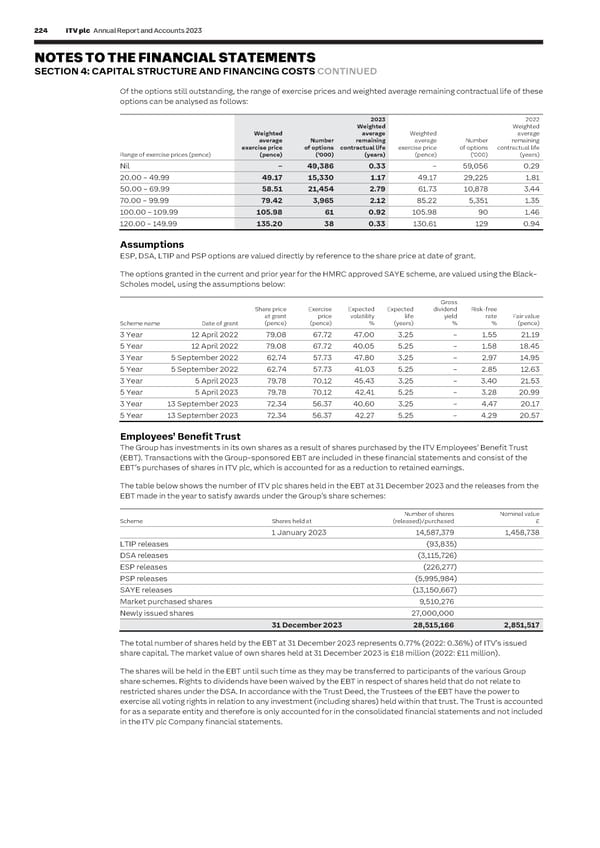

224 ITV plc Annual Report and Accounts 2023 ITV plc Annual Report and Accounts 2023 225 F I NOTES TO THE FINANCIAL STATEMENTS NAN SECTION 4: CAPITAL STRUCTURE AND FINANCING COSTS CONTINUED SECTION 5: OTHER NOTES C I AL Of the options still outstanding, the range of exercise prices and weighted average remaining contractual life of these 5.1 Keeping The related parties identified by the Directors include joint ventures, associated S T options can be analysed as follows: it simple undertakings, fixed asset investments and key management personnel. A Related T E 2023 2022 party To enable users of our financial statements to form a view about the effects of M E Weighted Weighted transactions related party relationships on the Group, we disclose the Group’s transactions with N Weighted average Weighted average T average Number remaining average Number remaining those related parties during the year and any associated year end trading balances. S exercise price of options contractual life exercise price of options contractual life Range of exercise prices (pence) (pence) (‘000) (years) (pence) (‘000) (years) Transactions with joint ventures and associated undertakings Nil – 49,386 0.33 – 59,056 0.29 20.00 – 49.99 49.17 15,330 1.17 49.17 29,225 1.81 Transactions with joint ventures and associated undertakings during the year were: 50.00 – 69.99 58.51 21,454 2.79 61.73 10,878 3.44 2023 2022 70.00 – 99.99 79.42 3,965 2.12 85.22 5,351 1.35 £m £m 100.00 – 109.99 105.98 61 0.92 105.98 90 1.46 Sales to joint ventures 60 41 120.00 – 149.99 135.20 38 0.33 130.61 129 0.94 Sales to associated undertakings 13 16 Purchases from joint ventures 33 33 Assumptions Purchases from associated undertakings 78 77 ESP, DSA, LTIP and PSP options are valued directly by reference to the share price at date of grant. The transactions with joint ventures primarily relate to sales and purchases of digital multiplex services with The options granted in the current and prior year for the HMRC approved SAYE scheme, are valued using the Black– Digital 3&4 Limited and distribution revenue from BritBox LLC, BritBox International Limited and BritBox Australia Scholes model, using the assumptions below: Management Pty Limited. Sales to associated undertakings include airtime sales to DTV Services Limited. Purchases from associated undertakings primarily relate to the purchase of news services from ITN Limited. Gross Share price Exercise Expected Expected dividend Risk-free All transactions with associated undertakings and joint ventures arise in the normal course of business on an arm’s at grant price volatility life yield rate Fair value length basis. The amounts owed by and to these related parties at 31 December were: Scheme name Date of grant (pence) (pence) % (years) % % (pence) 3 Year 12 April 2022 79.08 67.72 47.00 3.25 – 1.55 21.19 2023 2022 5 Year 12 April 2022 79.08 67.72 40.05 5.25 – 1.58 18.45 £m £m 3 Year 5 September 2022 62.74 57.73 47.80 3.25 – 2.97 14.95 Amounts owed by joint ventures 41 12 5 Year 5 September 2022 62.74 57.73 41.03 5.25 – 2.85 12.63 Amounts owed by associated undertakings 10 19 3 Year 5 April 2023 79.78 70.12 45.43 3.25 – 3.40 21.53 Amounts owed to joint ventures 6 5 5 Year 5 April 2023 79.78 70.12 42.41 5.25 – 3.28 20.99 Amounts owed to associated undertakings 8 17 3 Year 13 September 2023 72.34 56.37 40.60 3.25 – 4.47 20.17 None of the balances are secured. 5 Year 13 September 2023 72.34 56.37 42.27 5.25 – 4.29 20.57 Employees’ Benefit Trust Amounts owed by joint ventures primarily relate to trading with BritBox LLC and BritBox Australia Management Pty Limited. Balances owed by associated undertakings largely relate to Bedrock Entertainment LLC and Southrock The Group has investments in its own shares as a result of shares purchased by the ITV Employees’ Benefit Trust Productions LLC. Balances owed to associated undertakings primarily relate to trading with ITN Limited and amounts (EBT). Transactions with the Group-sponsored EBT are included in these financial statements and consist of the owed to Bedrock Entertainment LLC. EBT’s purchases of shares in ITV plc, which is accounted for as a reduction to retained earnings. Amounts paid to the Group’s retirement benefit plans are set out in note 3.7. The table below shows the number of ITV plc shares held in the EBT at 31 December 2023 and the releases from the EBT made in the year to satisfy awards under the Group’s share schemes: Transactions with key management personnel Key management consists of ITV plc Executive and Non-executive Directors and the other members of the ITV Number of shares Nominal value Management Board. Key management personnel compensation is as follows: Scheme Shares held at (released)/purchased £ 1 January 2023 14,587,379 1,458,738 2023 2022 LTIP releases (93,835) £m £m DSA releases (3,115,726) Short-term employee benefits 11 11 ESP releases (226,277) Share-based compensation 6 6 PSP releases (5,995,984) 17 17 SAYE releases (13,150,667) Market purchased shares 9,510,276 Newly issued shares 27,000,000 31 December 2023 28,515,166 2,851,517 The total number of shares held by the EBT at 31 December 2023 represents 0.77% (2022: 0.36%) of ITV’s issued share capital. The market value of own shares held at 31 December 2023 is £18 million (2022: £11 million). The shares will be held in the EBT until such time as they may be transferred to participants of the various Group share schemes. Rights to dividends have been waived by the EBT in respect of shares held that do not relate to restricted shares under the DSA. In accordance with the Trust Deed, the Trustees of the EBT have the power to exercise all voting rights in relation to any investment (including shares) held within that trust. The Trust is accounted for as a separate entity and therefore is only accounted for in the consolidated financial statements and not included in the ITV plc Company financial statements.

ITV Annual Report & Accounts Page 225 Page 227

ITV Annual Report & Accounts Page 225 Page 227